By Matt Wagner, CFA, Associate Director, Research

The dilemma of market concentration is front of mind for asset allocators.

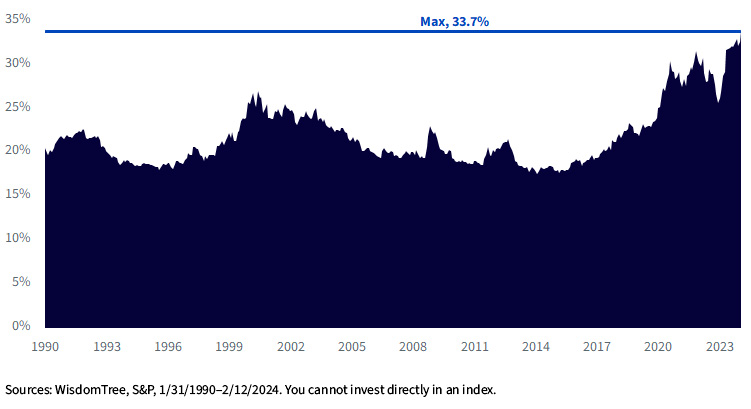

At no point in the last 30 years has the S&P 500 Index been so concentrated in just a handful of names.

The top 10 holdings account for almost 34% of the index’s weight, roughly double the weight of the top 10 holdings a decade ago.

S&P 500 Index Weight in Top 10 Holdings

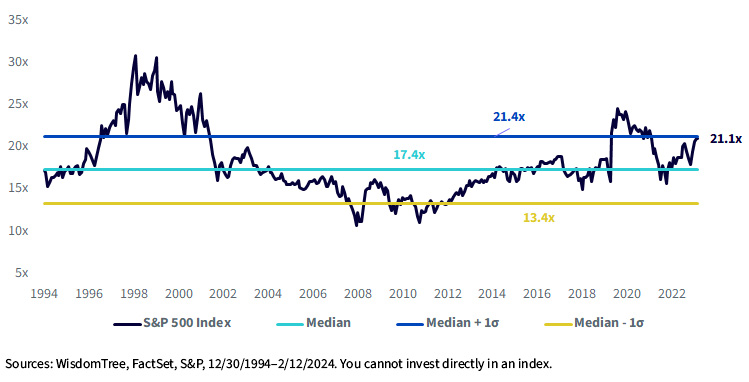

The growing dominance of a few richly valued companies has elevated S&P 500 valuations—lowering future return forecasts—and reduced the diversification benefits of index-based investing.

The current 21 times forward P/E on the index is well above the historical median valuation of 17 times.

S&P 500 Forward Price-to-Earnings Ratio

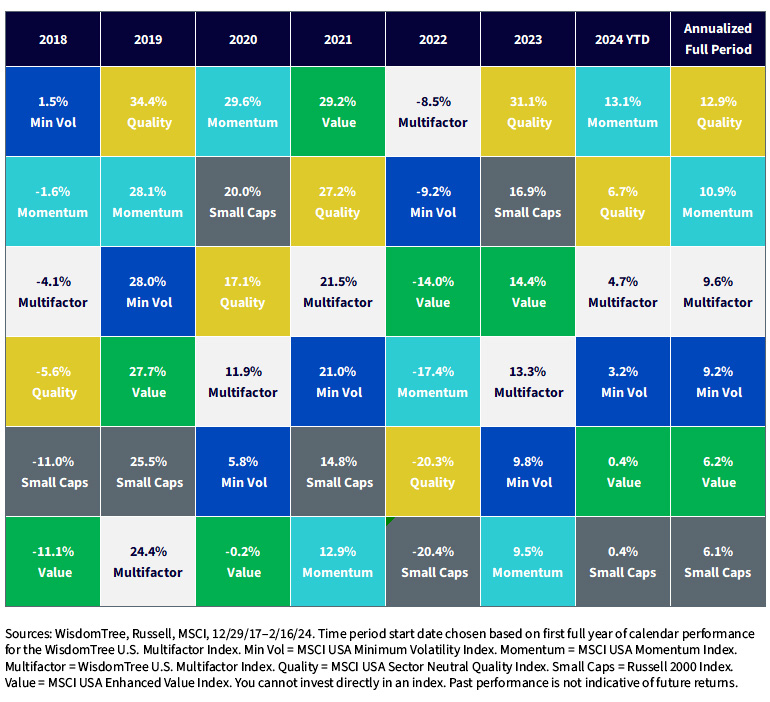

For potential solutions for market concentration and elevated valuations, some tend to look to include single factor strategies like small caps or value.

A multifactor approach, on the other hand, can offer a diversified portfolio without having to make a bet on any single factor.

Over the last several years, being factor diversified—as shown with the performance of the multifactor below—has navigated the extremes of performance from single factor indexes.

Factor Index Calendar Year Performance

U.S. Multifactor: A Diversified Factor Approach

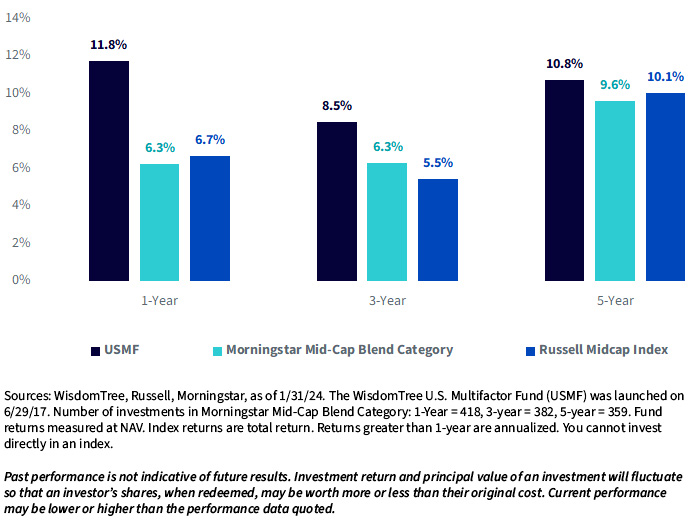

The WisdomTree U.S. Multifactor Fund (USMF) invests in mid- and large-cap U.S. equities in a fashion that closely resembles equal weighting. USMF selects 200 securities that have a high combined multifactor score on several widely accepted factors: value, quality, momentum and low correlation.

This multifactor score is used as part of the weighting mechanism, which is complemented by a low-volatility score that gives greater weight to less volatile stocks.

USMF’s modified equal-weighting approach results in a tilt to mid-cap securities. As a result, the Fund is included in Morningstar’s Mid-Cap Blend Category where it is rated 5 Stars relative to its category peers.1

USMF: Morningstar 5-Star Rated

For the most recent month-end and standardized performances and to download the Fund prospectus, click here.

Value AND Quality without Sacrificing Momentum

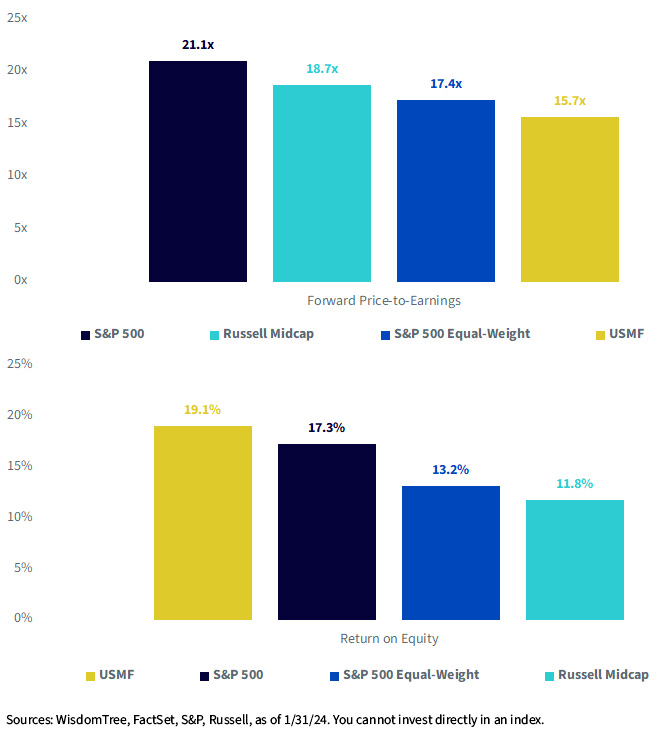

The S&P 500 Equal Weight Index, which gives the same weight to each of the 500 companies in the index, mitigates some of the valuation risk we saw with the S&P 500. Its P/E of 17.4 times is considerably lower than the 21.1 times of the S&P 500.

The S&P 500 Equal Weight also has some drawbacks. One of them is that it has lower profitability than the S&P 500, as measured by return on equity (ROE).

The diversified factor approach of USMF helps solve for this trade-off:

- USMF also has cheaper valuations than the S&P 500. Its P/E ratio is 15.7 times, which is lower than the 21.1 times of the S&P 500

- USMF has higher profitability than the S&P 500. Its ROE is 19.1%, which is higher than the 17.3% of the S&P 500

Fundamental Characteristics

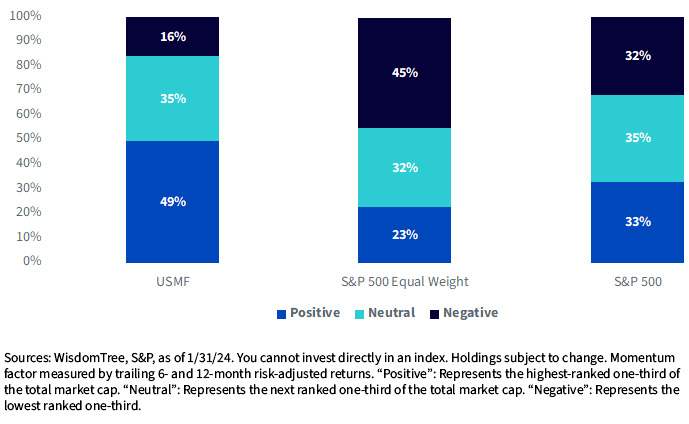

USMF also has positive exposure to the momentum factor, which looks for stocks that have strong recent performance.

The below bar chart helps illustrate the exposure to the momentum factor. The chart shows the percentage of weight in each of three categories: positive, neutral and negative.

USMF has 49% of its weight in the positive category, which is much higher than the 33% of the S&P 500 and the 23% of the S&P 500 Equal Weight. This means that USMF has more exposure to companies with positive trends in momentum.

The S&P 500 Equal Weight has a distinct negative momentum tilt. The index has 45% of its weight in the negative category, which is much higher than the 32% of the S&P 500 and the 16% of USMF.

The S&P 500 Equal Weight rebalances weights each quarter, which means selling outperformers and buying laggards in a systematic anti-momentum process.

USMF also rebalances every quarter using a rules-based, factor-diversified buy/sell discipline. This approach allows USMF to avoid selling winners too soon.

In summary, USMF is a diversified factor approach that offers a balanced exposure to academically researched factors that produces a diversified basket of 200 stocks with lower valuations, higher profitability and positive momentum exposure.

Momentum Factor Exposure

1 Category: Mid-Cap Blend. Overall rank based on 382 funds in category, 3-year percentile rank based on 382 funds in category, 5-year percentile rank based on 359 funds in category, as of 1/31/24.

The Morningstar Rating™ for funds, or “star rating,” is calculated for managed products with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance.

The top 10% of products in each product category receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars and the bottom 10% receive one star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three- and five-year Morningstar Rating metrics. The weights are: 100% 3-year rating for 36–59 months of total returns, 60% 5-year rating/40% 3-year rating for 60–119 months of total returns.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Investing in a Fund exposed to particular sectors increases the vulnerability to any single economic, political or regulatory development. This may result in greater share price volatility. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Morningstar, Inc. All Rights Reserved. The information herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.

Originally published 4 March 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.