“Disruptive growth” is becoming a prominent investment catchphrase, and rightfully so. But it remains a vexing proposition for some investors.

Advisors looking to deploy the advantages of disruptive growth investments within client portfolios can turn to WisdomTree’s new Disruptive Growth Model Portfolio.

“The WisdomTree Disruptive Growth ETF Model Portfolio targets structural growth themes that are believed to drive innovation across different industries and segments of society in the future,” according to the issuer. “The themes and affiliated ETFs selected for inclusion will typically have above-market growth projections. The model portfolio seeks maximum long-term capital appreciation and may include both WisdomTree and non-WisdomTree ETFs.”

Inside the New Model Portfolio

WisdomTree’s newest model portfolio features six ETFs at weights of 15% to 20% addressing disruptive growth segments, such as cloud computing, genomics and esports/gaming.

“The Disruptive Growth Model Portfolio targets structural growth themes driving innovation and future impact across different industries and segments of society,” said the issuer in a recent note. “The themes and constituent ETFs typically have premium growth projection, as well as seek to avoid holding overlap among one another. The investment objective is to achieve maximum long-term capital appreciation.”

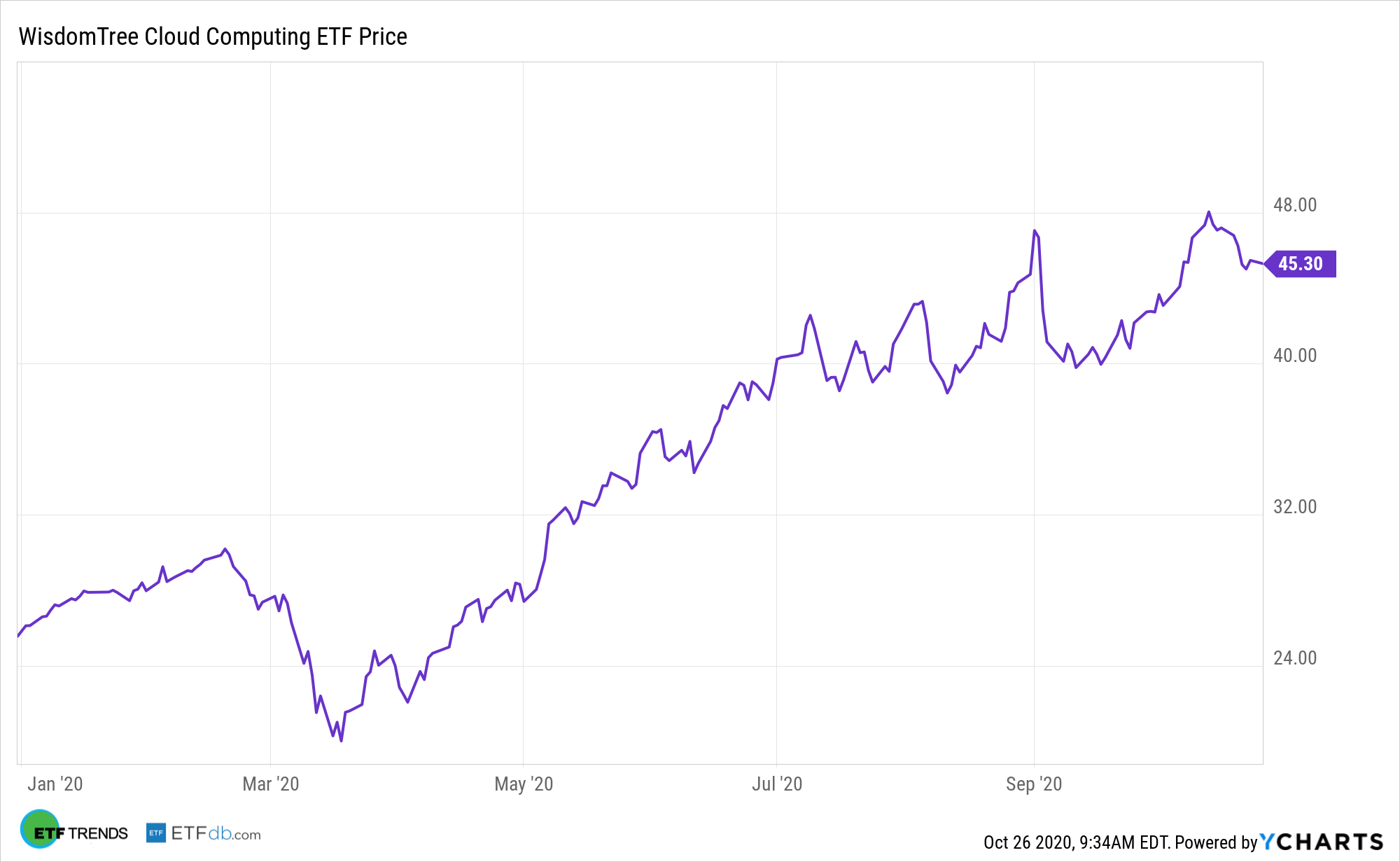

The WisdomTree Cloud Computing ETF (WCLD) is one of the foundational pieces in this model portfolio. The WisdomTree Cloud Computing Fund seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an equally weighted index designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers.

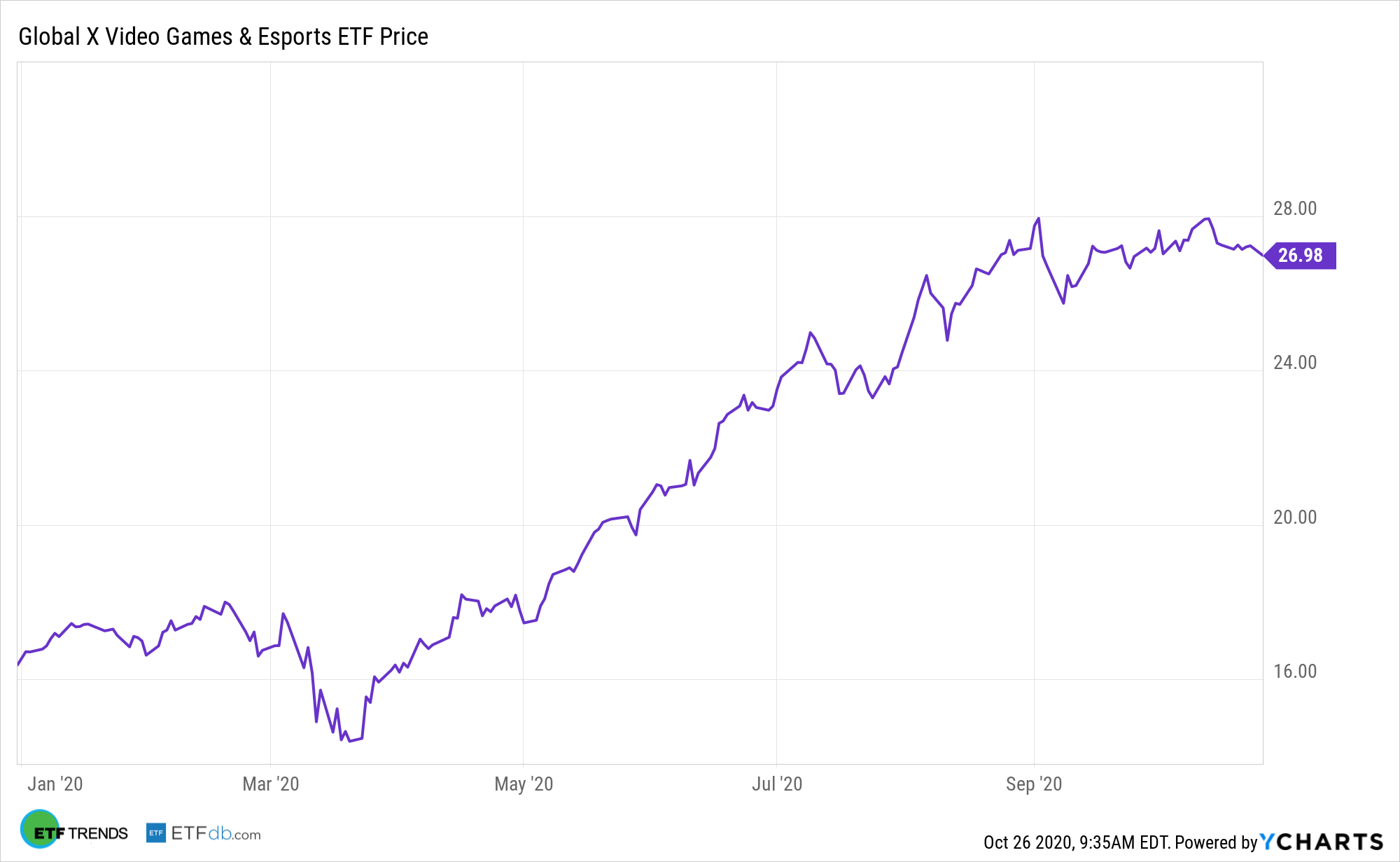

The Global X Video Games & Esports ETF (NASDAQ: HERO) is another component. HERO “seeks to invest in companies that develop or publish video games, facilitate the streaming and distribution of video gaming or esports content, own and operate within competitive esports leagues, or produce hardware used in video games and esports, including augmented and virtual reality,” according to Global X.

“Overall, investors have many thematic strategies at their disposal. WisdomTree can help financial advisors navigate this landscape and access the disruptive themes we believe deliver premium growth potential,” notes WisdomTree. “These strategies are commonly used as a complement to core equity portfolios, often providing exposures with low overlap to other growth- or technology-focused strategies, or as replacement of individual stock strategies seeking long-term growth.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.