Supported by a cyclical value rally on par with that of the U.S., European equities are among asset allocators’ most preferred ideas for the second half of 2021.

Indeed, valuations across the pond are attractive, but isolating specific European countries that offer investors the most upside can be tricky. One efficient avenue for easing that burden while mitigating some of the potential risks that could pop up in the Eurozone is the WisdomTree Developed International Factor Portfolio.

The model portfolio, which is part of a three-portfolio suite of factor-based model portfolios offered by WisdomTree, is home to five exchange traded funds that all qualify as diversified plays on ex-U.S. developed markets. While there are no Europe-specific ETFs in the portfolio, there’s still ample European exposure.

“The vast majority of investment banks are backing European stocks to outperform their U.S. peers through the remainder of the year and into 2022, as the region’s economic recovery and historic stimulus converge,” reports Elliot Smith for CNBC. “Recent economic data out of the euro zone suggests its recovery is gathering steam, after a sluggish start due to persistent lockdown measures and a slow vaccine rollout.”

Other Benefits to the Model Portfolio

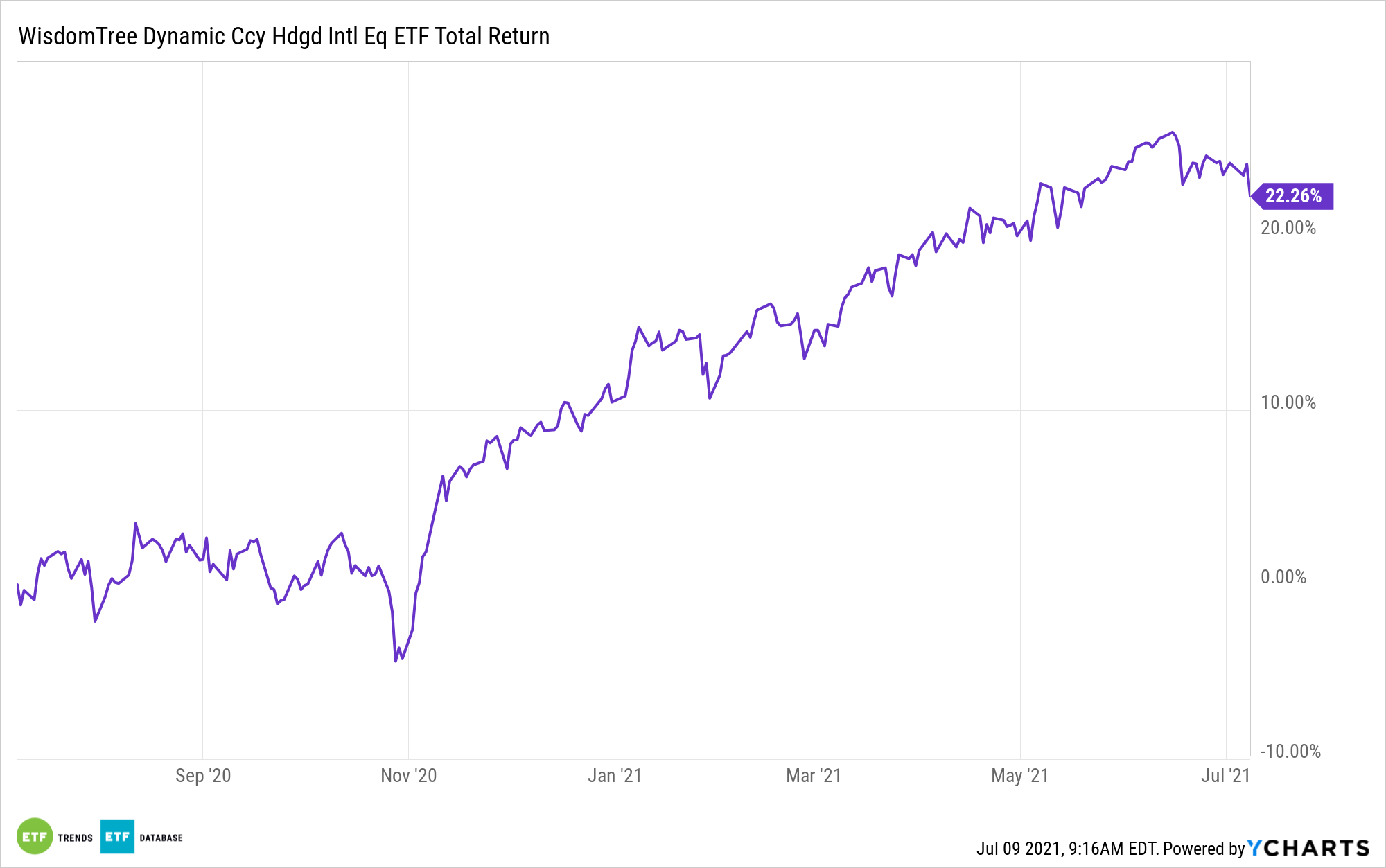

The WisdomTree Developed International Factor Portfolio has other benefits for advisors to consider. Take the case of the WisdomTree Dynamic Currency Hedged International Equity Fund (CBOE: DDWM), the model portfolio’s largest constituent.

As a currency-hedged ETF, DDWM can benefit if the dollar rallies against developed foreign currencies and that’s something to consider at a time when fixed income market observers are speculating the Federal Reserve could accelerate its time frame for rate tightening. Higher benchmark rates in the U.S. often trigger a stronger dollar, which could boost the allure of DDWM.

Another reason that the model portfolio’s Europe-heavy components could get a boost in the second half is that money managers appear to be underweight European equities. They may not want to be caught flatfooted if stocks in Europe rally in earnest.

“With global investors structurally underweight Europe, there is ample scope for the recent run of inflows, which should be counted in weeks rather than months, to persist for considerably longer if the investment narrative remains attractive,” Graham Secker, chief European equity strategist at Morgan Stanley, said, according to CNBC.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.