Rarely is it a bad time for investors to embrace the quality factor, but now looks like a particularly good time to tap international equities that fit the quality bill.

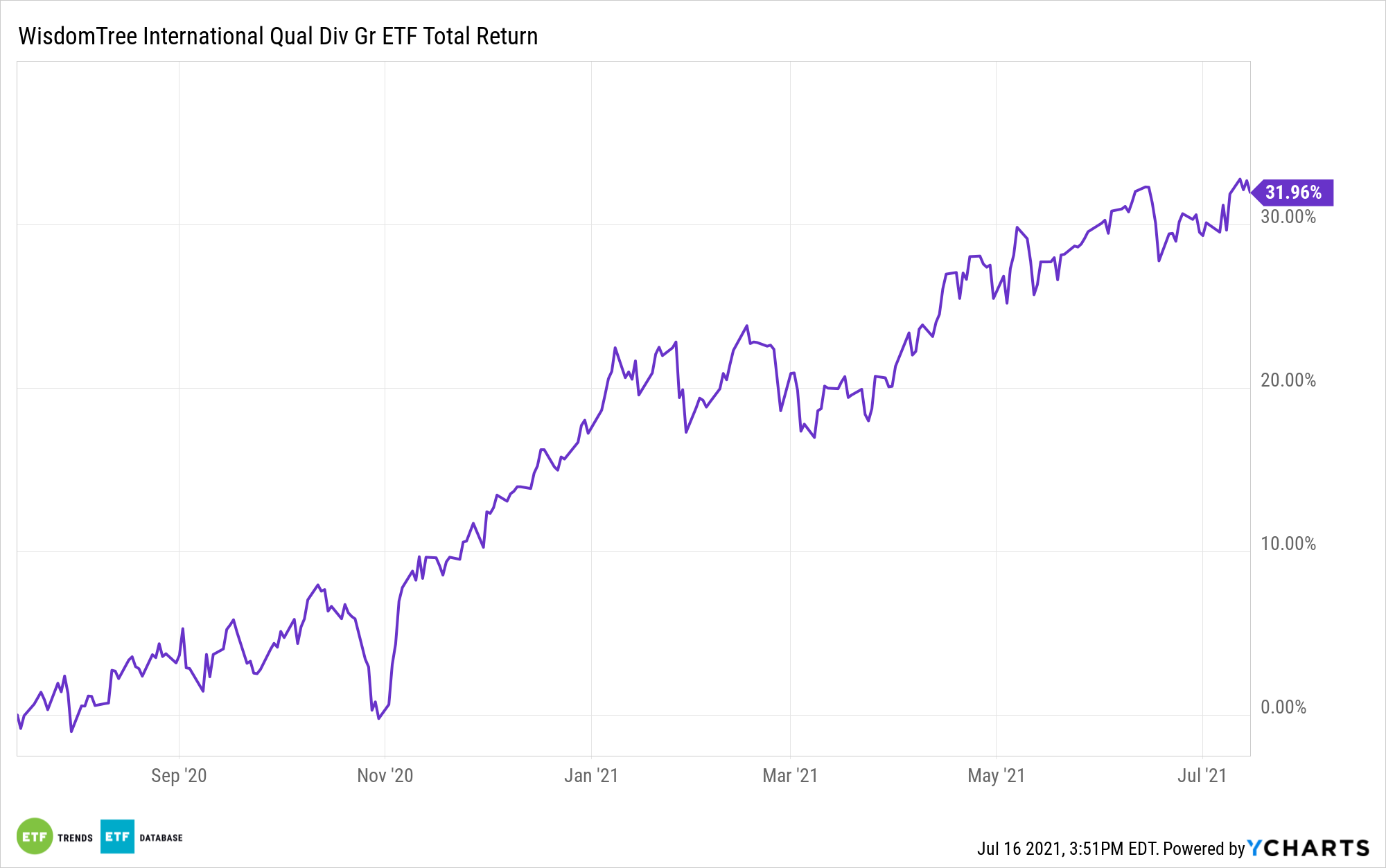

Enter the WisdomTree International Quality Dividend Growth Fund (CBOE: IQDG). Proving that quality works in investors’ favor, the WisdomTree exchange traded fund is higher by 12.57% year-to-date, beating the MSCI EAFE Index by nearly 300 basis points.

Typically, the quality factor trades at premiums relative to broader benchmarks, something IQDG has done against the MSCI EAFE Index. However, that’s starting to change, indicating investors can access international quality at attractive prices.

“Our barometer for international quality is the WisdomTree International Quality Dividend Growth Fund (IQDG), which launched in 2016 and has traded at a premium to the MSCI EAFE Index on a forward P/E basis since day one,” says WisdomTree analyst Brian Manby. “However, beginning in the third quarter of 2018, this relationship began to slowly break down as lower-quality stocks rallied relative to higher-quality ones.”

IQDG: A Dynamic Dividend Opportunity

IQDG’s 2.02% dividend yield is only slightly ahead of that sported by the MSCI EAFE Index, but the WisdomTree ETF is a relevant consideration ahead of broader international equity benchmarks at a time when ex-U.S. dividends are showing signs of life (and growth).

The fund’s dividend-weighted strategy and quality emphasis may better-align with investors’ income objectives than a traditional broad-based international fund. That’s important because market participants are increasingly prioritizing balance sheet strength.

“After all, we are exiting a global pandemic where the revenues and profits of many cyclical companies with weaker balance sheets may have disproportionately suffered compared to peers on more stable financial footing,” notes Manby. “As we return to an environment of global economic growth, prices for lower-quality stocks may be buoyed by investors’ renewed optimism.”

Other data points confirm the allure of IQDG. Based on trailing earnings, the WisdomTree ETF trades at steep discounts to the S&P 500 and the MSCI EAFE Index. However, the fund’s return on assets, return on equity, and return on sales are well in excess of those benchmarks. Additionally, the leverage ratios of IQDG member firms are well below those of S&P 500 and MSCI EAFE components.

The affordable opportunity to own international quality is not a result of poor performance either.

“On a year-to-date basis (as of June 30, 2021), both IQDG and its currency-hedged twin (IHDG—WisdomTree International Hedged Quality Dividend Growth Fund) are in the top quartile of funds in the Morningstar Foreign Large Growth category based on NAV performance. IHDG is number two overall, while IQDG stands at #16 out of more than 450 funds,” concludes Manby.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.