By Aneeka Gupta

Director, Macroeconomic Research

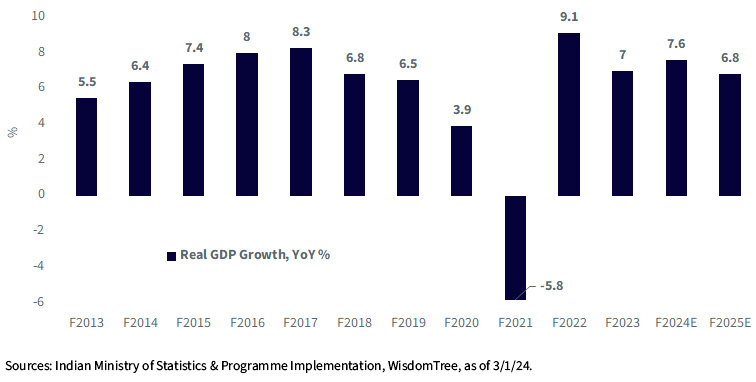

The Indian economy, yet again, has outdone investor expectations with growth up by 8.4% in the third quarter of the 2024 financial year,1 marking the fastest pace seen in six quarters. During the quarter, manufacturing (which accounts for 17% of the economy) posted the highest growth at 11.6% year on year (YOY), while agriculture (15% of the economy) remained a drag at -0.8% YOY as a result of uneven rain.2 The services sector remained resilient, posting an increase of 7% YOY.2

GDP Growth Expected to Rise 7.6% in F2024

Weak global demand has been driving exports of goods and services lower with an increase of only 3.4% (vs. 5.3% in Q2).2 With services positioned favorably, imports are rising at a faster clip of 8.3% (vs. 11.9% in Q2).2 Despite the uptick in third-quarter GDP, underlying growth continues to be supported by investment, which grew at 10.6% YOY, led by government spending and residential real estate.1 Private final consumption expenditure, an indicator of consumption demand, lagged with only a 3.5% increase, below the broader economy.2

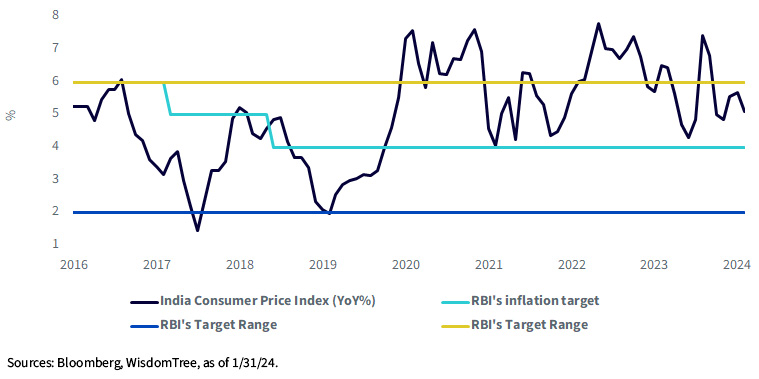

Positive GDP Surprise Should Not Make the RBI Hawkish

The Reserve Bank of India’s (RBI) projection for growth in the third quarter, of 6.5%, was in line with gross value added (GVA), which grew at 6.5%.2 The gap between GDP and GVA in the quarter can be explained by rising tax collections and a decline in government subsidies. Economic activity is expected to moderate over the coming quarters. The GVA, which excludes net indirect taxes, provides a better measure of underlying momentum in the economy.

There have also been encouraging signs of easing inflationary pressure, especially the moderation in food prices inflation. The RBI has kept interest rates unchanged at 6.5% and maintained a hawkish stance for most of 2023. As we do not find signs of over-heating in the Q3 GDP data, we expect the RBI to maintain its February view of “waiting a bit longer” to cut back on the resilient growth.

Inflation Is Approaching the RBI’s Inflation Target

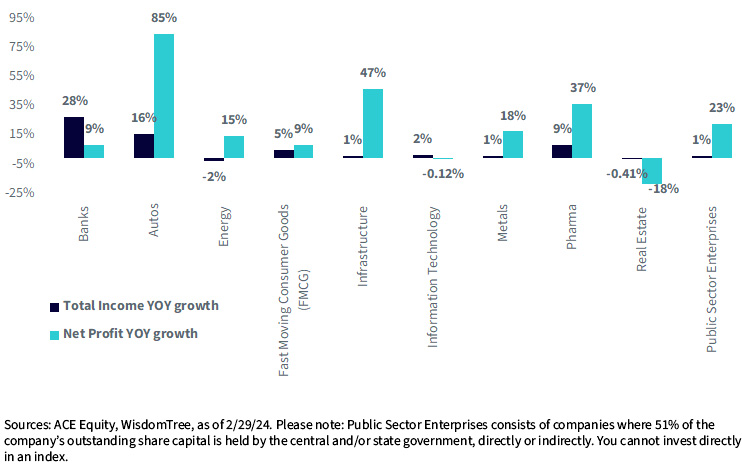

Resilient Earnings Results in Third Quarter

The Nifty 50 Index reported revenue growth of 9% in the third quarter alongside a net profit growth of 15%, exceeding consensus expectations. This highlights a slight decline in revenue expansion (14% over the past five quarters) yet was offset by higher profitability growth (12% over the past five quarters). Banks remained at the forefront from the aspect of revenue generation, while automobiles stood out among the top performers both from a revenue and earnings standpoint.

Nifty Index Earnings Results

India’s financial sector has been an important pillar for stability and growth prospects. The banking sector exhibited healthy business growth in the third quarter. However persistent net interest margin (NIM) pressure and high operational expenditure caused a dip in margins. Credit growth was driven by the retail sector. Retail loans formed 31% of banking credit followed by services at 27.8%, industries at 23.5% and agriculture at 13%. The corporate sector saw a gradual pick up aided by medium-sized enterprises.

The automotive sector provided stellar results over the quarter, aided by the decline in commodity prices, alleviation of supply-chain challenges and stability in FX rates. The USD-INR (Indian rupee) held within a narrow 3% range in 2023, mostly between 80.00 and 83.50. INR depreciated by just 0.6% relative to USD in 2023 compared to over 10% in 2022. Auto volumes (excluding tractors) grew at 16% annually led by a healthy recovery in two-wheelers and stable growth across other segments. Two-wheelers witnessed the sharpest growth of nearly 19% YOY during Q3. Demand for premium cars also remained strong, mainly in the urban areas.

The subdued results of the information technology sector were influenced by macroeconomic conditions, lower discretionary spending and seasonality. Attrition rates hit all-time lows for India’s IT sector in the quarter.

While the real estate sector dragged down overall earnings performance for the Nifty Index, the energy, pharma, metals and public sector enterprises (PSE) sectors displayed steady annual earnings growth in Q3.

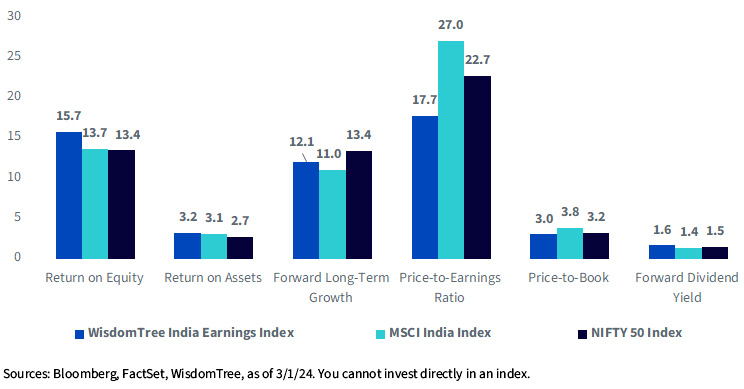

Adopting an Earnings Bias to Tap into Indian Equities

For investors looking to tap into India’s buoyant earnings growth at a discount, the WisdomTree India Earnings Fund (EPI), which seeks to track the WisdomTree India Earnings Index, offers a unique opportunity as it aims to lower the valuation risk inherent in buying Indian equities. EPI’s strategy represents the broadest possible cross-section of investable and profitable Indian companies.

At WisdomTree, we optimize valuation, by weighting by earnings and eliminating unprofitable companies, thereby allowing the more profitable companies to dominate the weighting in the Index. The unique earnings tilt allows EPI to provide investors with access to the broad market but at a more reasonable valuation, evident from the chart below.

Comparison of Fundamentals

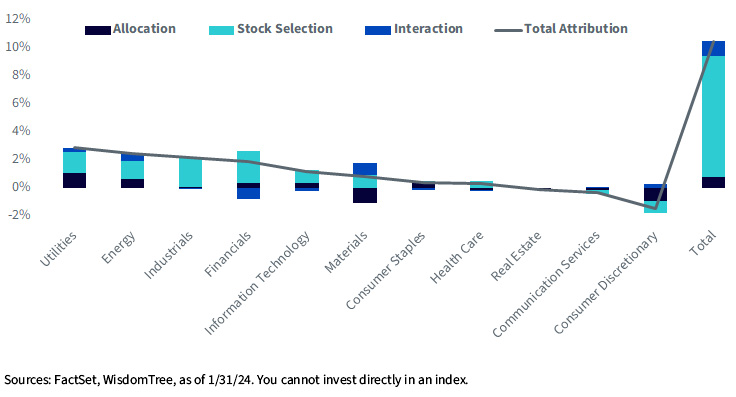

By earnings-weighting our strategy, the portfolio takes on some unique sector tilts compared to a market cap-weighted approach. Over the past year, utilities, energy, industrials and financials provided the highest contributions across sectors, enabling the WisdomTree India Earnings Index to outperform the MSCI India Index by 10.49%.

Sector Attribution: 1-Year

Less Concentration and Greater Diversification

The Q3 FY24 earnings results for the Nifty 50 Index (market cap-weighted) showed that Tata Motors, HDFC Bank, Tata Steel, ICICI Bank and JSW Steel contributed 56% of incremental YOY accretion in earnings. That, in our view, appears to be quite concentrated exposure within the Nifty 50 Index. The WisdomTree India Earnings Index’s earnings-weighted strategy enables less concentration. The contribution to earnings growth from Tata Motors, HDFC Bank, Tata Steel, ICICI Bank and JSW Steel is much lower, at 26% for WisdomTree India Earnings Fund versus the Nifty 50 Index at 56% or even MSCI India at 33.6%.

The earnings-weighted methodology of the WisdomTree India Earnings Index also allows for greater diversification across size. While MSCI India has a much higher exposure to large caps at 84%, WisdomTree’s India Earnings Index has 64% of its weight in large caps and the rest distributed across mid-caps at 25% and small caps at 11.2%. The attribution by size illustrates the benefit of diversification across size over the long term (three years) that helped WisdomTree India Earnings Index outperform the MSCI India Index by 7.51%

Size Attribution: 3 Years

Conclusion

India is the fifth-largest economy in the world and remains the fastest growing among the large economies with sustainable real GDP growth of 6%–7% per annum predicted over the next several years. Government reforms, a systematic clean-up of the system and digitization have been the key catalysts in boosting its growth trajectory. If one considers the first nine months of India’s financial year, ending March 31, we have seen stocks on the Nifty Index deliver 26% earnings growth.3 Expectations for earnings per share (EPS) growth remain high at 21% and 17% in FY24 and FY25. India appears well-cushioned against external vulnerabilities and is positioned favorably within global equity allocations.

1 October to December, Q3 in financial year, ending 3/31/24

2 Source: National Statistics Office

3 Source: ACE Equity

Originally published by WisdomTree on March 15, 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.

Important Risks Related to this Article

Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

For the most recent month-end and standardized performance and to download the respective Fund prospectus please click here.

For current Fund holdings, please click here. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.