By Bradley Krom, U.S. Head of Research

If you only focused on the returns of the MSCI Emerging Markets (EM) Index, you’d think EM was dead money. If you looked at the MSCI Emerging Markets Ex-China Index, you’d basically be at breakeven over the last two years. But if you look at the WisdomTree India Earnings Fund (EPI), you might be surprised to see what’s possible in India. In this piece, we discuss the fundamental drivers of Indian equity performance and why those drivers may be poised to continue.

China Dominates EM Benchmarks

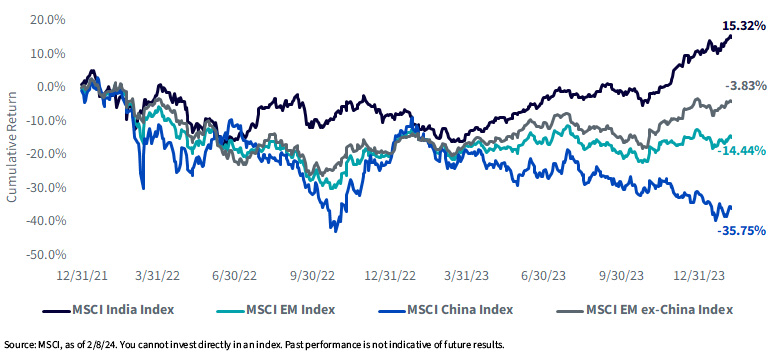

Over the last decade, China has made a concerted effort to broaden access to its capital markets. As a result, major benchmarks like the MSCI Emerging Markets Index have seen China rise in weight from less than 5% in the early 2000s to nearly 30% today. While China is a large market that deserves attention from investors, the challenge now is that the most commonly followed emerging markets benchmark is nearly completely beholden to Chinese equity market performance. As we show in the chart below, Chinese stocks have languished over the last two years, dragging down benchmark returns. However, even strategies that exclude China are slightly lower. We contrast these returns with Indian equities, which have delivered strong returns, particularly over the last year.

EM Equity Performance: 12/31/21–2/9/24

For definitions of terms in the graph above, please visit the glossary.

What’s Driving Returns

For investors who are open to the idea of not using a one-size-fits-all/broad-index-based approach to EM investing, your three best single-country options over the last five years have tended to be India, Taiwan and South Korea. However, what’s striking is the differentiation in drivers of total return.

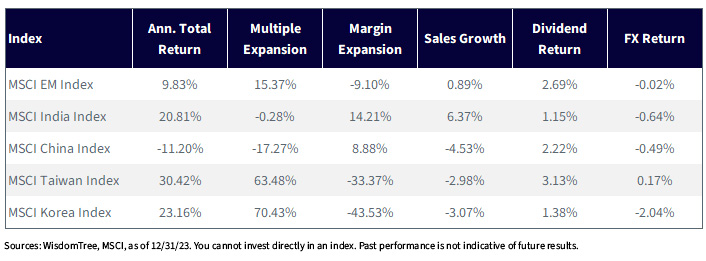

One Year

For definitions of terms in the table above, please visit the glossary.

As we mentioned before, as the largest weighting in emerging markets, concentration in China is weighing down broad index returns on account of dramatic multiple contraction as sales growth recedes. By contrast, India has experienced strong performance due to its strong fundamentals performance with multiple contraction over the last year. Although Taiwan has delivered nearly 1,000 basis points of excess returns, much of it has been driven by multiple expansion from its largest index holding, Taiwan Semiconductor. While TSMC has been a big beneficiary of the market’s focus on AI/the U.S. Chips Act, the question many investors face is: Are these types of results sustainable or repeatable going forward?

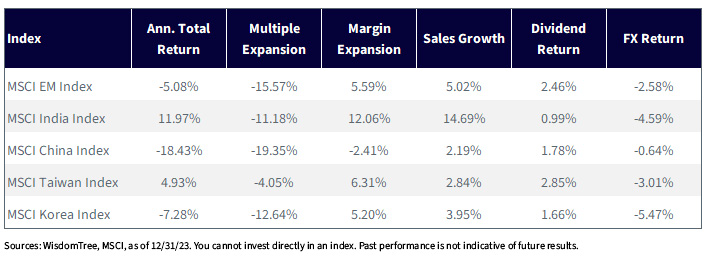

Three Years

Over the last three years, India has delivered best-in-class performance even when multiples have continued to contract. Despite this headwind, Indian companies have experienced double-digit sales and margin expansion. Additionally, FX headwinds in India could be abating, which could begin to unwind the nearly 5% erosion in total returns for U.S.-based investors.

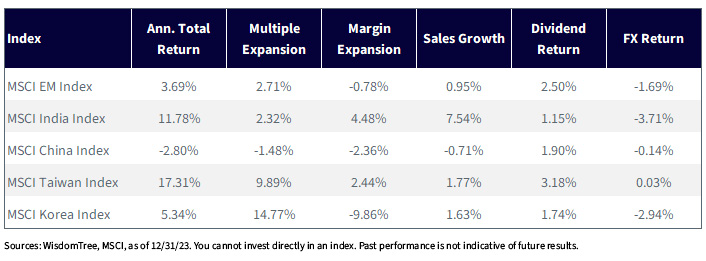

Five Years

Over the last five years, India has delivered strong fundamental performance, growing sales by nearly 8% per year. While multiples have expanded by 2.3% per year over during this period, they are far from overvalued, in our view. As long as India can continue to deliver solid growth versus other markets, we believe we may be in the early innings of a dramatic repricing of Indian assets versus China. We feel that China is currently on the verge of experiencing a lost decade. For many investors, India may be a strong option to counter a challenging macro environment and self-inflicted wounds from Chinese policy makers.

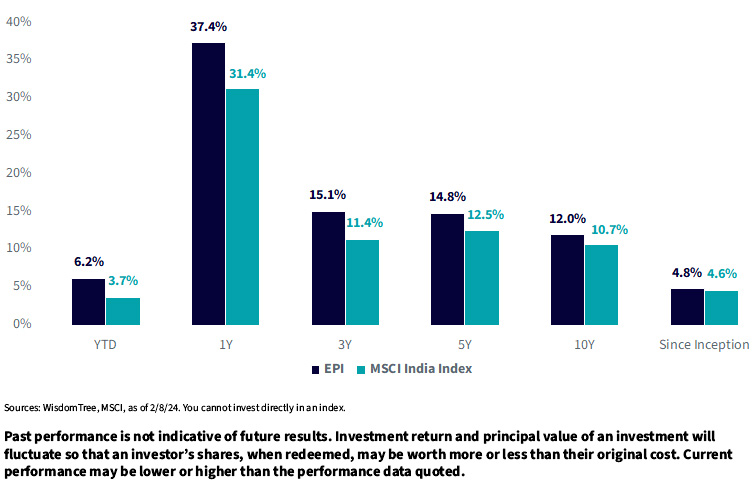

EPI vs. MSCI India Index Performance

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click here.

Adding Value vs. MSCI India

One of our primary views of investing is that market cap weighting is flawed. In India, this is no different. By focusing only on profitable companies, EPI tends to trade at a lower P/E multiple than MSCI India. Over time, this has had the impact of delivering excess returns during nearly every period we examined. While there are no guarantees that these trends will continue, we continue to advocate that strategies anchored to fundamentals can deliver long-term value to investors seeking growth from Indian equity exposure.

Originally published 14 February 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.