When investors turn toward international and emerging market ETFs, they face an interesting choice around currency hedging. Should they pick the ETF that hedges their exposure to the country’s currency, or go with the nonhedged ETF?

On one hand, if they invested in the hedged international ETF, they would not be exposed to a possible drop in value due to the foreign country’s decline in relative currency value. However, on the other hand, they may pay more in fees for this hedged protection.

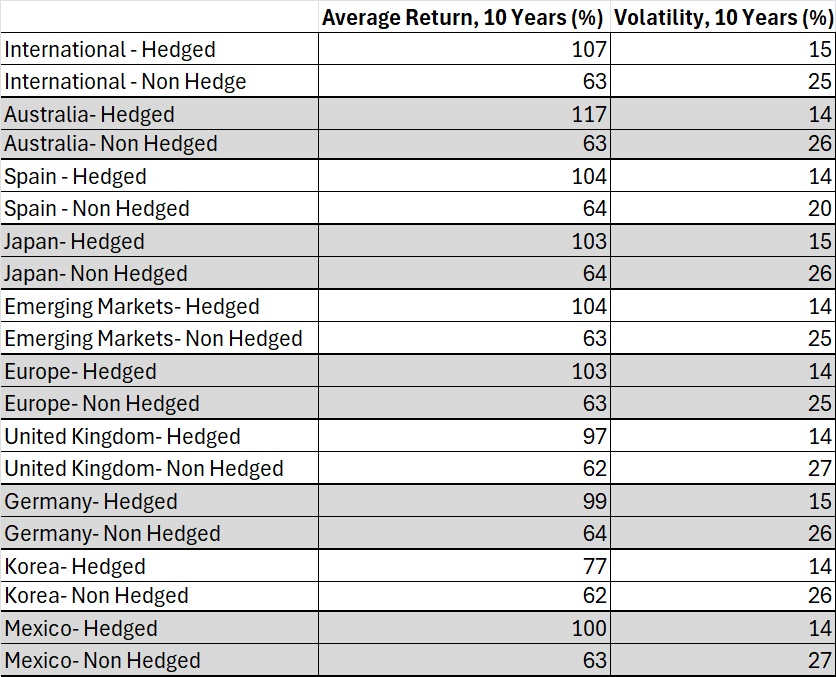

We tested this idea over nine different regions: Australia, Spain, Japan, Europe, the U.K., Germany, Korea, Mexico, and international (general). We then examined all ETFs in the U.S. that are focused on these regions. And we partitioned them by hedged and nonhedged (i.e., those exposed to fluctuations in the local currency value and those that are not).

Read More: Japan ETFs Ward Off Recession, Continue Trending Higher

Results of Currency Hedging Comparison

We then examined the average returns to the bifurcated nine categories and their volatilities. The first result we found was, across all categories, the hedged ETF has performed better than the nonhedged ETF over the past 10 years. On average, the spread between the hedged and nonhedged ETF was 40 percentage points in total over 10 years (or 4 percentage points annually).

In terms of volatility, the results were equally clear. The nonhedged ETFs had significantly higher volatility than the hedged ETFs across all the countries studied. The average difference in volatilities was 13 percentage points annually.

The results were pronounced across all nine categories. And surprisingly, even though one would expect the expense ratios of the hedged ETFs to be significantly higher than the nonhedged, we did not find any statistical difference between the two groupings.

In all, it appears that the hedged version of the international ETF has delivered better results. It came in with a near-equal expense ratio, lower volatility, and far better long-run returns. These results partially hold due to the long-run bull market on the USD, so it will be interesting to see if they hold over the next 10 years.

For more news, information, and analysis, visit the Modern Alpha Channel.