Combine rebounding European equities with the Greek sovereign debt crisis of 2009, and it’s not unreasonable to expect that many investors are not paying much attention to the “G” in the once infamous PIIGS acronym.

Since then, Greece was demoted to emerging markets status and, prior to the coronavirus pandemic, yields on Greek sovereign bonds were steadily declining, indicating investor appetite for debt once deemed risky was robust. Thing is, many of the problems that got Greece into trouble in the first place haven’t actually been solved, as WisdomTree Head of Equity Strategy Jeff Weniger details.

“Though the country faded from the front page in recent years, Greece’s overwhelming debt load never actually went down; the burden just stayed on an even keel as the government—to its credit—abided by EU-mandated deep austerity packages,” says Weniger. “Many do not realize it, but Greece ran budget surpluses from 2016–2019.”

However, COVID-19 lockdowns weighed on Greece’s tourism-dependent economy, and it appears market participants are starting to again express concern about the country’s finances as highlighted by a 3.51% decline in the MSCI All Greece Select 25/50 Index over the past month.

A Model Portfolio Solution?

Greece isn’t what it was in 2009, but looking further out, the country could be a thorn in the side of Eurozone participants if debt talks fall apart.

“Suppose we get to 2023 or 2024 and Greece’s public finances have not recovered from COVID-19,” adds Weniger. “That is a world that may witness a frustrated Greek populace perhaps playing hardball with wealthy northern neighbors, namely Germany, in future debt bailout negotiations.”

Advisors and investors have options for remaining engaged with Eurozone stocks while avoiding large allocations to Greece. For example, WisdomTree’s Developed International Factor Portfolio features five exchange traded funds, each with barely any or no exposure to Greek equities.

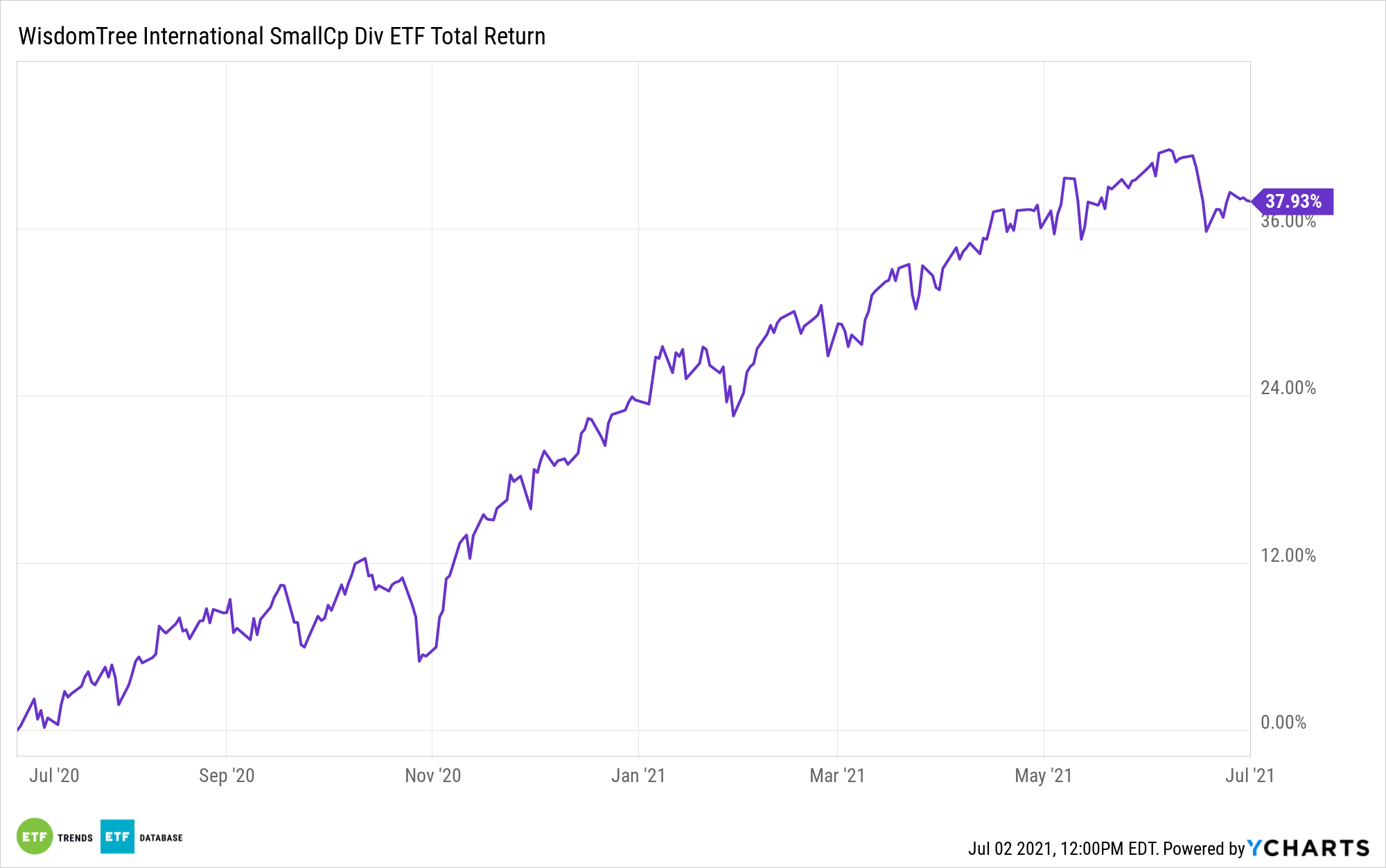

By way of positions in funds such as the WisdomTree International Quality Dividend Growth Fund (CBOE: IQDG) and the WisdomTree International SmallCap Dividend Fund (DLS), the model portfolio puts quality at the forefront. In fact, DLS significantly reduces overall Eurozone exposure, which could be advantageous if Greece roils markets again.

“First, owning the WisdomTree International SmallCap Dividend Fund (DLS) cuts the 31% down a little bit, to 24%,” notes Weniger. “That may fit for someone who wants to underweight the eurozone without going too boldly away from EAFE. Our strategy may also prove more conservative than the MSCI EAFE Index, as 7% of DLS has companies with negative earnings, whereas 11% of the developed world’s market capitalization is unprofitable.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.