By Kevin Flanagan, Head of Fixed Income Strategy

While the Fed didn’t cut rates at its December policy meeting, the way the money and bond markets have reacted post-FOMC, one could be forgiven for thinking the rate cuts had already begun. Indeed, most Treasury (UST) yields, especially along the coupon curve, have fallen in a rather noteworthy fashion over the last few trading sessions, as “rate cut euphoria” seems to have taken hold.

However, New York Fed President John Williams (a spokesperson for official Fed policy) interestingly pushed back on this recent market movement. He noted that “we aren’t really talking about rate cuts” and that it is “premature” to think about the March 2024 FOMC meeting as the starting date for cutting rates. Ultimately, upcoming economic and inflation data will determine the timing and magnitude of rate cuts, and that will create uncertainty and volatility in the UST market.

That being said, we are of the mindset that rate cuts are coming in 2024; it’s just a matter of when and by how much. Against this backdrop, we offer two fixed income solutions for navigating what will likely lie ahead for bond investors in the coming year from both an offense and defense perspective:

- On Offense (Rate Cut Solution): WisdomTree Yield Enhanced U.S. Short-Term Aggregate Bond Fund (SHAG)

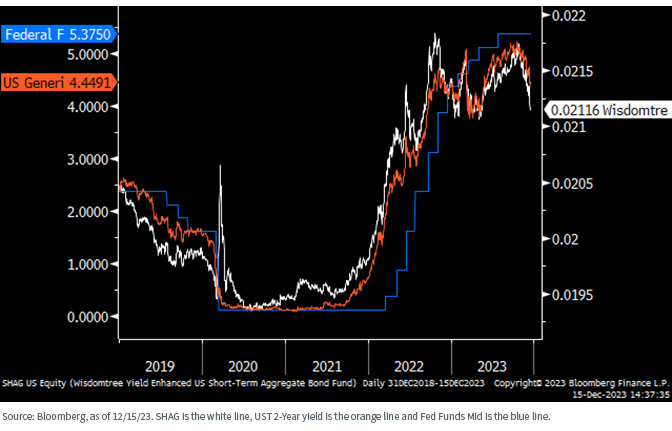

- SHAG is very correlated to the UST 2-Year yield, which is anchored to the Federal Funds Rate (see below).

- Thus, Fed rate cuts and/or rate cut expectations should show through here in a more direct fashion than intermediate or long duration vehicles.

Correlation of SHAG, UST 2-Year Yield and Fed Funds Target Midpoint

- Playing Defense (Income without the Volatility): WisdomTree Floating Rate Treasury Fund (USFR)

- USFR is tied to the UST 3-month t-bill auction yield, which is directly tied to the actual Federal Funds Rate.

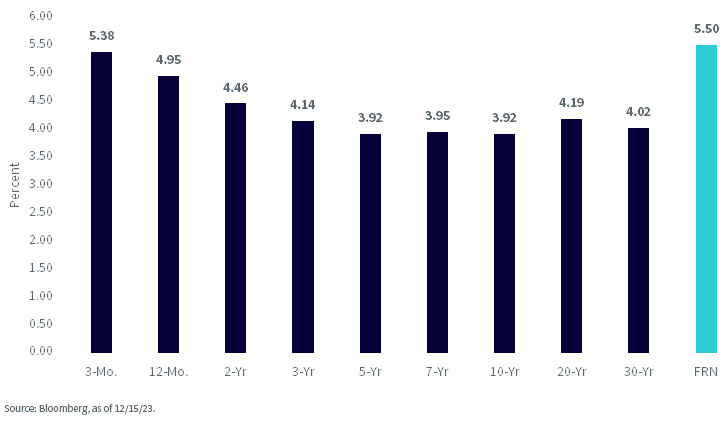

- Why is that important? Because the Fed hasn’t cut rates. The 3-month t-bill yield is unchanged post-FOMC vs. declines of roughly 30 basis points along the UST fixed coupon curve as of this writing.

- As mentioned, we believe Fed rate cuts are coming, but what if the market is wrong in its aggressive pricing on this front? Volatility.

- And don’t forget, the yield curve is still inverted (see below).

U.S. Treasury Yields

Conclusion

Once again, one can make the case that the UST market has already priced in a lot of good news, so in order to maintain yields at current levels (or even lower), validation will be necessary. In other words, future economic and labor market data need to reveal a visible slowing in growth, while inflation must continue to show signs of further cooling. These two forces will be necessary for the Fed to begin its process toward rate cuts.

Important Risks Related to this Article

SHAG: There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

USFR: There are risks associated with investing, including possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Originally published 20 December 2023.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.