Some market pundits love clarion calls and hyperbole, but there are times when credibly rare opportunities do emerge.

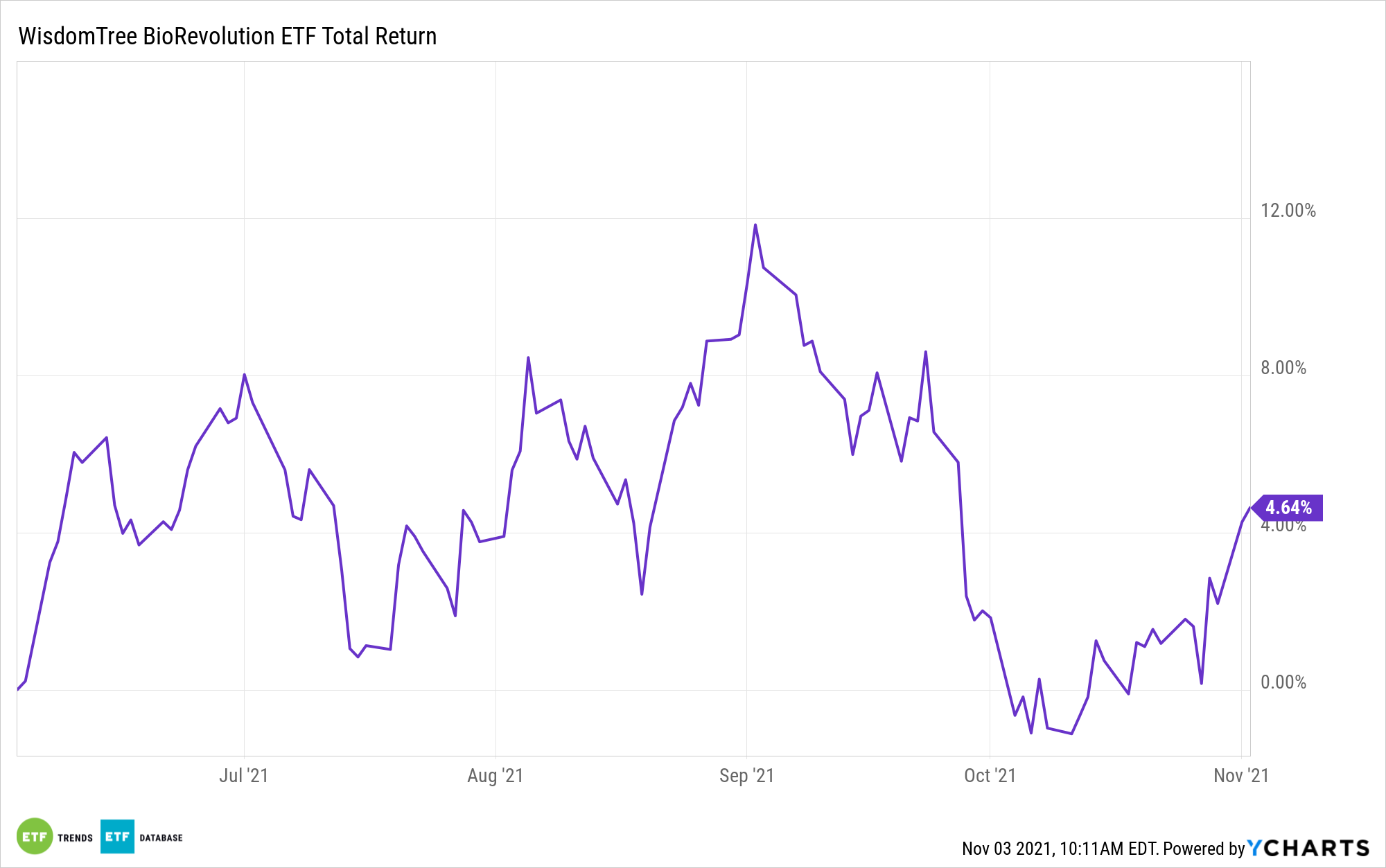

That might be happening today with biotech, genomics, and other next-generation healthcare stocks, and that could open the door for upside with exchange traded funds like the WisdomTree BioRevolution Fund (WDNA). WDNA, which debuted earlier this year, tracks the WisdomTree BioRevolution Index (WTDNA).

After setting torrid paces last year, due in large part to the race to develop a coronavirus vaccine, some familiar disruptive healthcare ETFs are struggling this year. For example, the largest biotech ETF is up just 6.64% year-to-date while many genomics stocks and funds are saddled with double-digit losses.

“The range of performance within Pharmaceuticals, Biotechnology & Life Sciences is by far the widest of any other industry group. Even excluding Moderna’s outlying +200% return, the Pharmaceuticals, Biotechnology & Life Sciences return disparity still ranks near the top of the list,” notes WisdomTree analyst Kara Marciscano.

That doesn’t mean that investors should throw in the towel on biorevolution fare and WDNA. The case for innovative healthcare strategies was cemented long before the coronavirus pandemic. The global health crisis simply confirmed the need for the industry to evolve and become more nimble, indicating that the 2021 struggles being endured by some WDNA components are more exception than rule.

“In the context of a global pandemic, it’s no surprise that the firms working on the world’s antidote were some of the biggest movers,” says Marciscano. “Novel virus aside, we still view Pharmaceuticals, Biotechnology & Life Sciences companies as one of the most idiosyncratic subsets of the market. The performance of many of these companies is driven by developments that are unique to their product pipelines, like clinical trial results or patent authorizations, which contributes to a wider variation of returns within the industry group.”

Said another way, COVID-19 could be completely eradicated tomorrow, but that wouldn’t diminish the case for biorevolution investing because WDNA member firms are working on myriad other compelling drugs, technologies, and therapies. In fact, the WisdomTree ETF, despite its rookie status, might be one of the best-positioned funds in terms of capitalizing on a new era of healthcare investing.

“WDNA is uniquely positioned to provide exposure to companies that are reading, understanding, writing and editing DNA for applications within the health care vertical and across interdisciplinary fields like agriculture, food, materials, chemicals and energy production. WDNA currently allocates 15% of its weight to companies outside of the Health Care sector,” concludes Marciscano.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.