Despite the controversies in Chinese tech, the sector remains one of the hottest factors in the emerging markets equation.

Advisors can access it in broad-based fashion via WisdomTree’s Emerging Markets Multi-Factor Portfolio.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Emerging Market equities primarily using factor focused ETFs. The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETF,” according to WisdomTree.

Using model portfolios to access China can reduce risk and answer some of the most important questions clients have regarding exposure to the world’s second-largest economy.

“But there are serious questions that could affect a longer-term outlook for China, like what to make of the tense political environment,” writes Liqian Ren, WisdomTree director of modern alpha. “We expect the Biden Administration will be more friendly to global trade partners, alleviating some pressure on China and the global economy from Trump’s trade wars. Yet not all of the political debate is centered on U.S. actions. Will China’s government take actions to limit the growth of its Internet powerhouses like Alibaba? We believe the answer is clearly yes. The outcome will be a push-and-pull game among Chinese regulators, entrepreneurs and public sentiments.”

Snag the Right Overseas Exposure with WisdomTree

The world’s second largest economy appears to be laser-focused on becoming the world’s dominant tech nation. Investors looking to get exposure to China and leverage strength in technology can look to the WisdomTree model portfolio.

“We believe every company in China faces idiosyncratic political risk, both in China and from the U.S. We believe owning a portfolio, particularly an ex-SOE portfolio, is the most prudent and less risky way to invest in China,” notes Ren.

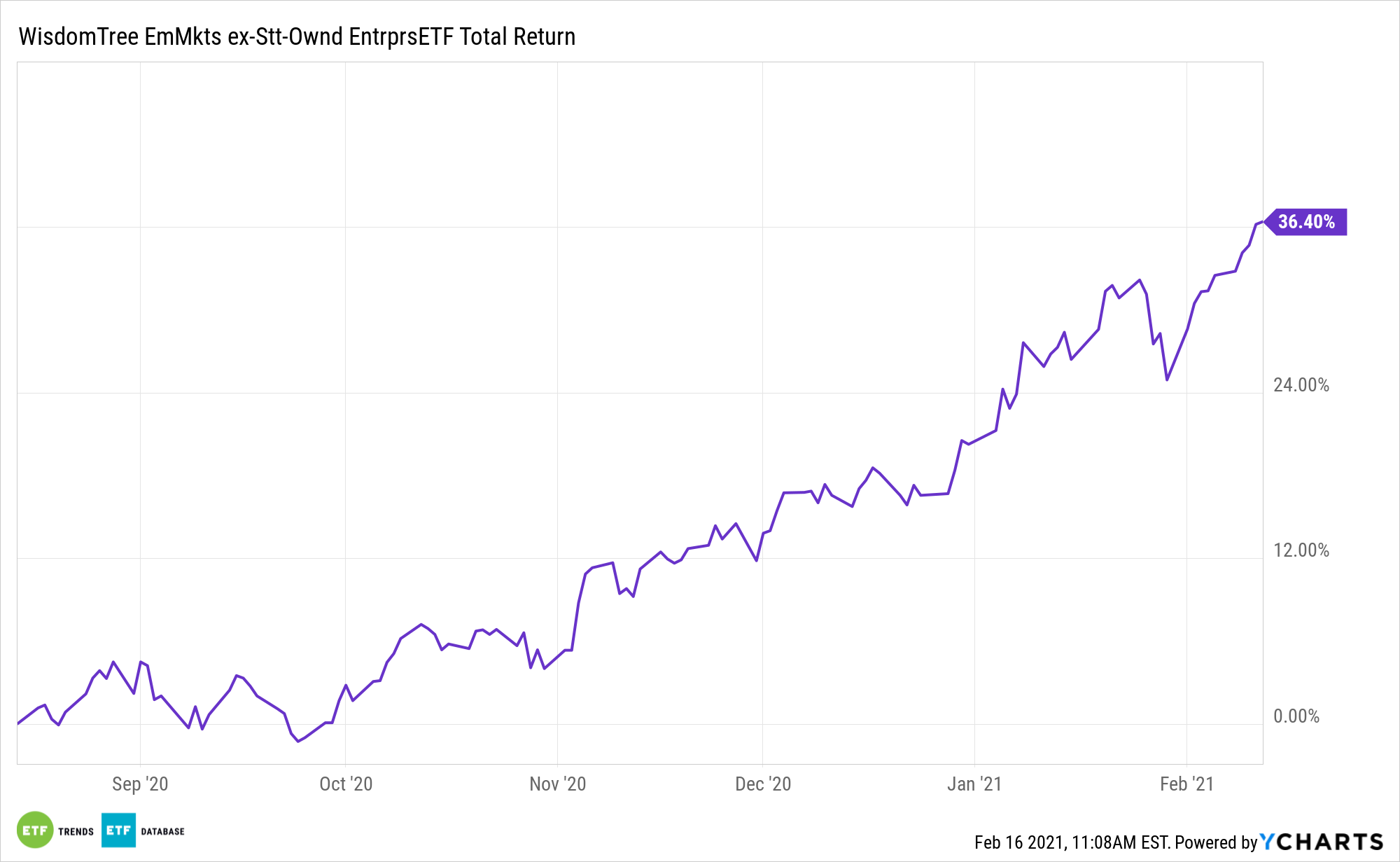

One of the benefits of the WisdomTree model portfolio is its exposure to the WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE). XSOE steers clear of state-controlled companies, as well as Chinese companies at the center of de-listing controversies.

XSOE is topping the MSCI Emerging Markets Index by nearly 160 basis points to start 2021.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.