By Kevin Flanagan, Head of Fixed Income Strategy

A Federal Reserve (Fed) meeting on St. Patrick’s Day—for a bond guy like me, there’s nothing like it. In honor of these two events coinciding this year, and given what has recently been transpiring in the U.S. Treasury market (UST), an Irish saying comes to mind: If you buy what you don’t need, you might have to sell what you do.

This year’s rise in the UST 10-year yield has created speculation that the timing of the Fed’s first rate hike could get pushed up, while also heightening discussion about when any balance sheet tapering talk might occur. Based on recent comments from Powell & Co., and of course today’s FOMC meeting, the Fed appears to be in no hurry for a liftoff, i.e., raising the Fed Funds target range over the next year or two.

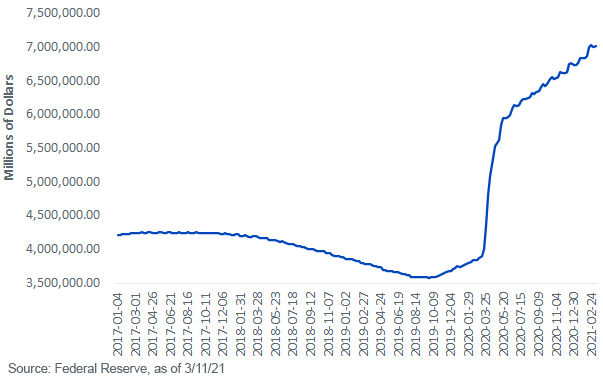

Fed Holdings of Treasuries, Agency Debt & MBS

Against this backdrop, it appears the more likely Fed policy headlines for this year will center around its balance sheet. But before any possible taper talk, the UST market has been waiting to see if the policy makers will make any shifts in the composition of their purchases. On this front, Chair Powell has been trying to thread the needle between what is considered ‘normal’ rate movements given the improved economic outlook and something that “was notable and caught my eye.”

At this point, the Fed seems to be downplaying the notion of a disorderly move higher in the UST 10-Year yield and instead focusing more on keeping monetary policy right where it is, namely, highly accommodative. Thus, the maturity composition of the Fed’s Treasury purchases, for now, has not been altered.

In terms of the Fed’s balance sheet, the policy makers’ holdings of Treasuries, mortgage-backed securities (MBS) and agencies have now topped $7 trillion. The accompanying graph reveals a bit of a sawtooth pattern since spring of last year, but the unmistakable trend is one of higher totals. In fact, since March 2020, the Fed’s System Open Market Account (SOMA) has risen by over $3.1 trillion, with a little under $300 billion occurring year-to-date.

Conclusion

What often gets overlooked by investors is that even though the Fed is buying Treasuries at a rather aggressive clip, rates can still rise, specifically in the intermediate to longer duration areas. This possible development is important to keep in mind when positioning your fixed income portfolio.

Unless otherwise stated, data source is Federal Reserve, as of 3/11/21.

Originally published by WisdomTree, 3/17/19

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.