Emerging markets equities perked up in late 2020. Advisors looking to capitalize on an extension of that trend have options to consider in 2021.

A solid starting point is the WisdomTree Emerging Markets Multi-Factor Portfolio.

“This model portfolio is designed for investors with a long-term horizon looking for exposure to a broad universe of Emerging Market equities primarily using factor focused ETFs. The selected ETFs provide certain factor tilts that have the potential to generate excess return relative to comparable cap-weighted benchmarks over longer-term holding periods. The strategies may use both WisdomTree and non-WisdomTree ETF,” according to WisdomTree.

If the Federal Reserve holds fast to its commitment to keep rates low, that could keep on fueling a weaker dollar. This, in turn, will help translate into more strength for the local currencies of emerging markets.

A Wise Choice Among Model Portfolios

“The dollar has continued on the slide that started when global risk appetite rose from the grave in March. EM equities have a strong negative relationship with the dollar, and additional fiscal stimulus measures from Congress may have the effect of further dollar weakness in a reflationary environment,” according to WisdomTree research.

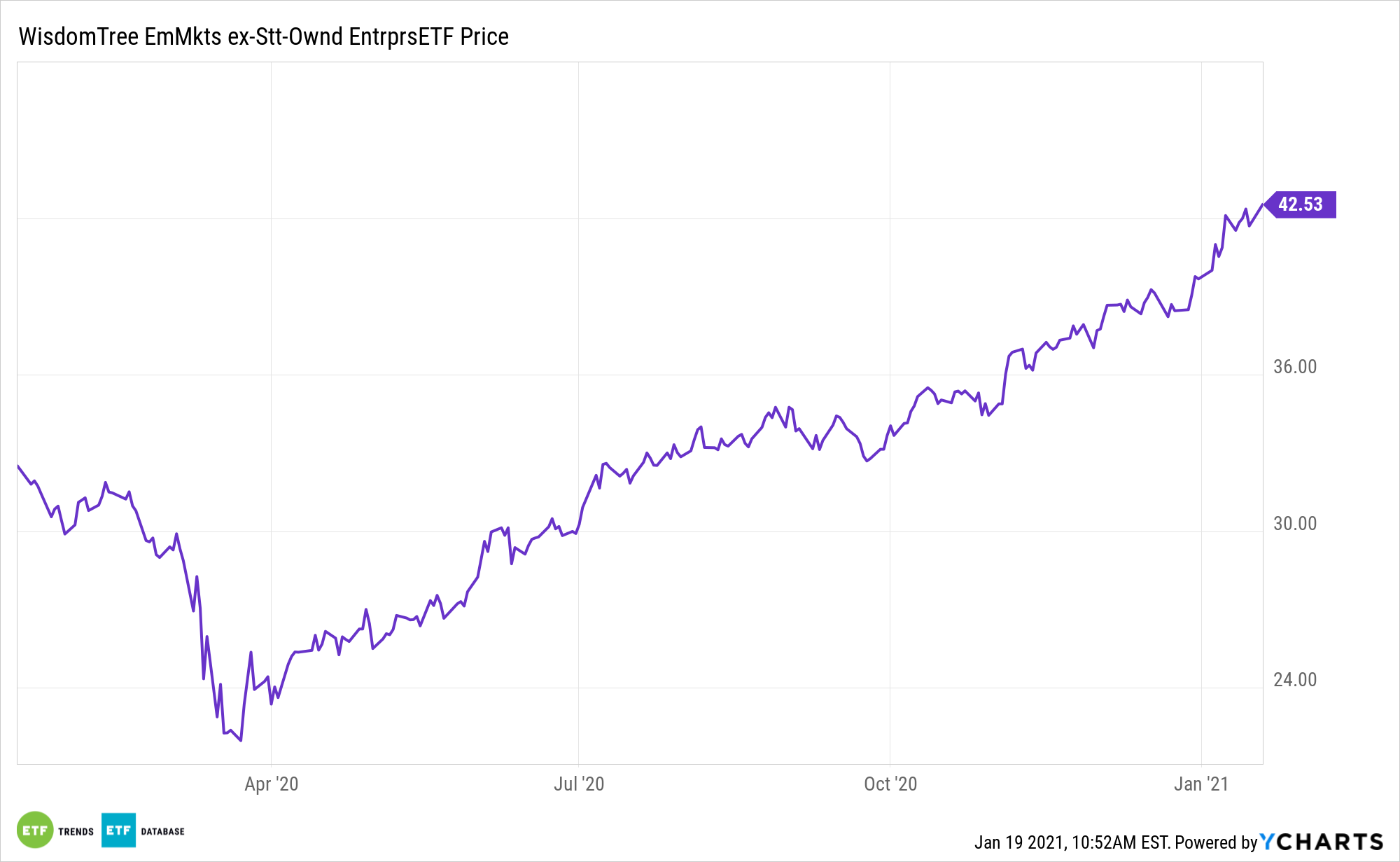

One of the benefits of the WisdomTree model portfolio is its exposure to the WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE). XSOE steers clear of state-controlled companies as well as Chinese companies at the center of delisting controversies.

“A big outstanding question mark about the asset class is the political tension between China and the U.S. While the Biden administration is likely to be more predictable in its dealings with foreign leaders, there is bipartisan support for a tough stance with China in the aftermath of the COVID-19 pandemic and the growing number of restrictions on Hong Kong,” according to WisdomTree. “While these political tensions are hard to predict, taking an non-state-owned approach can help mitigate this risk. On November 12, 2020, outgoing President Donald Trump announced Executive Order (EO) 13959, banning U.S. investors from investing in securities identified by the Department of Defense as Communist Chinese military companies (CCMCs).”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.