Investors often lean toward large-cap stocks, and that’s still true when they venture into emerging markets. Large-cap bias explains the popularity of funds linked to the MSCI Emerging Markets Index and comparable benchmarks.

However, that bias isn’t paying off this year. Due to China’s regulatory crackdown that’s ensnared mostly large-cap companies, the MSCI Emerging Markets Index closed the third quarter with a 3.3% year-to-date loss.

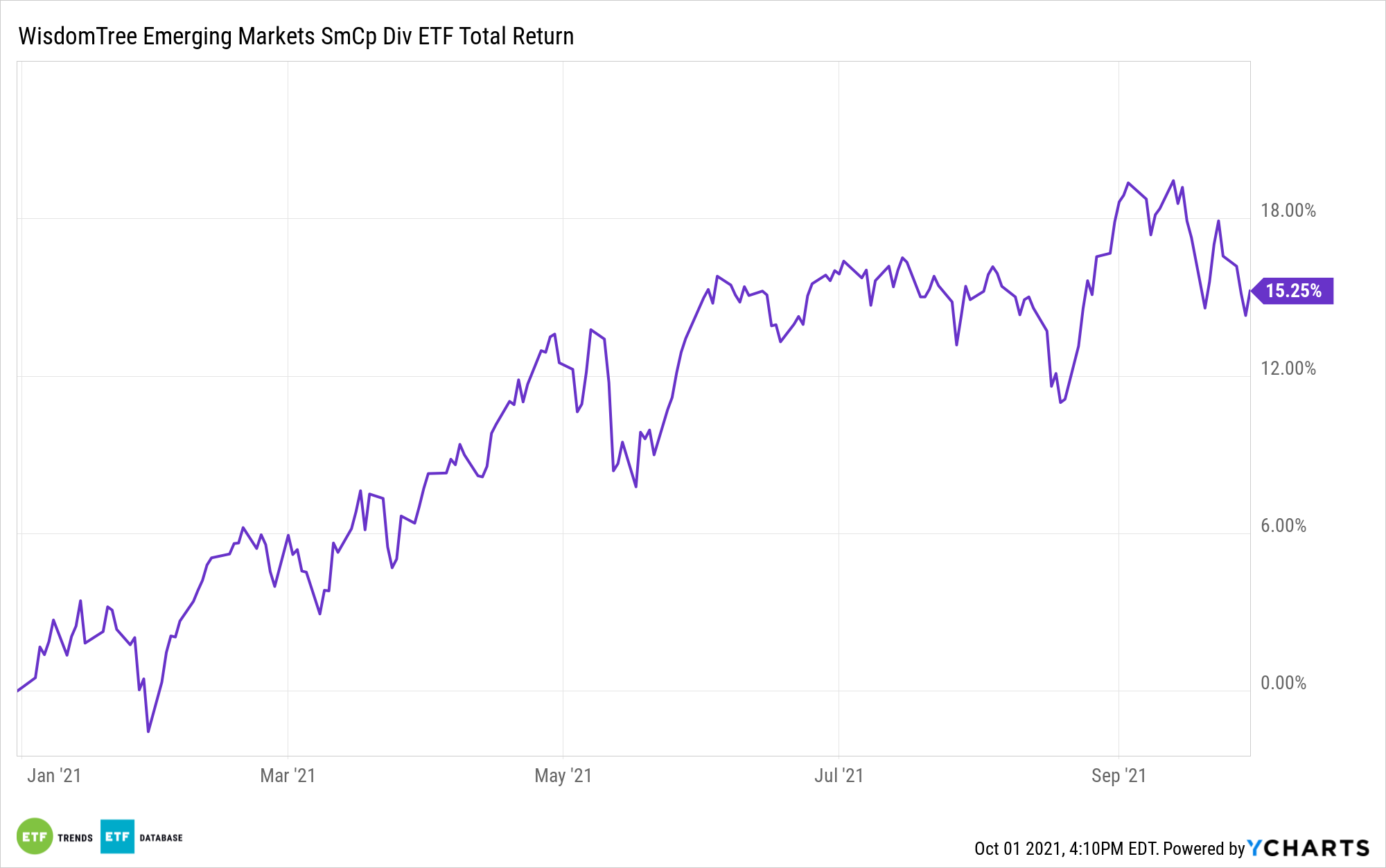

That dour showing may prompt investors to assume that emerging markets small-caps are performing even worse than large-cap counterparts. Actually, the opposite is true. Just look at the WisdomTree Emerging Markets SmallCap Dividend Fund (NYSEArca: DGS), which is higher by more than 15% year-to-date as of Friday. Investors may be missing out on this opportunity.

“Investors can be forgiven for not realizing how well the asset class has done,” says WisdomTree asset allocation director Joseph Tenaglia. “There is currently $750 billion invested in U.S.-listed EM mutual funds and ETFs. Of those assets, less than 2% of all EM fund assets are in dedicated small-cap funds.”

As its name implies, DGS is a dividend exchange traded fund, and it delivers the goods on that front. The WisdomTree ETF yields 3.77% compared to 0.83% to the domestic-focused Russell 2000 Index and nearly 200 basis points above the yield on the MSCI Emerging Markets Index. DGS offers other benefits.

“As opposed to small-cap stocks in the developed world, EM small-cap dividend payers have historically been less volatile than their large-cap peers (DGS beta since inception vs. MSCI EM Index: 0.94),” adds Tenaglia. “Lastly, EM small caps are showing in today’s environment exactly how great of a diversifier they can be alongside large-cap EM companies.”

The $2.26 billion DGS, which turns 14 years old later this month, debunks another myth associated with emerging markets stocks: that China dominates the small-cap space.

It’s a reasonable assumption given China’s status as the world’s second-largest economy. As is seen in the U.S. and China, the larger an economy and equity market, the more vibrant a small-cap realm can be.

However, Chinese stocks account for just 13.44% of DGS’s roster, placing the country third, well behind Taiwan and South Korea — a pair of high quality, tech-heavy markets with big dividend growth potential. In other words, at a time when investors are looking to generate equity income and limit risk in China while remaining engaged with emerging markets stocks, DGS is an ideal ETF to consider.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.