Domestic equities are ready to turn in solid performances again this year. Advisors can put factor-based approaches on their side with the right model portfolios.

Take the case of the WisdomTree Core Equity Model Portfolio, which features 11 exchange traded funds spanning a wide array of U.S. equity concepts.

“This model portfolio is designed for growth-oriented investors with a long-term horizon looking to maximize long-term potential for capital growth through a globally diversified set of equity ETFs,” writes the issuer.

This model portfolio is positioned to capitalize on some important trends that emerged late last year.

“Relative to the All Country World Index (ACWI), we maintain our over-weight position in U.S. equities going into 2021. 2020 marked the eighth year of the past nine in which U.S. equities outperformed their international peers,” according to WisdomTree research. “The year was highlighted by the continued domination of big tech stocks; however, the final few months of the year saw a long-awaited catch-up rally by beaten-down cyclical assets and small caps.”

A Big Quality or Value Believer?

Several of the ETFs in the model portfolio feature exposure to the quality and value factors. The former is usually persistent, while the latter appears to be awakening from a long slumber.

“Quality remains undervalued and serves as an anchor for our equity models. We believe 2021 may finally be the year that value stocks outperform, given their historical tendency to do so in early-cycle periods combined with the increasing regulatory risk facing some big tech names,” notes WisdomTree. “We continue to ensure our portfolios have lower valuations, as defined by price-to-earnings ratios, and are tilted toward value and size; however, we elected to add more explicit growth exposure in order to balance a portion of our value bias and to act as a hedge if the expected value rebound does not take hold.”

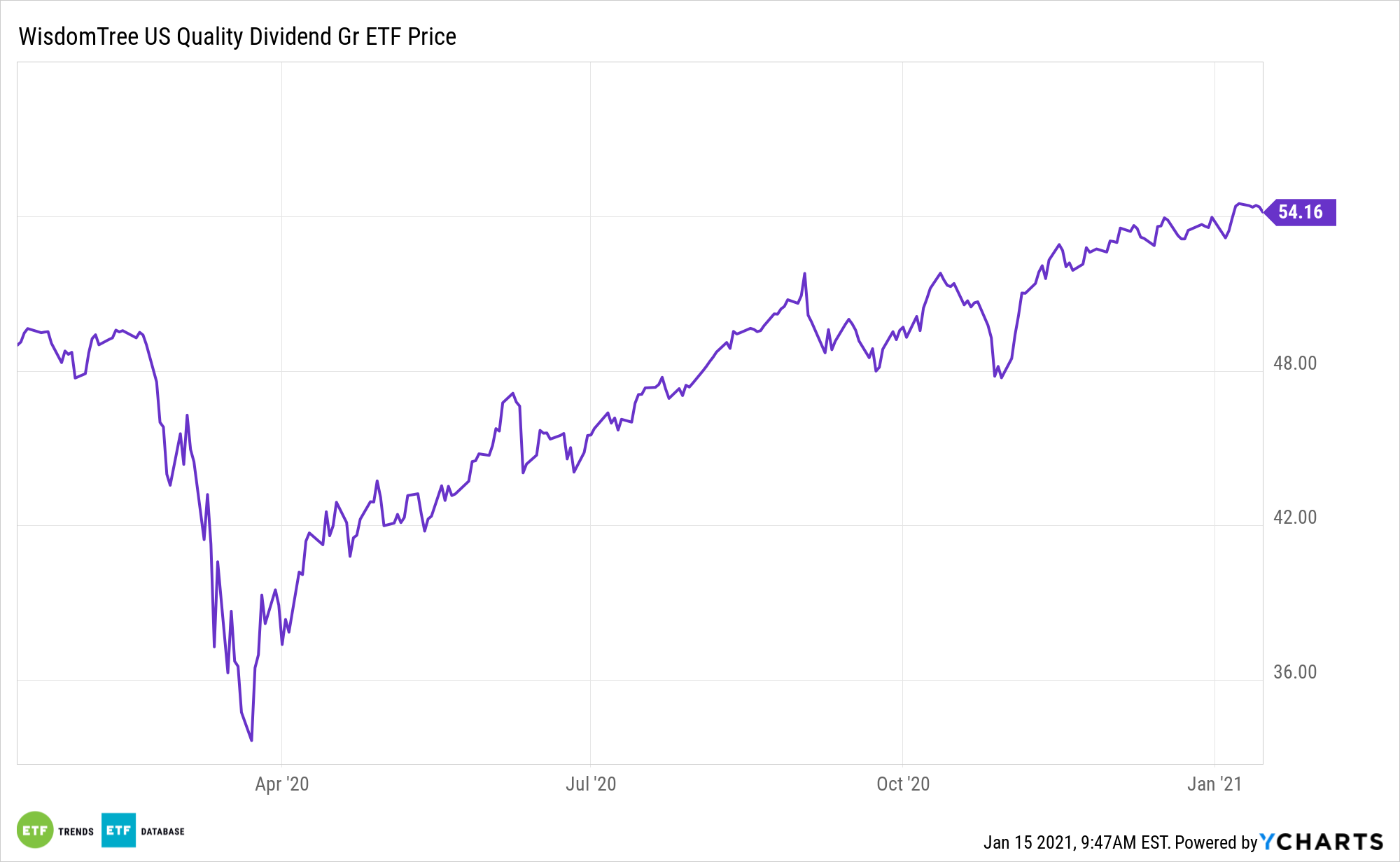

The WisdomTree U.S. Quality Dividend Growth Fund (NasdaqGM: DGRW) is one of the marquee holdings in the model portfolio.

DGRW seeks to track the price and yield performance of the WisdomTree U.S. Quality Dividend Growth Index. The index is a fundamentally weighted index that consists of dividend-paying U.S. common stocks with growth characteristics.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.