The dominance of a few large technology stocks in the S&P 500 has caused concern among investors, but there may be useful alternatives in the form of equal-weighting approaches or dividend-growth strategies.

If those high-flying tech-oriented stocks are overpriced, will they crash the index on their way down as dramatically as they propelled it on the way up? After all, the “Magnificent 7” is now roughly 30% of the index. And if they’re poised to fall, how is it possible to own U.S. stocks and avert this potential outcome?

One way, as DoubleLine’s Jeffrey Gundlach has suggested in recent webcasts, is to own an equal-weighted version of the index. Funds such as the Invesco S&P 500 Equal Weight ETF (RSP) and the iShares MSCI USA Equal Weighted ETF (EUSA) can deliver that exposure, dramatically subduing the effect of the “Magnificent 7” on future returns.

Gundlach’s DoubleLine has even issued a fund that equally weights the stocks in the Fortune 500, the DoubleLine Fortune 500 Equal Weight ETF (DFVE).

Dividend Growth vs. Equal Weight

But Simeon Hyman, ProShares Global Investment Strategist, speaking about the S&P 500, says “Maybe the bottom 493 [stocks] don’t deserve to be elevated [in the manner they would be in an equal weighting of the top 500].”

A better way to avoid a heavy weighting in the Mag 7, says Hyman is to own dividend-paying stocks. But Hyman doesn’t mean indiscriminately owning anything that has yield — especially very high yield, which can also mean stagnant growth and high debt. Instead, he means companies that have a long history of dividend growth. That often captures high-quality businesses with strong returns on invested capital.

Naturally, ProShares runs a suite of funds dedicated to “dividend aristocrats” or stocks that have paid dividends consistently for long periods including the $11.8 billion ProShares S&P 500 Dividend Aristocrats (NOBL). The fund tracks the performance of the S&P Dividend Aristocrats Index, an index of large-cap stocks that have annually increased their dividends for 25 years.

Hyman says a growing dividend is a “forward-looking signal.” Because stocks that cut dividends get punished by the market, companies that issue them and grow them are generally confident that they can maintain them.

Underperforming Aristocrats

Although Hyman isn’t willing to say the largest technology names are in bubble territory, he does note that “we haven’t seen this level of underperformance [by the aristocrats versus the S&P 500]” since the first tech bubble. NOBL gained around 8% last year against a 26% surge for the S&P 500.

While the “Magnificent 7” are highly profitable companies, the profitability of the aristocrats is higher than the broad index. The aristocrats have an average return on assets “well north of 5%,” says Hyman. That compares well to the 3.5% ROA of the cap-weighted index and the 2% ROA of the equally weighted version of the index.

Profitability gets even worse if you simply choose the highest-yielding stocks. For example, the iShares Select Dividend ETF (DVY) tracks the Dow Jones US Select Dividend Index, which consists of the 100 highest yielders excluding REITs. The ROA on that fund is less than 2%.

Rounding Out the Dividend Growth Choices

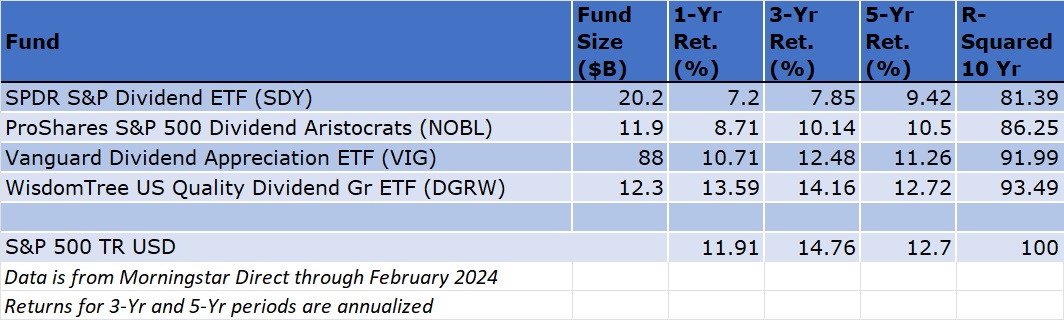

Investors have three other big choices among dividend growth funds – the behemoth $88 billion Vanguard Dividend Appreciation ETF (VIG), the $20 billion SPDR S&P Dividend ETF (SDY), and the $12 billion WisdomTree US Quality Dividend Growth ETF (DGRW).

VIG tracks the S&P US Dividend Growers Index, which contains companies that have grown dividends for the past decade, and market cap weights those stocks. It contains over 300 stocks, and as a consequence of its market-cap weighting methodology, it has tended to look like the S&P 500 with a 10-year r-squared of more than 91.

SDY, the second largest fund in this comparison, tracks the S&P US Dividend Growers Index. The underlying index includes only companies that have grown their dividends annually for at least 20 years and weights them by yield. This move away from market cap weighting has differentiated the fund from the S&P 500 more than VIG’s underlying has, and it has a 10-year r-squared of 81. It has also made the fund more value-oriented than VIG or NOBL.

DGRW Combines Growth and Quality

Finally, DGRW tracks an index constructed with stocks that have a minimum of $2 billion in market capitalization and also pay dividends. In addition, the index emphasizes growth and quality characteristics. It uses long-term earnings growth expectations to rank its components for the former. The index relies on historical averages for return on equity and return on assets to rank companies for the latter. The methodology weights companies by dividends and rebalances annually

DGRW’s underlying index has as large a technology weighting as the S&P 500. Its top two holdings are Microsoft and Apple, which represent more than 12% of its assets. But its NVIDIA exposure is more muted with the stock in the eighth slot soaking up around 3% of the fund’s assets. Also, Amazon, Alphabet, Meta, and Tesla aren’t in the top 10.

Lower quality companies that haven’t grown their dividends consistently may have their day in the sun too. But dividend growers can be a sensible way to gain exposure to U.S. stocks right now.

For more news, information, and analysis, visit the Modern Alpha Channel.