By Jeff Weniger, CFA, Director, Asset Allocation, WisdomTree

There have been so many false dawns for value stocks in recent years that I hesitate to ask:

Was last week the turnaround?

If so, it would mark a switch that is 14 years in the making. The S&P 500 Growth Index’s bout of outperformance relative to the S&P 500 Value Index started in summer 2006. From July 31, 2006 through this past Friday, growth stocks returned 12% annually, a quintupling. S&P 500 Value, in turn, returned less than 7% annually, a return of “just” 156%.

The last couple weeks have seen a perfect storm for Big Tech, the sector that is growth’s driving force. With everyone forced to stay home, why not check in on your Facebook “friends” or watch a movie on Netflix—for the entirety of 2020?

Pfizer and BioNTech’s bombshell announcement that their vaccine demonstrated 90% effectiveness turned “the COVID-19 trade” on its head. With the prospect that this nightmare could go away in 2021, up went hotel stocks, airlines, oil companies—you name it—while most of the Big Tech giants watched the rally from the sidelines.

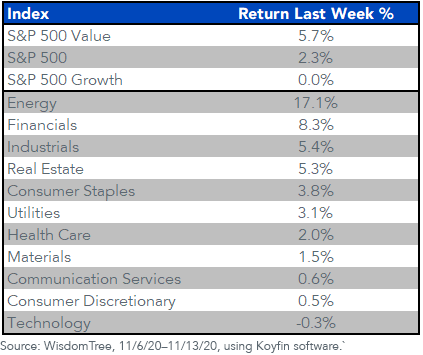

Facebook, which went into the pre-vaccine weekend changing hands at $293, ended the week at $277. Google-parent Alphabet’s A class of shares were little budged, up just 13 points to $1,772. This was in a week that saw the S&P rally 2.3%, with every non-Tech sector up, some sharply.

Figure 1: S&P 500 Performance Last Week

The vaccine was far from the only catalyst for value’s sharply higher week amid a tape that refused to reward growth-oriented Consumer Discretionary and Technology companies.

Beijing sent a chill through Tech bones when it announced its desire to check monopolistic power at Tencent, Alibaba and Meituan—that country’s three dynamos.

That development hit the wires in tandem with the EU coming after Amazon for anti-competitive practices, specifically pertaining to its use of vendors’ data to one-up small players in France and Germany. There has been no post-election rally for Jeff Bezos’s brainchild: At $3,128 per share, Amazon has been chopping sideways since July. It may be lost in the chatter amid the market’s November strength, but Amazon is $400 lower than its September peak above $3,500.

Unlike the disappointments in Silicon Valley, the S&P 500 Energy Index surged 17% last week, Financials 8%. Those are the two most quintessentially value sectors out there.

It makes you wonder: Is this it? Was the vaccine news “the thing” that is big enough, bold enough, life-changing enough to upend the market’s dynamics?

If that is the case, open the playbook: Rising interest rates on account of economic reopening would aid the banks. Your road trip to see your sister for Independence Day 2021? It may be on. That means the fuel demand we came to accept as “normal” in 2020 looks very different next year.

Is the 14-year wait for value to take market leadership control from growth finally over?

I will say this: If the market needed a catalyst—a big one—you would be hard-pressed to think of something grander than a COVID-19 vaccine announcement.

Unless otherwise stated, data source is Koyfin, as of November 13, 2020.

Originally published by WisdomTree, 11/16/20

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.