With the calendar turning to July, another month has been added to the value rally. For those keeping score, it’s now 10 months old, and if history is any guide, this would be about the time investors start rotating out of lower quality value stocks – the ones that ignited the current rally – and into higher quality fare.

If that scenario plays out, it could benefit quality exchange traded funds, including the WisdomTree U.S. Quality Dividend Growth Fund (NasdaqGM: DGRW). As its name implies, DGRW is a dividend growth strategy with quality leanings. Those are concepts that are appealing in any environment, but those perks may also lead to higher valuations. That’s not the case today.

“Another interesting dynamic taking hold is that quality strategies—which select growth and quality companies—are showing valuations that rival traditional value indexes but with a different composition and sector mix,” writes Jeremy Schwartz, WisdomTree global head of research.

Indeed, the $5.96 billion DGRW isn’t heavily allocated to traditional value sectors. Of those groups, only financial services are somewhat prominently displayed within DGRW. Emphasis on “somewhat” because financial stocks account for just 5.59% of the ETF’s weight – good for just the sixth-largest sector exposure in the fund.

Avoiding Junk

As noted above, some lower quality stocks have driven the value factor higher this year. Previous value rallies shows that scenario has a shelf life.

“Strong balance sheet stocks are associated with higher-quality companies, and weak balance sheet companies are associated with low-quality stocks—and this big return dispersion—30 percentage point differential returns over the last six months or so—are leading to valuation discrepancies in these basket,” adds Schwartz.

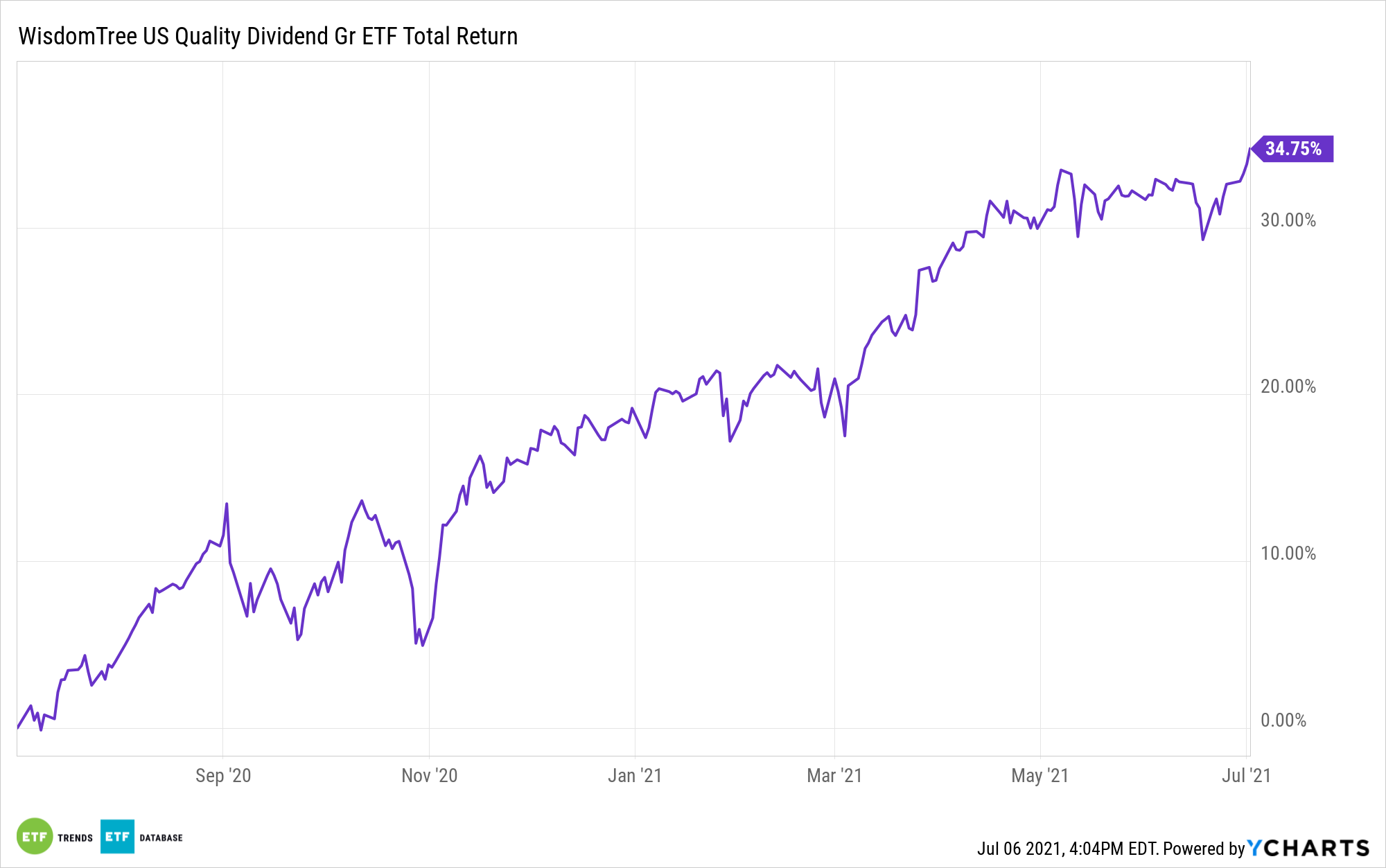

That gap and the contributions of low quality to value’s strength this year are favorable for DGRW on the basis that the chasm could be narrowed and market participants might soon renew their affinity for now discounted quality stocks. As it is, DGRW isn’t sitting idly by this year. The fund is up almost 12% year-to-date and resides near all-time highs.

Another point in DGRW’s favor is that many of its components score well on the basis of return on assets (ROA) and return on equity – something that cannot be said of many traditional value indices. DGRW’s multiples are even more attractive than some of those old-school value benchmarks.

“While traditional value strategies select companies that earn lower returns on capital (measured by return on equity (ROE) or even return on assets (ROA)), the WisdomTree Quality Dividend Growth Fund (DGRW) is showing valuation multiples as compelling as the value benchmarks but with a process that focuses on high return on capital and strong balance sheet stocks,” continues Schwartz.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.