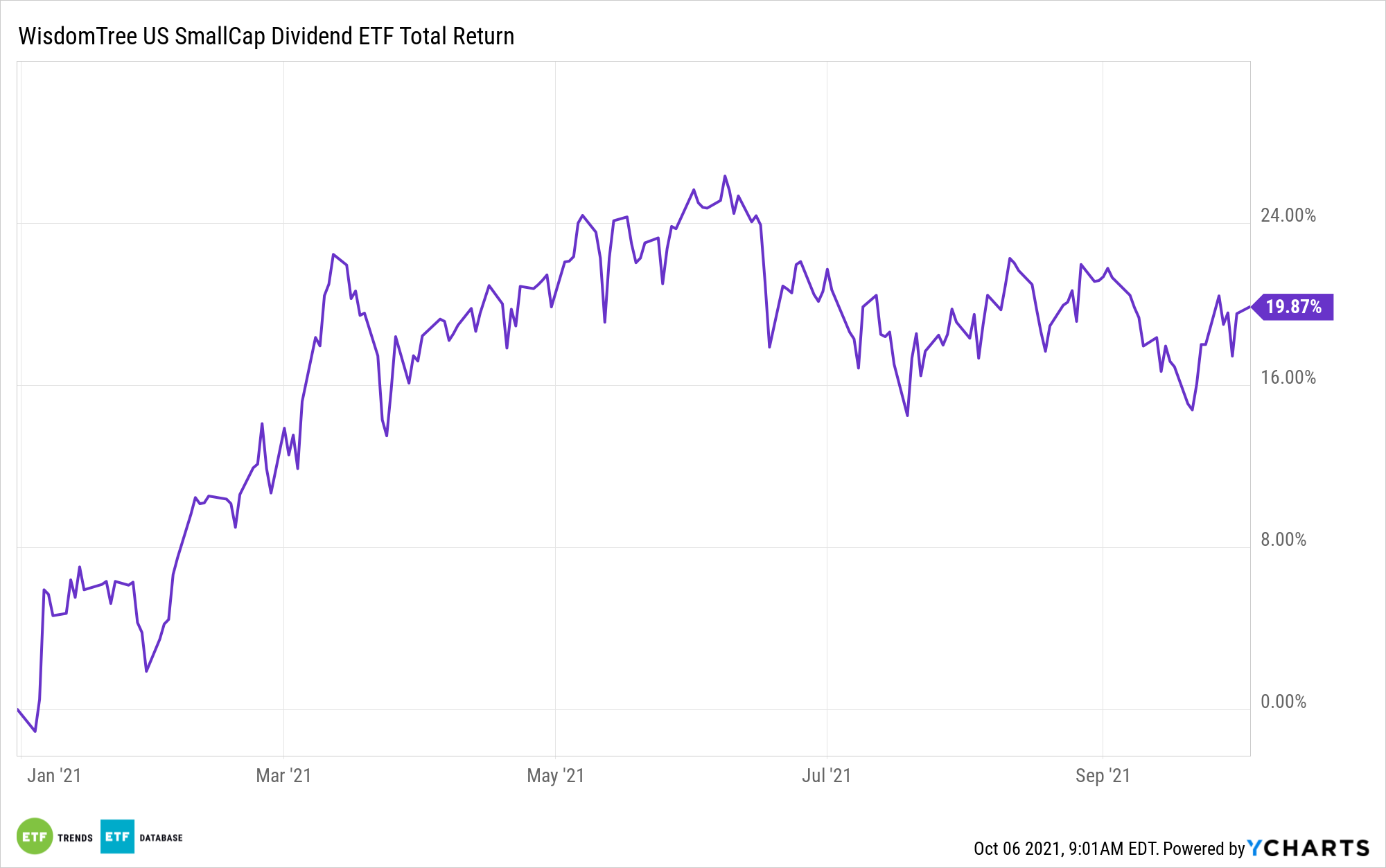

Small-cap and value stocks enjoyed plenty of good times in the first quarter of 2021, but since the end of the second quarter, there’s been a lot of lethargy, even some downside, for small-caps and value equities.

Some exchange traded funds that marry smaller stocks with the value factor are holding up better than others. For example, the WisdomTree U.S. SmallCap Dividend Fund (NYSEArca: DES) is modestly higher off its July lows and resides just 6% below its 52-week high as of Oct. 5. DES follows the WisdomTree U.S. SmallCap Dividend Index and could rally into year-end with some market observers wagering that the reopening playbook is set to be revisited by investors.

“Growth and large-cap stocks surged in July and August as investors rotated out of value and small-cap stocks. As such, value and small-cap stocks have become more undervalued,” says Morningstar analyst Dave Sekera. “By individual stock, the rotation also led to an increase in the number of undervalued opportunities. The percentage of our coverage with 4- or 5-star ratings has doubled to 24% from last quarter.”

A point highlighted by Sekera is economic normalization, which was stunted in the third quarter thanks to the emergence of the Delta strain of the ongoing COVID-19 pandemic. Economic normalization implies that the economy and consumers are getting back to normal or pre-pandemic behavior — a scenario that previously benefited cyclical stocks.

DES has ample cyclical exposure. For example, the financial services and consumer discretionary sectors combine for 39% of the fund’s weight, according to issuer data. There’s more good news for investors considering DES: Not only are value stocks inexpensive today, but the same is true of small-caps.

“We continue to see the best value for investors in the value category, which according to a composite of our fundamental equity valuations are undervalued, especially relative to core and growth categories, which remain overvalued. Small-cap stocks are the most undervalued, with the undervaluation concentrated in value and growth categories, whereas core small-cap stocks are at the high end of our fairly valued range,” adds Sekera.

The Morningstar analyst notes that at the sector level, energy and consumer cyclical are the most undervalued groups. Those sectors combine for about 13% of DES’s roster. Materials and consumer staples, which combine for almost 17% of DES, are back in fair value range, says Sekera. DES has a distribution yield of 3.44 — well above the comparable metric on traditional small-cap indexes.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.