By Liqian Ren, Director of Modern Alpha

Key Takeaways

- Currency hedging is crucial for mitigating risks in global investing by managing foreign exchange fluctuations while preserving equity exposure.

- Our dynamic currency-hedged ETFs have proven to reduce portfolio risk through factor-based strategies.

- The momentum factor’s increased weight in our currency model since 2023 has continued to lower portfolio risk despite more varied hedge ratios.

In the complex world of global investing, currency risk plays a significant role. When investors allocate funds to foreign equities, they implicitly expose themselves to foreign exchange fluctuations. Currency hedging strategies aim to mitigate this risk while preserving the original equity exposure.

At times, distinguishing risk enhancements stemming from currency movements from those originating from stock portfolios can be challenging. Within our suite of offerings, we present three distinct strategies where the equity portfolio remains the same, and the sole variation is the currency approach.

This transparency provides investors with a concise view of the impact of currency hedging. In general, whether dynamically managed or fully hedged, currency hedging has consistently reduced overall portfolio risk.

Risk Reduction through Dynamic Currency Hedging

At WisdomTree, we employ bottom-up factor-based strategies (such as momentum and low volatility) for our active currency hedging models. Over the long term, our dynamic currency model has consistently added value. While the alpha generated by the currency model may vary in shorter time periods, one consistent trend remains: dynamic currency hedging effectively reduced portfolio risk.

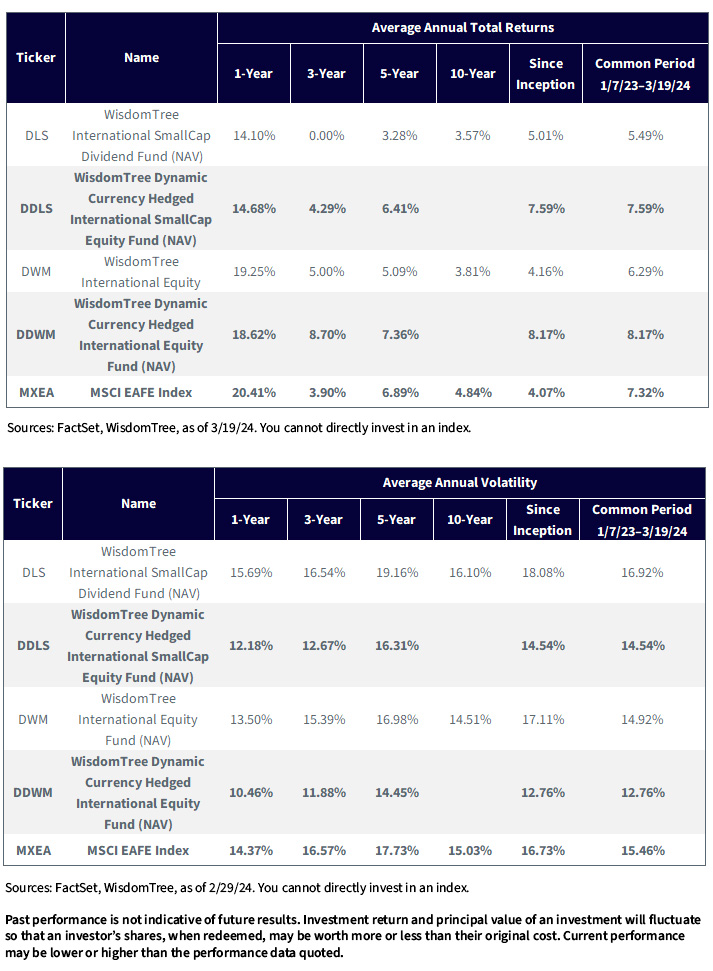

Let’s examine two specific scenarios:

1. International Dividend-Weighted Large-Cap ETFs:

- One of our original suites, launched in 2006, was our unhedged broad-based developed world ETF, ticker DWM.

- Ten years later, in 2016, we added a dynamic hedged variation. With DDWM, we observe a reduction in portfolio risk across the board.

- Notably, the value factor itself carries inherent risk. Therefore, portfolios with a value tilt can particularly benefit from currency hedging as a risk mitigation tool.

2. International Smaller-Cap ETFs:

- DLS was the first ETF in the industry to provide exposure to international small caps back in 2006 and was WisdomTree’s largest ETF, in the first few years. At a time when the euro was trading at 1.60 to the dollar, this was one of the ETFs that gave us the idea to provide currency-hedged ETFs in the first place, with the idea stocks could offer value if one could mitigate an overly strong currency.

- The addition of dynamic currency hedging added via DDLS, when compared to the unhedged DLS, resulted in lower portfolio risk.

- Again, the value tilt in smaller-cap portfolios underscores the value of currency hedging to reduce overall portfolio risk.

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: DLS, DDLS, DWM, DDWM.

Investors Paid to Hedge in Many Currencies

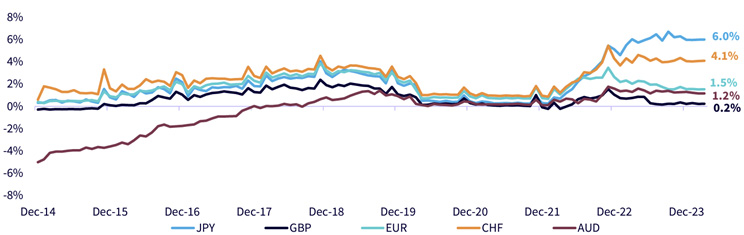

Annualized Carry by Currency

MSCI EAFE Annualized Carry

In the current geopolitical environment, adding a weak dollar bet via your foreign equity exposures is no longer necessarily the best baseline allocation. Rather, a strong dollar could become a headwind to U.S. earnings—and so adding more long U.S. dollar exposures is a more interesting diversifier.

Currently, even as the U.S. is expected to lower interest rates, the 2.6% interest rate differential (carry) earned by hedging will be lowered but continue to be positive for a while.

Dynamic Currency Model Now More Momentum Driven

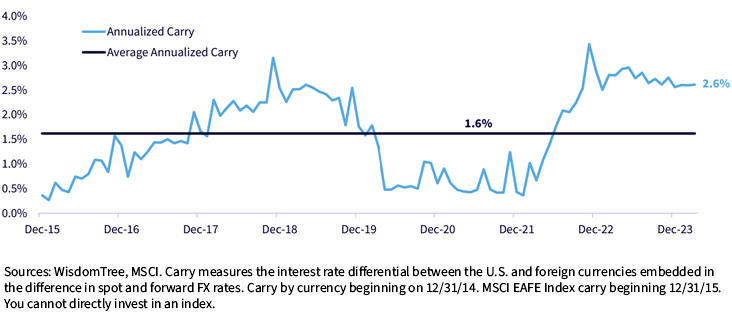

Historically, momentum tends to be the strongest factor in currency hedging. Our revamped dynamic currency model has about 60% weight in the momentum factor for both developed and emerging markets.

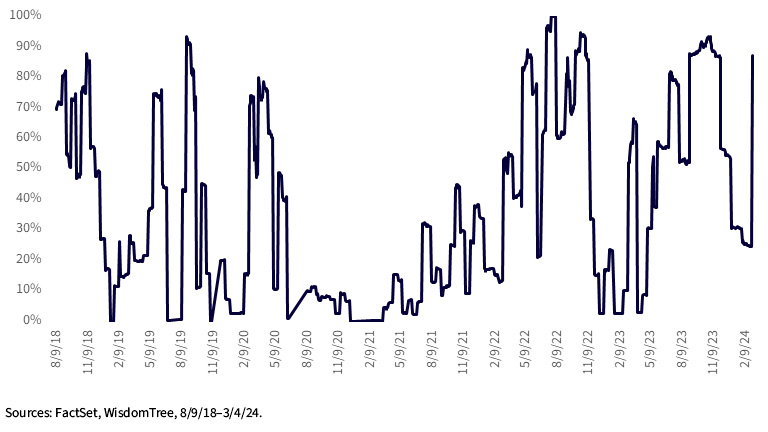

For the international developed universe, the weight of the momentum factor is higher from 2023, resulting in more varied hedge ratios. However, the currency overlay continued to reduce portfolio risk after the revamp, even as more momentum was introduced for the hedge ratio itself.

Portfolio Hedge Ratio Over Time

Prior to the revamp, the dynamic emerging markets currency model also heavily relied on the momentum factor. Consequently, the volatility of the portfolio hedge ratio was similar before and after 2023.

Emerging Market Multifactor Fund (EMMF) Hedge Ratio

In summary, the risk reduction of currency hedging was evident across the board, in our other currency-hedged strategies, such as the WisdomTree Japan Hedged Equity Fund (DXJ), the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), the dynamic currency hedging WisdomTree International Multifactor (DWMF) and Emerging Markets Multifactor (EMMF) Funds.

Macro currency calls are harder to incorporate into a systematic portfolio, thus in most active currency spaces, we’ve stuck with a factor-based active model to capture some benefits of dynamic currency hedging. And we recommend clients consider some exposure to currency hedging strategies to reduce portfolio risk in this uncertain environment.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

DWM: Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DDWM: The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DLS: Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DDLS: The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.

Originally published 25 March 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.