By Alejandro Saltiel, CFA, Head of Indexes, U.S.

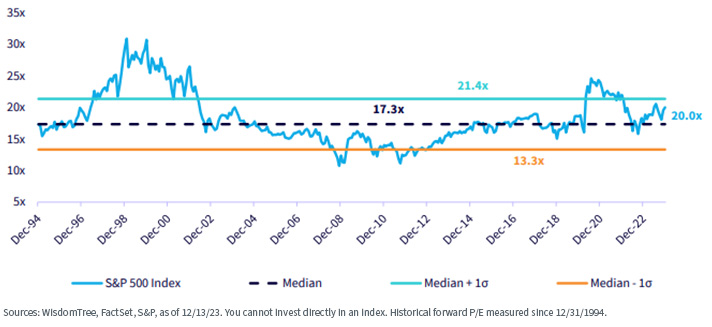

The current valuation of the S&P 500 Index is at 20 times forward earnings. The below chart, taken from WisdomTree’s Daily Market Snapshot, shows this is above the 30-year median but still within 1 standard deviation. Our Senior Economist, Jeremy Siegel, has written that 20 times forward earnings is actually a fair multiple for the S&P 500 Index over time and corresponds to a 5% earnings yield and expectation for real returns over five to seven years.

But certainly, this multiple is above the long-term average and, with fears about a potential recession bringing earnings downgrade risk, higher than normal valuations create some agita.

S&P 500 Index Forward P/E Ratio

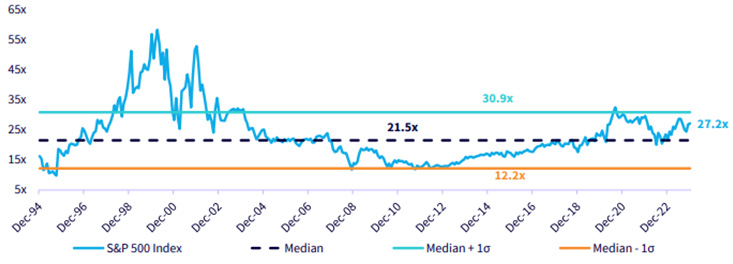

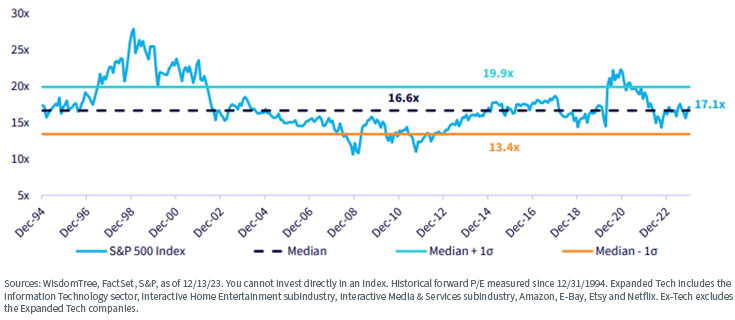

If we break out the S&P 500 into an Expanded Tech basket, which includes the Information Technology sector, Interactive Home Entertainment subindustry, Interactive Media & Services subindustry, Amazon, E-Bay, Etsy and Netflix, and an Ex-Tech basket, we can see that most of the value premium multiple is driven by the Expanded Tech stocks. The Ex-Tech part of the market has been trading around 10 P/E points below the tech basket.

This is important as the current market capitalization weight of the Expanded Tech basket in the S&P 500 is at an historical high of 39%.

S&P 500 Expanded Tech Forward P/E Ratio

S&P 500 Ex-Tech Forward P/E Ratio

Concerns about valuations have caused some to focus on strategies like equal weighting the S&P 500, which brings with it a greater size bias toward mid-cap companies.

WisdomTree is a pioneer in fundamentally weighting strategies. We seek to manage risks like valuation and profitability inherent with market cap-weighted strategies.

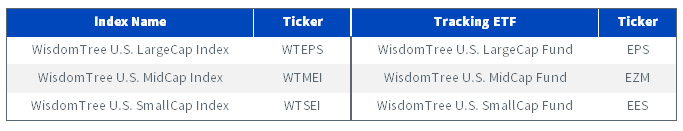

In 2007, WisdomTree launched its Domestic Core Equity family of Funds, seeking to give investors broad exposure to the different size cuts in the U.S. markets by selecting profitable companies and weighting them by their earnings.

WisdomTree Core Equity Family

In rebalancing these strategies annually, the WisdomTree U.S. LargeCap (EPS), MidCap (EZM) and SmallCap (EES) Funds maintain lower valuations than the broad market and ensure investors are not overpaying as markets rise.

Filtering Out Negative Earners

Screening out unprofitable names can have a meaningful impact depending on size cut.

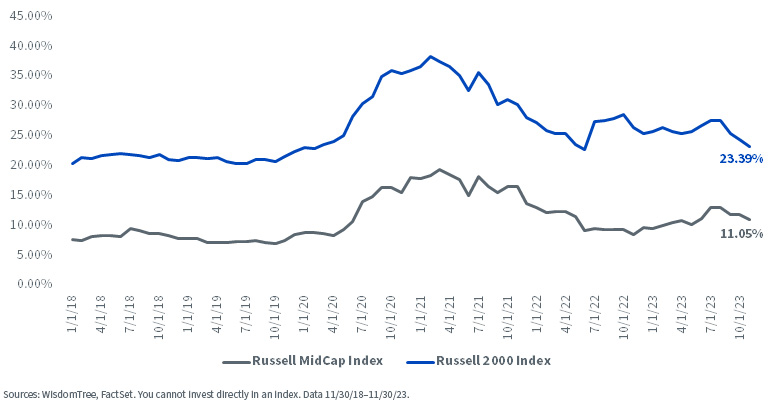

As of the end of November, 23.4% of the weight in the Russell 2000 Index was made up of companies that had negative earnings over the past 12 months. Although this number is lower in the mid-cap universe, it is still north of 11% and peaked around 20% in the months following the Covid pandemic.

% Weight in Negative Earners

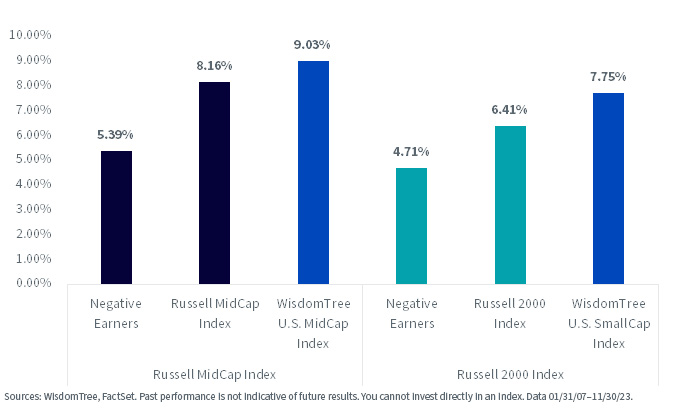

Looking back 17 years, the group of negative earners significantly underperformed the broader benchmark, thus systematically identifying and removing these companies has made a significant impact and is a contributing reason why WTMEI and WTSEI have outperformed their respective benchmarks since their inception in January 2007.

Returns since January 2007

For definitions of indices in the graph above, please visit the glossary.

Rebalance Process

In recent years, we’ve improved the Domestic Core Equity Indexes by creating the WisdomTree Core Equity Index Committee, which oversees the rebalance of these Indexes. The Committee ensures the earnings measure used as input in the annual reconstitution properly reflect a company’s recurring profitability and verifies the risk reduction components of the methodology are correctly implemented. These risk reduction components include limiting exposure to companies with higher-than-average earnings risk along with actively constraining sector and individual security biases, reducing active risk versus the market.

We believe that this systematic process represents an advantage versus other index providers, like S&P, who do not add unprofitable names to their indexes but do not screen for profitability once a company is in the index.

Improving Measure of Earnings

One of the focus areas of the Index Committee is a topic with increased academic coverage over the past few years: how traditional accounting measures fail to reflect the structure of modern businesses.

Technology and Health Care companies, among others, invest significantly in intangible assets such as research and development (R&D) to develop products, patents and other competitive advantages.

Since 1974, the Financial Accounting Standards Board (FASB) has required that companies expense R&D, deducting it in their income statement on the fiscal year the expense is incurred. Businesses that spend on tangible assets, such as vehicles and factories, are allowed to capitalize these expenses and depreciate/amortize them throughout the life of the asset—basically, spreading out their expense across many reporting periods.

The argument behind this is that tangible assets have a value that can be easily assessed, whereas intangible assets are more difficult (or impossible) to value. In a conservative approach by the FASB, intangible assets are not assigned a value on the balance sheet, unlike tangible assets.

All else equal, this distinction results in higher earnings for asset-heavy businesses operating in the Industrials, Materials and Energy sectors and lower measures for asset-light businesses in the Information Technology and Health Care sectors. This can have important implications in terms of eligibility and weighting for the WisdomTree Domestic Core Equity Funds.

Rebalance Results

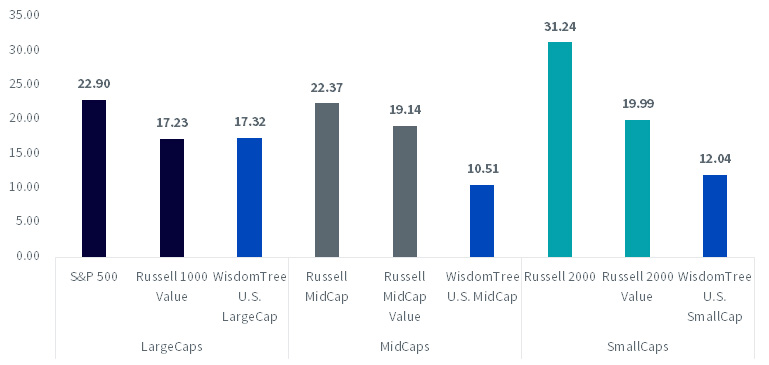

WisdomTree rebalanced its Domestic Core Equity Funds after the close on December 13. As a result of their annual reconstitution, these portfolios are trading at significant discounts to their broad-based benchmarks (even their value benchmarks).

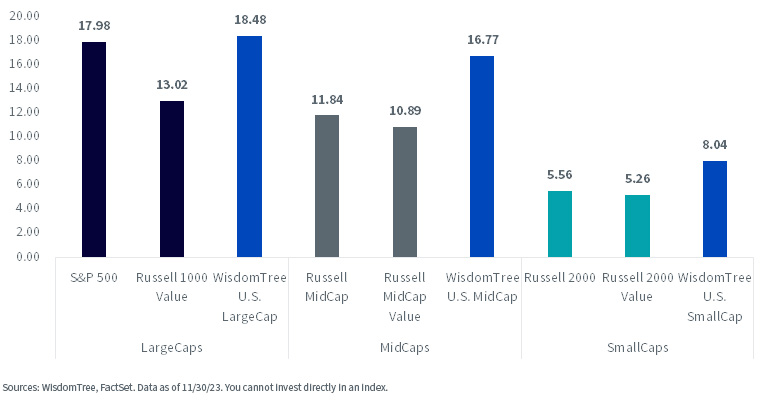

As intended, the combination of earnings weighting, along with the previously mentioned risk-reduction layer, results in higher quality characteristics, with aggregate return on equity (ROE) above their benchmarks and significantly above the value Indexes, even though they have competitive or significantly lower P/E metrics.

Price-to-Earnings Ratio

Return on Equity

For definitions of indices in the graph above, please visit the glossary.

Outlook for 2024

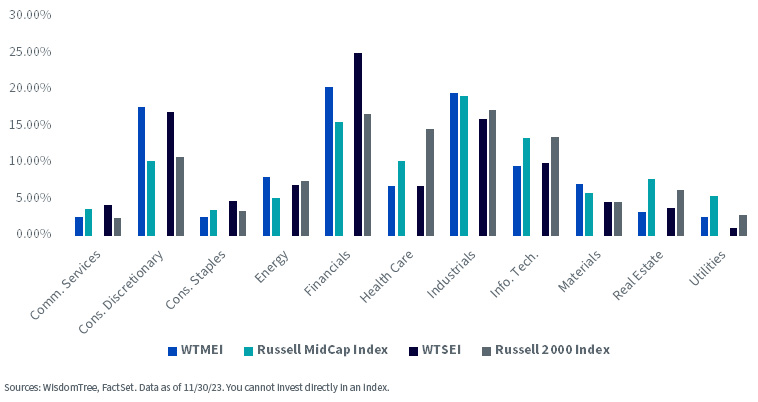

Going into 2024 and due to their earnings focus, WTMEI and WTSEI remain over-weight in cyclical sectors compared to their broad benchmarks. Although lower rates have historically benefited companies with lower or even negative earnings, we don’t see rates going back to zero, which makes the focus on profitability and valuation important.

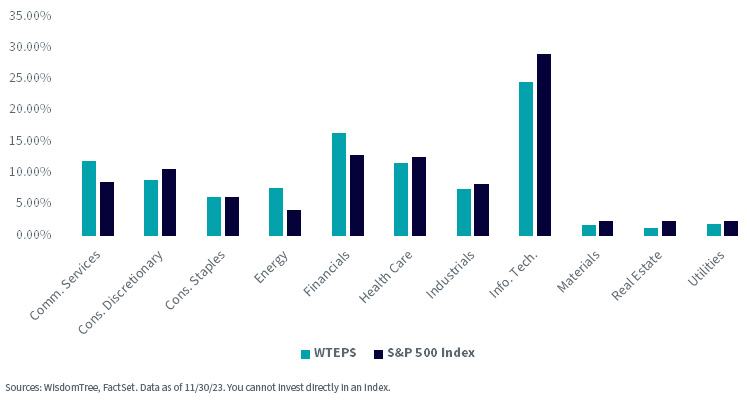

Meanwhile WTEPS’s sector biases are contained except for its slight over-weight in Financials and under-weight in Information Technology, seeking to provide investors with a core exposure at constrained valuations and increased quality.

Important Risks Related to this Article

For current Fund holdings, please click the respective fund ticker: EPS, EZM, EES. Holdings are subject to risk and change.

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Originally published 28 December 2023.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.