The Consumer Price Index (CPI) continues running higher at an uncomfortable pace, prompting many investors to consider inflation-fighting assets.

Often, Treasury Inflation Protected Securities (TIPS) top that list. While TIPS and the related exchange traded funds are raking in plenty of cash this year, there are other ways to beat inflation, some of which are outperforming TIPS.

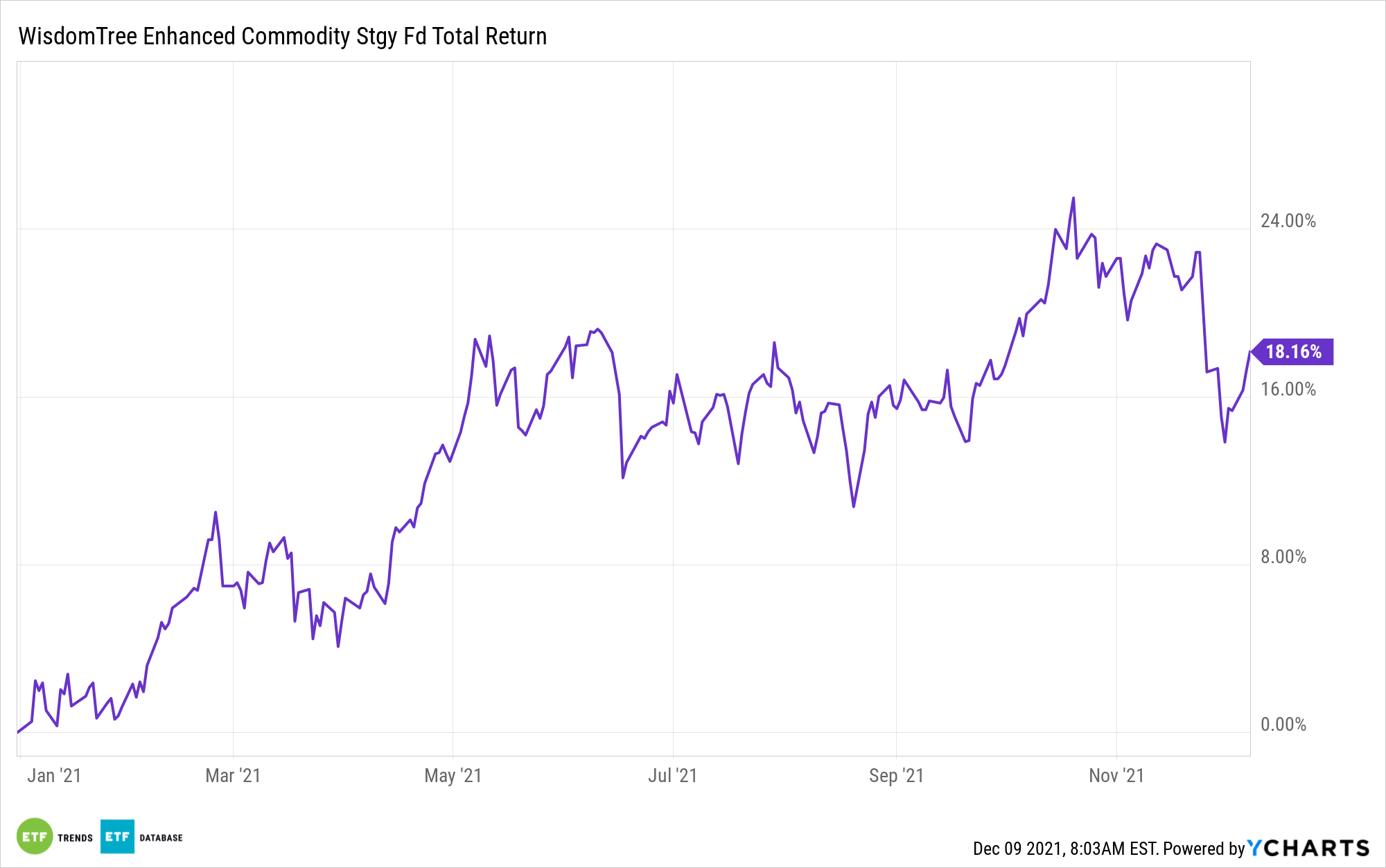

Commodities and the WisdomTree Enhanced Commodity Strategy Fund (GCC) are delivering for investors in a suddenly hot inflationary environment. In fact, the actively managed WisdomTree exchange traded fund is higher by almost 8% year-to-date compared to a gain of just 1.15% for the largest TIPS ETF.

“When it comes to assets that can hedge against inflation, commodities have historically stood out as winners. The asset class had the strongest inflation beta of all assets we have analyzed. It beat assets that are supposed to be structurally linked to inflation, such as U.S. Treasury Inflation-Protected Securities (TIPS),” says Nitesh Shah, director of research, WisdomTree Europe.

GCC’s sturdiness against the backdrop of soaring consumer prices isn’t surprising. Commodities sensitivity, or beta, to rising headline inflation is well ahead of that of TIPS, junk bonds, stocks, and government bonds.

“We believe commodities are an attractive hedging tool especially given today’s environment, given the nature of what is driving inflation. Commodities’ beta to unexpected inflation is even stronger than its beta to expected inflation,” adds Shah. “If the drivers of inflation today are unexpected, then based on our research, commodities are the place to turn to.”

What’s interesting about GCC’s impressive showing in 2021 is that it’s accruing while gold — traditionally a popular inflation hedge — is struggling. That highlights the benefits of GCC being actively managed. It’s not confined by an index, so it doesn’t have to own gold.

Today, GCC’s gold exposure is light. On the other hand, the fund recently added bitcoin futures to its roster, and it can allocate up to 5% of its weight to that asset class. Still, the case for gold isn’t lost, and if fourth-quarter CPI readings rise, bullion could be back in style.

“We have argued that Q4 2021 is a critical time for gold to prove itself. We certainly hope that the next inflation reading acts as a defibrillator to bring the metal back to life on a more consistent basis,” concludes Shah.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.