By Christopher Gannatti, CFA, Global Head of Research

January 11, 2024, was an historic day within the exchange-traded fund (ETF) industry, as it marked the first time ETFs tracking the spot price of bitcoin were allowed to trade.

The competitive forces of how many launches come at once brought down execution costs, as a number of firms, including WisdomTree, waived management fees to zero for the first six months.

Some discussion we’re hearing:

- The first gold ETF traded in the U.S. market on November 18, 2004.1 Gold’s market capitalization was estimated to be roughly $1.7–$1.8 trillion around this time, growing to about $14 trillion nearly 20 years later.2 Gold’s path does not guarantee anything regarding bitcoin, but there’s a parallel in that investing and storing gold as physical bars is not as easy as buying shares in an ETF.

- Acceptance of an asset class within the ETF structure: ETFs have garnered over $8 trillion of AUM in the U.S.3 The first filings for a spot bitcoin ETF date back to 2013,4 but the market structure itself needed time to mature. ETFs help take that maturity of bitcoin another step further.

- Volatility: One of the measurable things that everyone can see is the volatility of bitcoin’s price. Volatile assets are often considered riskier than less volatile assets since the asset’s price is expected to be less predictable. With that said, we are talking about an asset that delivered roughly 50% average annual returns over the past 10 years at a level of something close to 80% annualized volatility.5 Broad equity benchmarks, like an S&P 500 Index, would be below 20% annualized volatility over this same period. There are many investors that might see the 50% average annual return, but that would not be able to live with the 80% annualized volatility.

Bitcoin’s Volatility Trends

Brent Donnelly, a friend of ours at Spectra Markets, put out some interesting charts that we reference here.6 Brent showed bitcoin’s price volatility has been declining for a significant period, and this has had nothing to do with ETFs. The market itself has been maturing, prices and market cap have been rising, and more participants trading and investing, which have all brought down the volatility.

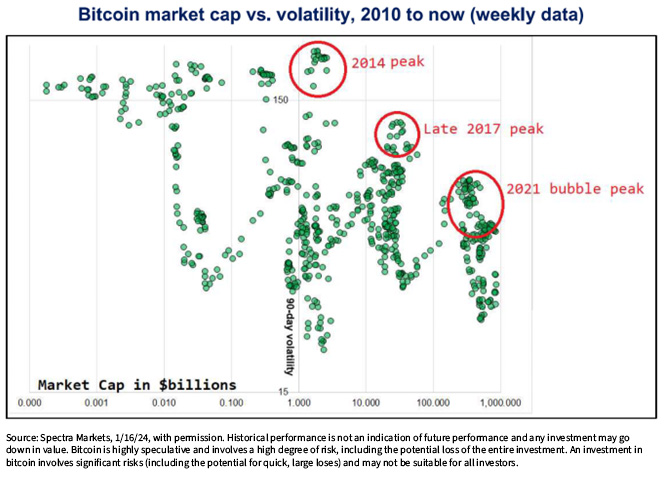

In figure 1, we see:

- The horizontal axis represents the market capitalization of bitcoin in billions of U.S. dollars. The 2014 peak saw the market capitalization around $1 billion, then the late-2017 peak was above $10 billion—getting toward $50 billion. The 2021 peak was around $1 trillion. One can see that this is a logarithmic scale and not a case where one line represents one unit—it is a far faster increase than that.

- The pattern of trading in bitcoin has been one of peaks and troughs, with the troughs sometimes labeled as winters. There have been periods with big swings upward in price, and then there have been these other, colder periods. At each time, you can look back at a market capitalization chart and note when there were these different near-term peaks that were followed by the so-called crypto-winters.

- The vertical axis represents the 90-day annualized volatility. The number 150 refers to 150%—a very high level. The 2021 bubble peak is roughly halfway up the scale on the vertical, relative to the 2014 peak. This is telling us that even if 2021 was also a bubble peak, the volatility in bitcoin’s price was much lower in 2021 than it was seven years earlier.

Figure 1: Bitcoin’s Market Capitalization vs. Volatility, Marking Different Market Cap Peaks

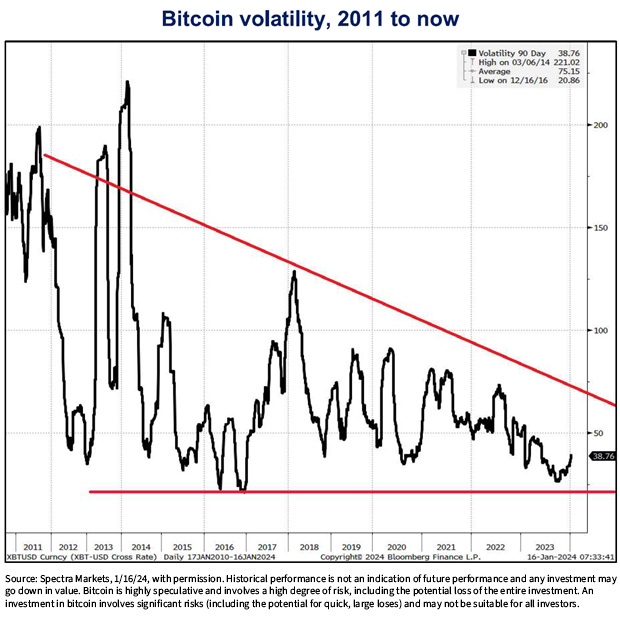

In figure 2:

- The volatility of any asset, bitcoin included, is not constant. One must always specify a time frame to make the calculation and recognize that if one rolls that calculation forward or backward in time, the figure can move up or down. In 2014, there was a 90-day period that saw bitcoin’s price volatility above 200%. However, that reading has not really been approached since that unique point. It doesn’t mean it couldn’t go back to those levels—it is just not the observed trend.

- In 2023, it’s clear that the 90-day volatility of bitcoin’s price was below 50%. We cannot state with certainty it will stay there or it must be there—but that is a big difference from what was observed earlier in the time series.

Figure 2: Time Series Data for 90-Day Bitcoin Volatility, 2011 to Present

Conclusion: Multiple Signals Tell Us Bitcoin Is Maturing As an Asset Class

The fact that spot bitcoin exposure is available in the ETF structure was an important milestone, but it was just one among an array of signals that indicate bitcoin as an asset class is on its journey toward maturation. We believe one important signal is volatility, which has historically been trending downward.

This will be one of the signals we continue to watch, and we thank Brent Donnelly for assembling such clean, clear depictions of the story in this case.

1 Refers to the launch of the SPDR Gold Shares strategy.

2 Source: “Chart Market Capitalization of Gold and Bitcoin,” ingoldwetrust.report, 2023 with WisdomTree estimates of overall gold supply to 2004.

3 Source: Deborah Fuhr, “Assets Invested in the ETFs Industry in the United States Reached a New Milestone of $8.12 Trillion at the End of 2023,” Nasdaq, 1/18/24.

4 Source: Collin Z Groebe et al, “Road to Bitcoin Investment Cleared with SEC’s Approval of 11 Spot Bitcoin ETFs,” Winston & Strawn LLP, 1/11/24.

5 Specific period is 12/31/13–12/31/23, the most recent 10 years.

6 Report published 1/16/24.

Originally published 5 February 2024.

For more news, information, and analysis, visit the Modern Alpha Channel.

Important Risks Related to this Article

Crypto assets, such as bitcoin and ether, are complex, generally exhibit extreme price volatility and unpredictability, and should be viewed as highly speculative assets. Crypto assets are frequently referred to as crypto “currencies,” but they typically operate without central authority or banks, are not backed by any government or issuing entity (i.e., no right of recourse), have no government or insurance protections, are not legal tender and have limited or no usability as compared to fiat currencies. Federal, state or foreign governments may restrict the use, transfer, exchange and value of crypto assets, and regulation in the U.S. and worldwide is still developing.

Crypto asset exchanges and/or settlement facilities may stop operating, permanently shut down or experience issues due to security breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your customer / Anti-Money Laundering) procedures, non-compliance with applicable rules and regulations, technical glitches, hackers, malware or other reasons, which could negatively impact the price of any cryptocurrency traded on such exchanges or reliant on a settlement facility or otherwise may prevent access or use of the crypto asset. Crypto assets can experience unique events, such as forks or airdrops, which can impact the value and functionality of the crypto asset. Crypto asset transactions are generally irreversible, which means that a crypto asset may be unrecoverable in instances where: (i) it is sent to an incorrect address, (ii) the incorrect amount is sent, or (iii) transactions are made fraudulently from an account. A crypto asset may decline in popularity, acceptance or use, thereby impairing its price, and the price of a crypto asset may also be impacted by the transactions of a small number of holders of such crypto asset. Crypto assets may be difficult to value and valuations, even for the same crypto asset, may differ significantly by pricing source or otherwise be suspect due to market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto assets generally rely on blockchain technology and blockchain technology is a relatively new and untested technology which operates as a distributed ledger. Blockchain systems could be subject to internet connectivity disruptions, consensus failures or cybersecurity attacks, and the date or time that you initiate a transaction may be different then when it is recorded on the blockchain. Access to a given blockchain requires an individualized key, which, if compromised, could result in loss due to theft, destruction or inaccessibility. In addition, different crypto assets exhibit different characteristics, use cases and risk profiles. Information provided by WisdomTree regarding digital assets, crypto assets or blockchain networks should not be considered or relied upon as investment or other advice, as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network or any particular strategy.