The current market environment has presented advisors and investors with a host of challenges as bonds and equities have both experienced losses. Advisors have increasingly turned to alternative investments, such as commodities, seeking return potentials for their portfolios, and for good reason. Some noteworthy things are happening within the commodities futures markets that are perhaps not garnering as much attention as they should be.

Contango has been an often-discussed concern in recent years for investment in commodity futures contracts, whereby the futures price is higher than the spot price. Current advisors and investors tend to be more familiar with contango and arbitrage than the opposite, backwardation.

The roll yield is the yield that the investor receives as the long position that the futures contract has converges with the current spot price. When commodities are in contango, this is typically at a cost to the investor and generally is offset through arbitrage and other advanced strategies.

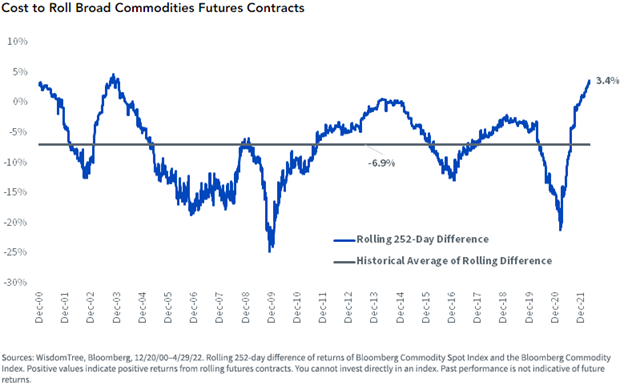

Jeremy Schwartz, CFA and global CIO at WisdomTree, discussed the average historical cost of rolling futures from an expiring contract to a new one (measured by comparing the difference between the Bloomberg Commodity Spot Index and the Excess Return Index of the futures) as an average of 7% a year, dating back to 1999.

Image source: WisdomTree Blog

What’s being seen more often in the current market environment, however, particularly in the energy sector but more broadly in other commodities, is backwardation in which the spot price is higher than the futures prices. This means that the roll yield is currently contributing to returns as opposed to detracting from them.

“In no sector is this more apparent than Energy, where very high levels of demand have pushed up spot prices while farther out prices remain relatively subdued,” Schwartz explained. “While the average cost to roll Energy futures was 10.6% over the last 20 years, over the trailing 12 months, the net benefit has been 12%. The stories on how Energy futures funds are outperforming spot oil have been few and far between, though.”

While the costs for rolling energy futures have dramatically reversed course, it’s not the only place where these changes have been seen. Though less pronounced than energy, commodities such as aluminum, nickel, sugar, and cotton have also experienced backwardation that is contributing to returns.

GCC Offers Diversified Commodities Futures Exposure

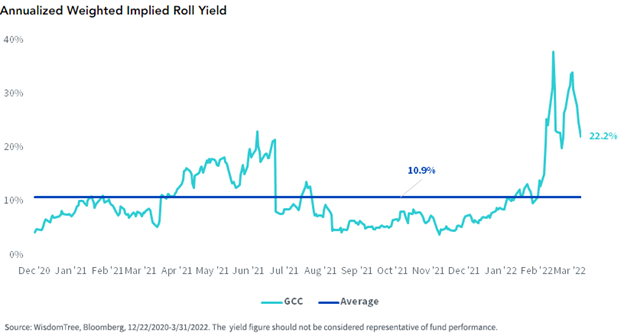

The WisdomTree Enhanced Commodity Strategy Fund (GCC) takes positions in a diversity of commodities, from energy to agriculture (like cotton and sugar), primarily through futures contracts. Over the last 12 months, the fund has an average implied roll yield of 10.9% but is currently much higher, offering significant contributions to returns.

Image source: WisdomTree Blog

GCC invests in a basket of commodities and bitcoin futures in seeking diversification in assets that are uncorrelated to most equities and fixed income returns. The fund is an actively managed ETF that offers broad exposure to the following commodities sectors: agriculture, energy, industrial metals, and precious metals, mainly via futures contracts. It can also invest up to 5% of its net assets into bitcoin futures contracts, a regulated space under the purview of the CFTC, but it does not invest directly in bitcoin. GCC carries an expense ratio of 0.55%.

“During a time when few assets have hedged inflation, commodities certainly look timely for this new regime,” Schwartz said.

For more news, information, and strategy, visit the Modern Alpha Channel.