The 2021 asset-gathering pace of exchange traded funds is simply breathtaking.

Last month, equity-based ETFs added $41 billion of inflows, bringing the year-to-date tally to $295.4 billion. In five months stock ETFs eclipsed their 2020 inflows.

Not surprisingly, the eagerness of investors – both professionals and retail – to embrace ETFs is benefiting an array of funds and issuers. Take the case of WisdomTree (NASDAQ: WETF), which is getting a big lift from the WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE).

“WisdomTree reclaimed its spot among the industry’s top 10 in May. It collected $585 million last month and has garnered over $2.2 billion in flows for the year to date,” write Morningstar analysts Ryan Jackson and Ben Johnson. “XSOE has been the firm’s crown jewel, pulling in $1.3 billion for the year to date. This fund targets emerging-markets stocks but excludes all state-owned enterprises, allowing it to sidestep some of the unique governance risks that can plague emerging-markets strategies.”

An Impressive Stretch for ‘XSOE’

On a standalone basis, XSOE’s 2021 asset-gathering proficiency is impressive. It’s even more so when considering emerging markets equities are putting up lukewarm performances. Moreover, some Chinese tech and internet companies, including Alibaba (BABA), Ant Financial, Tencent, JD.com (JD), and others, have been under intense regulatory scrutiny.

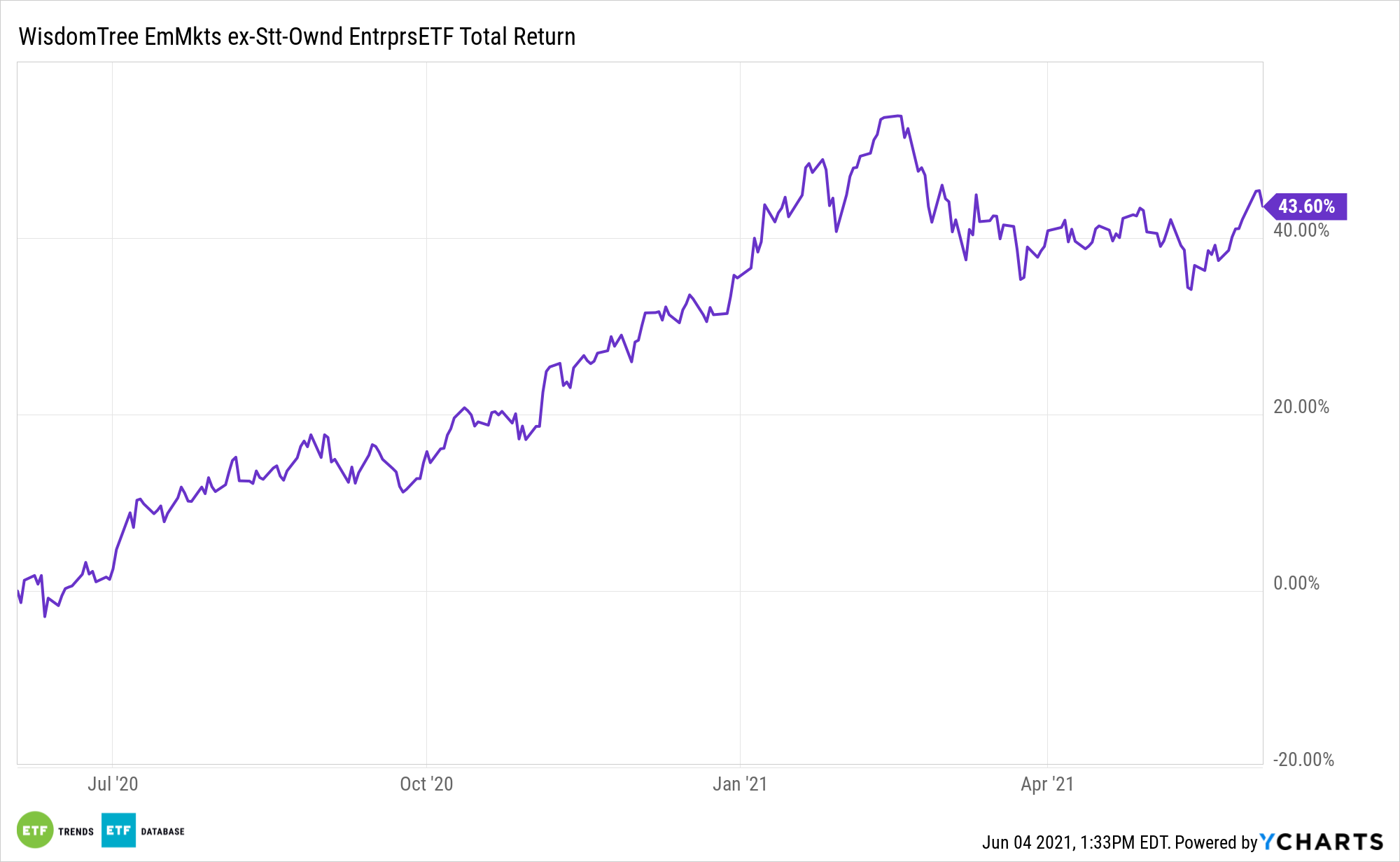

Even with that, XSOE is up 7.3%. While that lags the MSCI Emerging Markets Index, if history is an accurate indicator, that laggard status could prove fleeting. For the three years ending June 2, the WisdomTree ETF is higher by 44.6% as compared to 31.2% for the emerging markets benchmark. Additionally, XSOE’s annualized volatility over that span is slightly less than that of the MSCI Emerging Markets Index, according to ETF Replay data, confirming superior risk-adjusted returns.

During that span, XSOE’s maximum drawdown was 150 basis points below that of the MSCI Emerging Markets Index.

XSOE, which debuted in December 2014, is one of several WisdomTree emerging markets ETFs that eschew state-run companies. The others are the WisdomTree China ex-State-Owned Enterprises Fund (NasdaqGM: CXSE) and the WisdomTree India ex-State-Owned Enterprises Fund (IXSE), the newest member of the trio. Over the past 12 months, CXSE has handily beaten the MSCI China Index.

CXSE and XSOE charge 0.32% per year while the annual fee on IXSE is 0.58%.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.