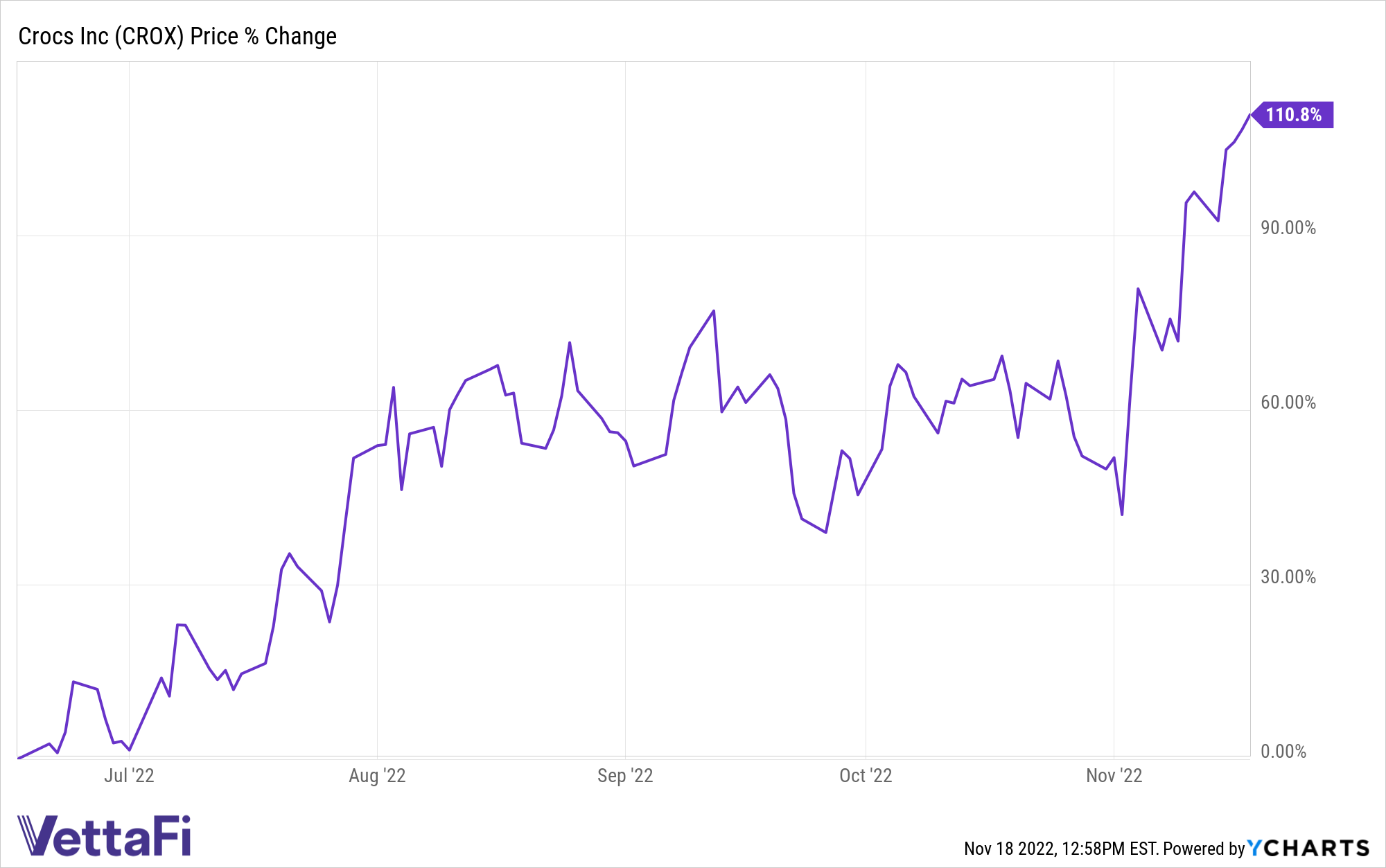

A few months ago, investors were walking away from Crocs. Now, it’s currently looking like a number of investors would like to be back in the retailer’s shoes. After shares of the footwear specialist dropped nearly 75% from late 2021 to June 2022, Crocs has seen its stock rise nearly 111% over the last five months.

Part of this is due to the company reporting strong quarterly earnings in August and in November, putting some investor concerns over inflation, consumer spending, and the stock’s valuation to rest. Crocs management also raised its outlook for the full year, which is boosting investor confidence.

Now, after reporting strong profits and seeing its stock soar, the shoemaker is showing investors — and its customers — that it not only knows how to navigate the current market environment, but also how to connect with its customers.

Last week, Crocs opened a virtual holiday store with virtual platform Obsess. This is after the retailer debuted its first, more limited store in June, as part of a partnership with singer Saweetie. The success of Crocs’ last virtual store encouraged the company to go even further with this new shop for the holidays.

“As a brand, we’re focused on transcending from products into emotion through more immersive and digital-first experiences,” Feliz Papich, vice president of digital product management and consumer experience at Crocs, told Glossy. “Evolving beyond traditional channels opens the door to an increasingly mutual, interactive relationship with consumers.”

Crocs is currently the fourth-largest holding in the Neuberger Berman Connected Consumer ETF (NYSE Arca: NBCC), weighing in at 3.69% as of November 17. NBCC targets companies that demonstrate significant growth potential from connectivity-based consumerism.

Neuberger Berman’s data science capabilities will be used to evaluate the web search and spending tendencies of millions of consumers, and the call transcripts and filings of over 4,000 public companies to daily identify the opportunities that appear best positioned for mass adoption in the digital age. NBCC is managed by Kevin McCarthy, John San Marco, Kai Cui, Timothy Creedon, and Hari Ramanan.

“Retailers need to reimagine their technology or business model to connect with the Gen Y and Gen Z consumers,” said John Aguilar, senior vice president and head of U.S. intermediary marketing at Neuberger Berman. “How are companies reimagining themselves to future-proof their business to connect with that digitally native cohort?”

Launched in April, NBCC spans a broad range of industries globally and may invest in companies of any market cap. The team will evaluate the web search and spending tendencies of millions of consumers and the daily call transcripts and filings of over 4,000 public companies to identify the best opportunities for mass adoption in the digital age.

For more news, information, and strategy, visit the Megatrends Channel.