Another volatile month for markets comes to a close, with major indexes giving back some of January’s gains.

Following January’s strong rally, stocks struggled in February, as recent economic reports showed inflation unexpectedly increasing the month prior. The S&P 500 lost 3% during the month but is still up 4% year to date.

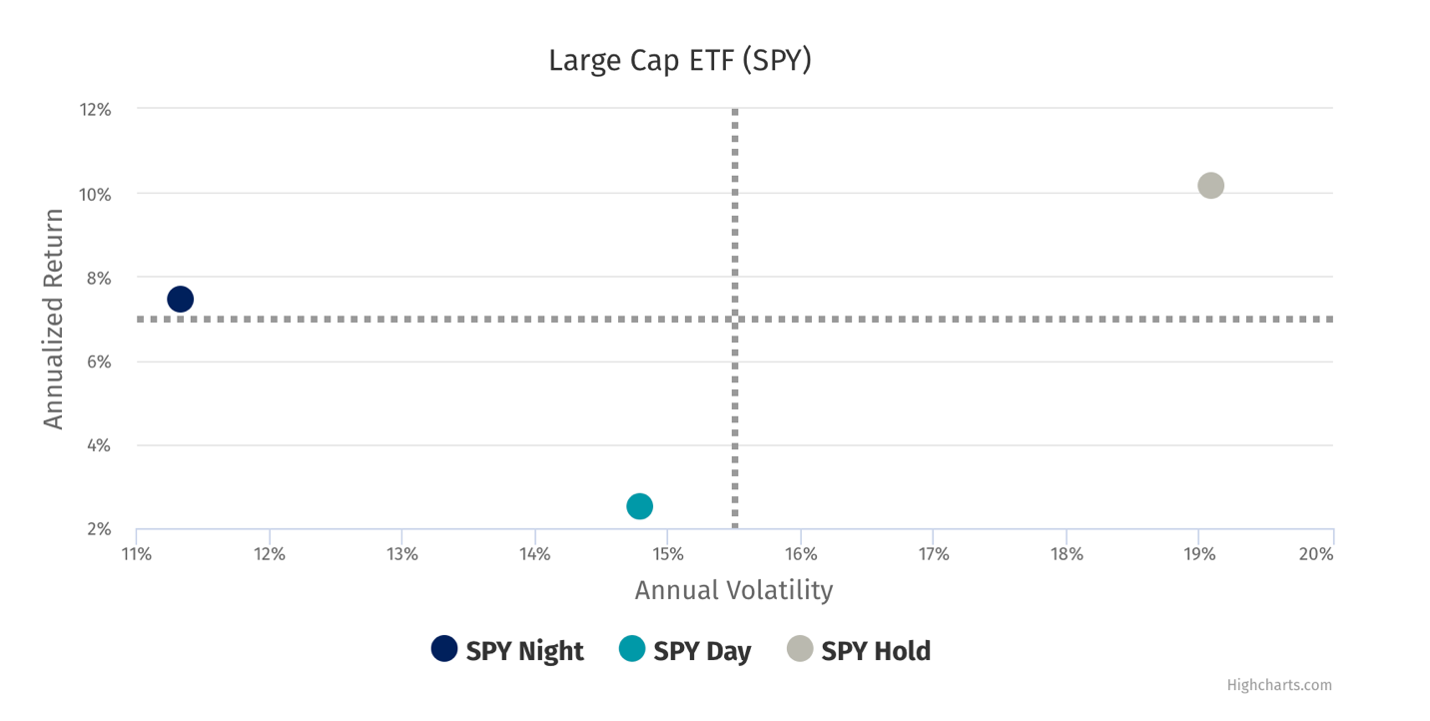

Market volatility rose above the 20-year average for another consecutive month. Bucking historical trends, the day sessions of the SPDR S&P 500 ETF Trust (SPY) have outperformed the night sessions year to date — albeit with significantly more volatility.

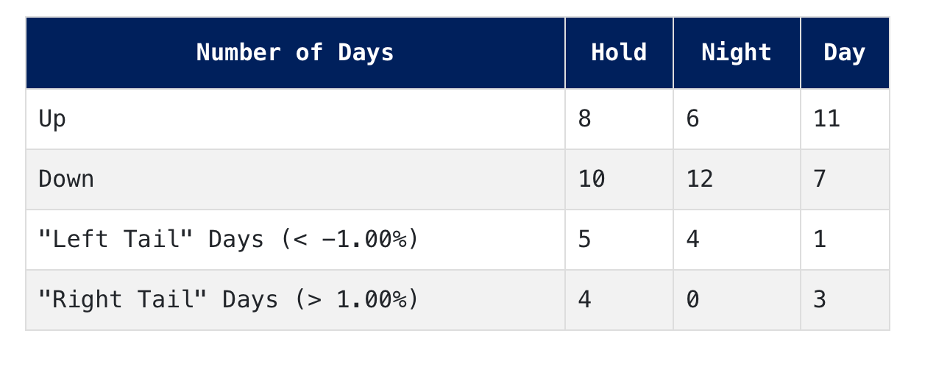

During the 19 trading days in February, 47% of buy-and-hold sessions were in the tails (< -1.00 or >1.00), well exceeding the historical average of 26% of hold sessions in the tails. The day session and night session each had 21% tail days. Historically, 19% of day sessions are in the tails, and 9% of night sessions are in the tails, according to data from NightShares.

While the day session had three times more right tail days than left tail days in February, this is a sharp contrast from what has been observed over the past decades. Historically, the day has had an average of 19% more left-tail days than right-tail days.

In January, the night session had just one tail day, while hold had eight tail days and the day had five tail days.

As markets remain challenged, February’s performance is another anomaly. This is the third time across a 21-year history that the night session has lagged buy-and-hold by over 400 basis points in February. The other two years in which this occurred were 2011 and 2015.

Despite underperformance year to date, investing in the night session of the U.S. large-cap equity market has a track record of adding value to portfolios.

In addition to exhibiting the same non-correlated characteristics of alternative asset classes, the night session has historically outperformed daytime trading on a risk-adjusted basis.

During the past 20 years (2003 through 2022), the day and night sessions of SPY have returned 2.05% and 7.50%, respectively, while holding the fund returned 9.71%.

By investing only in the night, investors have historically avoided volatility and have been rewarded with higher risk-adjusted returns. Meanwhile, tilting into the night (1x day/1.5x night exposure), delivered 13.06% in returns during the same period, according to data from AlphaTrAI Research.

Investors can capitalize on this phenomenon and tilt into the night with the NightShares 500 1x/1.5x ETF (NSPL). Notably, even while maintaining the day exposure, the 1x day/1.5x night exposure Sharpe ratio is 0.65, higher than the buy-and-hold session’s Sharpe ratio of 0.58.

For more news, information, and analysis, visit the Night Effect Channel.