Equal weight strategies could show strength in the second half as market breadth has shown signs of improving.

Recent broader returns have turned the S&P 500 year-to-date breadth positive. The benchmark’s month-to-date breadth has significantly improved, with 425 names up and 78 names down as of June 7, Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, wrote in a note.

The S&P 500 is up 11.98% on a total return basis year to date and would now need the top 20 to turn the index negative, compared to just eight as of the end of May, Silverblatt wrote.

“Heading into the second half advisors should expect the market to be less top-heavy,” Todd Rosenbluth, head of research at VettaFi, said. “More moderately sized large caps are likely to perform better than they have thus far. An equal-weighted approach has done well over the long term.”

How Market Breadth Affects Equal Weight Strategies

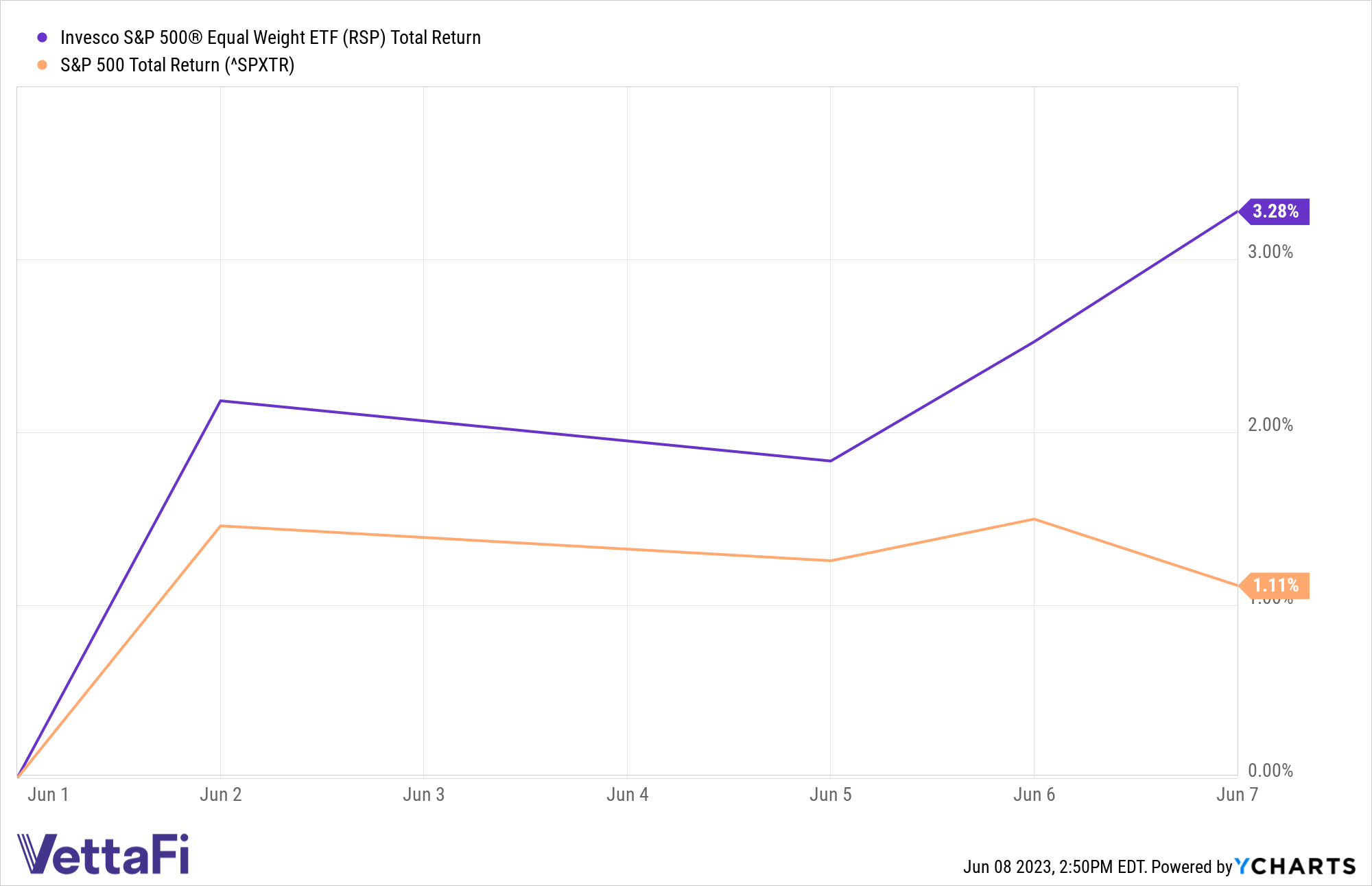

Equal weight strategies are better positioned as market breadth, which looks at how many stocks advance or decline, widens. Equal weight is showing strength in June after lagging during the first five months of the year.

See more: “When Does Equal Weight Outperform?”

The Invesco S&P 500® Equal Weight ETF (RSP), which is based on the S&P 500 Equal Weight Index, is up 3.3% month to date, while the S&P 500 is up 1.1%.

Equal-weight strategies show strength as market breadth improves

See more: “Invesco Changes Tickers for Equal-Weight Sector ETFs”

Equal weighting effectively removes size bias from a portfolio. This offers more protection if a large company or sector experiences a downturn. Conversely, equal weighting is positioned to lag when a small number of mega-caps contribute most of the performance. However, equal weight strategies are best used as a long-term core holding and have historically outperformed over longer durations.

For more news, information, and analysis, visit the Portfolio Strategies Channel.