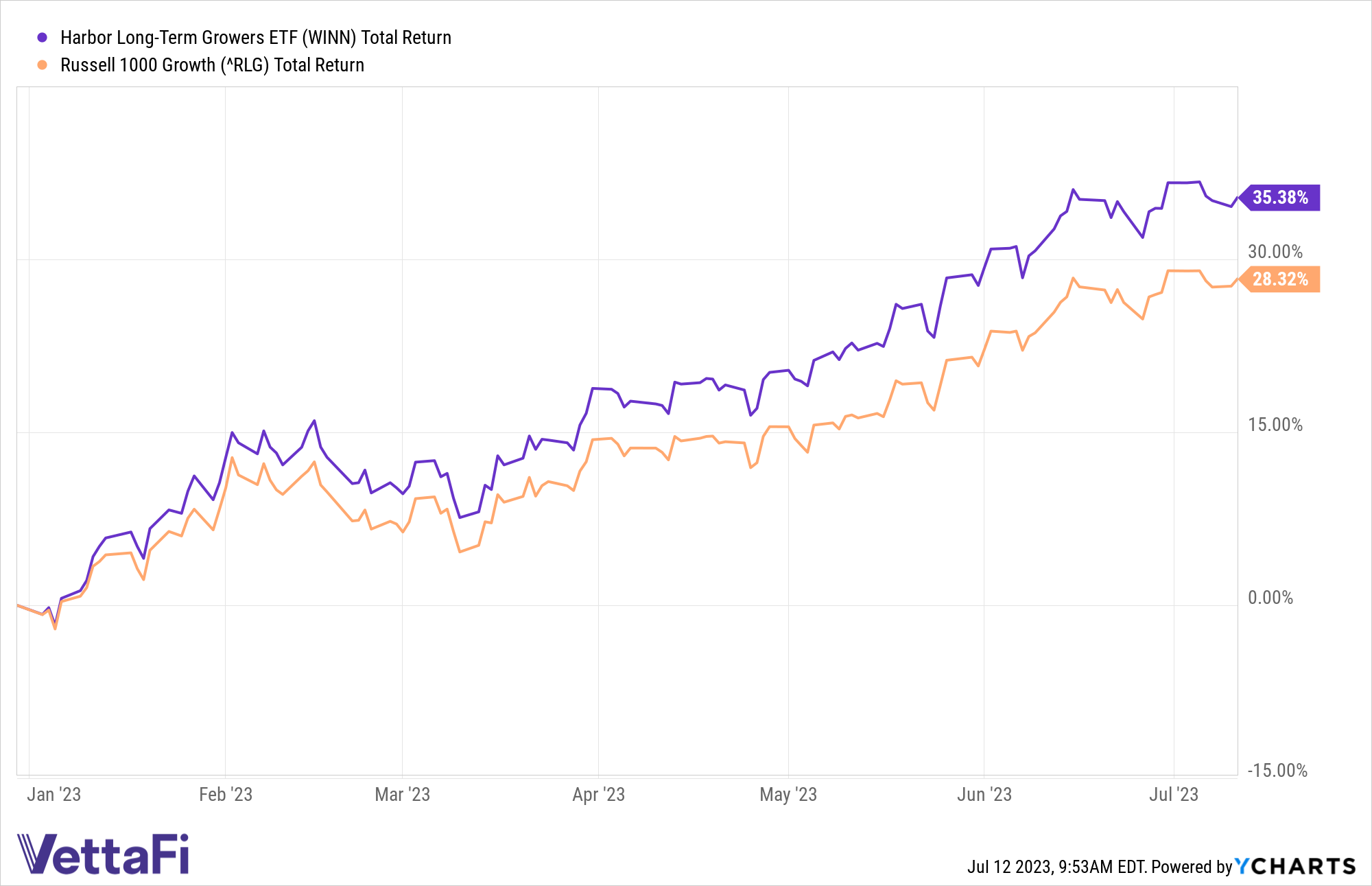

The Harbor Long-Term Growers ETF (WINN) outpaced the benchmark during the first half of 2023, showcasing the potential advantages of active management.

U.S. large-cap growth is one of the largest segments of portfolios globally, making it an important area for advisors to seek out quality funds to maximize returns for clients. Active management may be a way to do that, particularly in the new regime, as markets remain more complex.

Performance during the first half helps shed light on the positioning of active management in the current environment. Active growth ETF WINN has gained 35.4% year to date on a total return basis at NAV as of July 11. Meanwhile, the benchmark Russell 1000 Growth index advanced 28.3% during the same period.

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050. For the most current standardized performance and holdings: WINN

How an Active Growth ETF Can Outperform

WINN’s distinct investment strategy separates it from passive index funds in the space. The Fund is actively managed by subadvisor Jennison Associates and employs a proprietary combination of bottom-up, fundamental research, and systematic portfolio construction.

WINN’s investment strategy seeks to exploit market inefficiencies by investing in companies with under-appreciated multi-year structural growth opportunities, according to the firm.

This strategy allows the Fund and portfolio managers to capture opportunities that are out of the purview of indexes, which are inherently backward-looking as they continue to allocate to past winners.

Holding 72 securities as of June 30, 2023, considerably less than the top-heavy benchmark, WINN’s managers deliberately lean into concentration to seek to generate outperformance.

A key trend during the first half was the strong outperformance from large caps. The active fund tilts toward larger companies than the benchmark, which supported WINN’s first-half outperformance. The median market cap of WINN’s portfolio was $91 billion as of May 31, compared to the benchmark’s $16 billion.

Compared to the benchmark, WINN offers greater exposure to the consumer discretionary sector, while underweighting the consumer staples, materials, and industrials sectors. Notably, the fund does not include any companies in the materials or utilities sectors as of June 30, 2023.

For more news, information, and analysis, visit the Market Insights Channel.

Important Information

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

All investments involve risk including the possible loss of principal. Please refer to the Fund’s prospectus for additional risks associated with the Fund.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

Diversification does not assure a profit or protect against loss in a declining market.

Additional Information

ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

The Russell 1000® Growth Index is an unmanaged index generally representative of the U.S. market for larger capitalization growth stocks. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Russell 1000® Growth Index and Russell® are trademarks of Frank Russell Company.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Jennison Associates LLC is an independent subadvisor to the Harbor Long-Term Growers ETF.

This article was prepared as Harbor Funds paid sponsorship with VettaFI.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

3001446