As the Harbor International Compounders ETF’s (OSEA) celebrates its first birthday, the fund’s performance is worth highlighting.

OSEA is an active high conviction international growth ETF. The fund provides exposure to companies believed to be able to sustain growth levels well into the future.

The fund is designed and managed by Copenhagen-based subadvisor C WorldWide. It has a distinct concentrated portfolio and benchmark-agnostic approach that sets it apart from category peers.

See more: “OSEA Active Manager on Stock Picking and Capturing Ripe Opportunities”

“Advisors focused on active management believe in the ability to make astute stock recommendations. In its first year, OSEA has done just that with a concentrated, best-ideas approach. The fund’s strong initial track record warrants further attention,” according to Todd Rosenbluth, VettaFI.

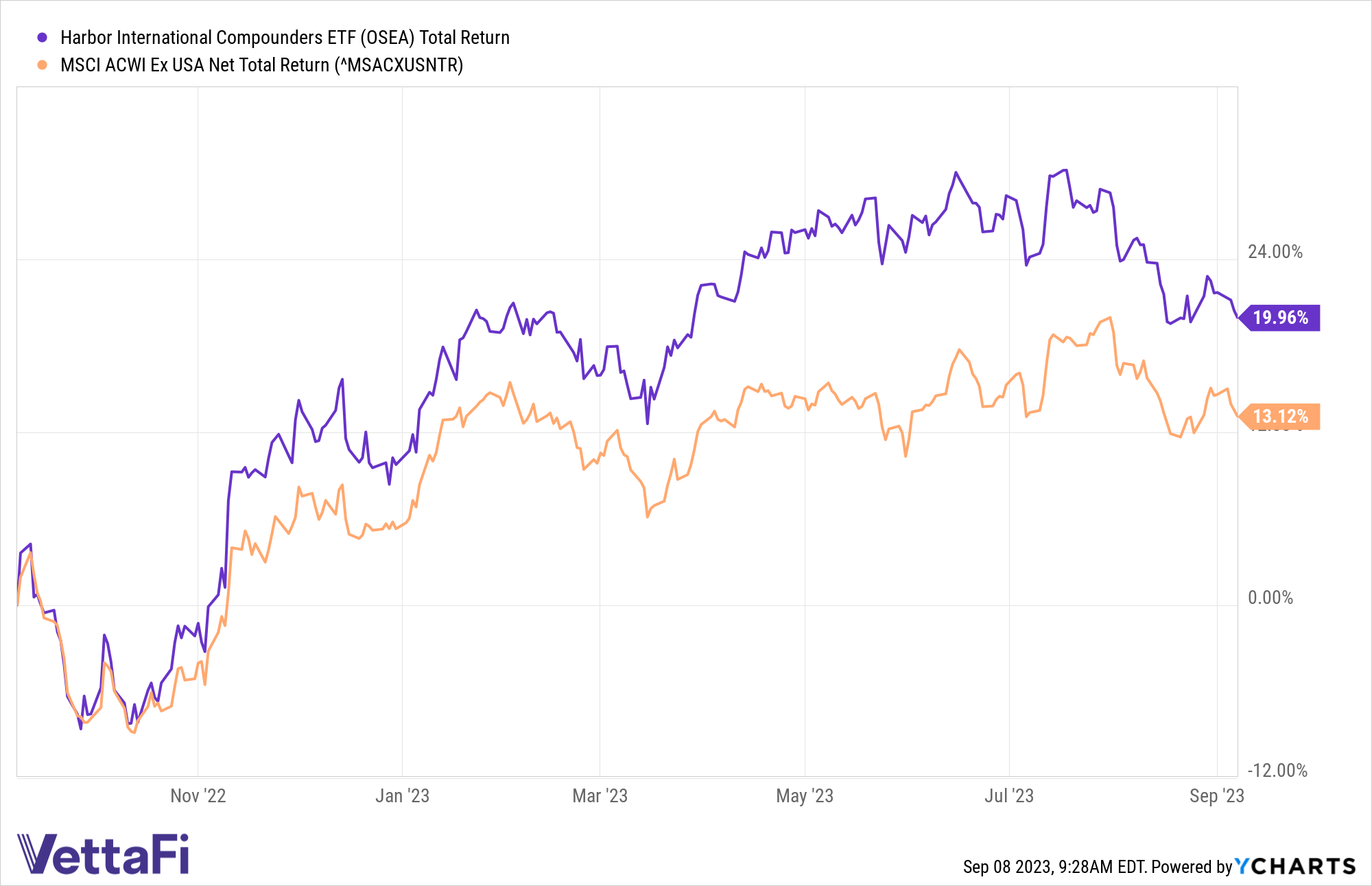

C WorldWide’s active management has worked to demonstrate its ability to outperform the ETF’s benchmark MSCI ACWI Ex. U.S. Index since its September 7, 2022 launch.

Active international ETF OSEA’s performance between September 7, 2022 and September 7, 2023

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050.

All investments involve risk including the possible loss of principal. Please refer to the Fund’s prospectus for additional risks associated with the Fund. For the Fund’s prospectus, holdings, and most current standardized performance, please click: OSEA

In the year following the fund’s launch, OSEA has gained 20% at NAV while the benchmark MSCI ACWI Ex. U.S. has increased 13.1%. OSEA is outpacing the benchmark by nearly 200 basis points year to date. The figures look at the total return level (using the closing price of the security adjusted to include price appreciation, dividend, and distribution).

How OSEA Invests

Importantly, rather than trying to provide diversified exposure to all international markets, OSEA methodically invests in what it deems to be the 30 best global opportunities.

C WorldWide’s investment team comprises experienced stock pickers. OSEA will always hold just 30 companies, making each stock decision an active competition of capital. Furthermore, the investment team utilizes a strict one in, one out approach.

The investment team seeks to identify high-quality companies with consistent recurring revenues, stable free cash flows, and sustainable returns on invested capital. As part of its selection process, the investment team evaluates potential constituents by assessing each company’s business model, management, and financial and valuation metrics, among other things.

For more news, information, and analysis, visit the Market Insights Channel.

Important Information

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Performance data shown represents past performance and is no guarantee of future results.

OSEA Risks: There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

The Subadvisor considers certain ESG factors in evaluating company quality which may result in the selection or exclusion of securities for reasons other than performance and the Fund may underperform relative to other funds that do not consider ESG factors.

The MSCI All Country World Ex. US (ND) Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global developed and emerging markets, excluding the U.S. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

This information should not be considered as a recommendation to purchase or sell a particular security.

Additional Information

A basis point is one hundredth of 1 percentage point.

Free cash flow represents the cash that a company generates after accounting for cash outflows to support operations and maintain its capital assets.

Returns based on capital is similar to returns based on equity, which measure a company’s profit as a percentage of the combined total worth of all ownership interests in the company. Return on capital, in addition to using the value of ownership interests in a company, also includes the total value of debts owed by the company in the form of loans and bonds.

C Worldwide is a third-party subadvisor to the Harbor International Compounders ETF

This article was prepared as Harbor Funds paid sponsorship with VettaFI.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

3109836