Alternatives have seen a lot more interest in the first half of 2022 than they have in years, with advisors and investors seeking either hedges, performance, or some variation of both in a market environment that has caused traditional portfolio allocations to largely suffer. Managed futures have stepped into the spotlight for the ability to provide “crisis alpha” during market dislocations and respond to changing market conditions as they happen.

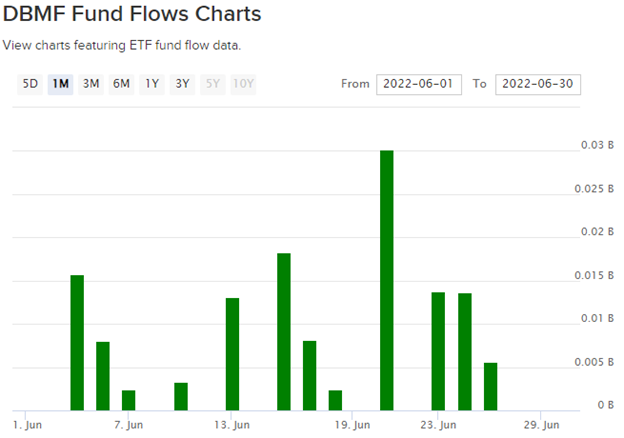

The iMGP DBi Managed Futures Strategy ETF (DBMF), a four-star Morningstar rated fund and the highest-ranked managed futures ETF with Morningstar, experienced an influx of inflows in June.

Image source: ETFdb.com

Over June, DBMF brought in $134.64 million. For comparison, over the same time a year ago, the fund brought in $4.29 million. In the eyes of advisors and investors, now is the time for managed futures. Though those like Corey Hoffstein, co-founder and CIO of Newfound Research, who utilize the fund in a return stacking model, believe that they’re a great all-weather allocation and diversifier for a portfolio.

“If you look at managed futures historically, whether you look at just the individual sleeves like a trend on rates, trend on equities, trend on commodities, trend on currencies, what you find is they actually perform well historically in both inflation and deflationary environments,” Hoffstein said in a recent interview.

See also: Corey Hoffstein on Return Stacking and Managed Futures

DBMF a Multi-Solution Option for Portfolios

Whether advisors are seeking a portfolio diversifier, a hedge during market volatility, or performance potential during market dislocations, the iMGP DBi Managed Futures Strategy ETF (DBMF) can be a possible solution for all of the above. The year-to-date return for the fund is currently 25.11% according to the DBMF website.

DBMF is a managed futures fund designed to capture performance no matter how equity markets are moving. The fund seeks long-term capital appreciation by investing in some of the most liquid U.S.-based futures contracts in a strategy utilized by hedge funds.

DBMF allows for the diversification of portfolios across asset classes that are uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within derivatives, mostly futures contracts, and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestic managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value and takes short positions in derivatives with exposures expected to fall in value. Under normal market conditions, the fund seeks to maintain volatility between 8%–10% annually.

DBMF has a management fee of 0.85% and an additional 10 bps for other expenses listed in the prospectus.

For more news, information, and strategy, visit the Managed Futures Channel.