The Nasdaq Composite closed down for the week in its third straight week of losses as broad equities slipped as well. Investors looking for portfolio diversifiers and stabilizers as tech and equities slide and yields rise in bonds in August should consider the iMGP DBi Managed Futures Strategy ETF (DBMF), given the fund’s performance month-to-date.

This week marks the longest the Nasdaq has closed at a weekly loss consecutively since December. Broad equities closed down for the third week in a row as well, its longest losing streak since February.

“I feel like the markets are rethinking their optimism from July, where we had the soft landing narrative,” Michelle Cluver, senior portfolio strategist at Global X ETFs, told CNBC.

Second quarter earnings season mainly brought positive results for mega-cap tech companies. Alphabet (GOOGL) reported revenue and profit beats, Meta (META) revealed double-digit revenue growth year-over-year, and Apple (APPL) beat earnings and sales forecasts.

That said, Apple sales dropped YoY by 1% and forecast lower revenue in the current quarter. Microsoft (MSFT) also reported reduced revenue growth for the current quarter and slowing growth for three consecutive quarters.

DBMF Holds Steady While Tech Bonds Falls in August

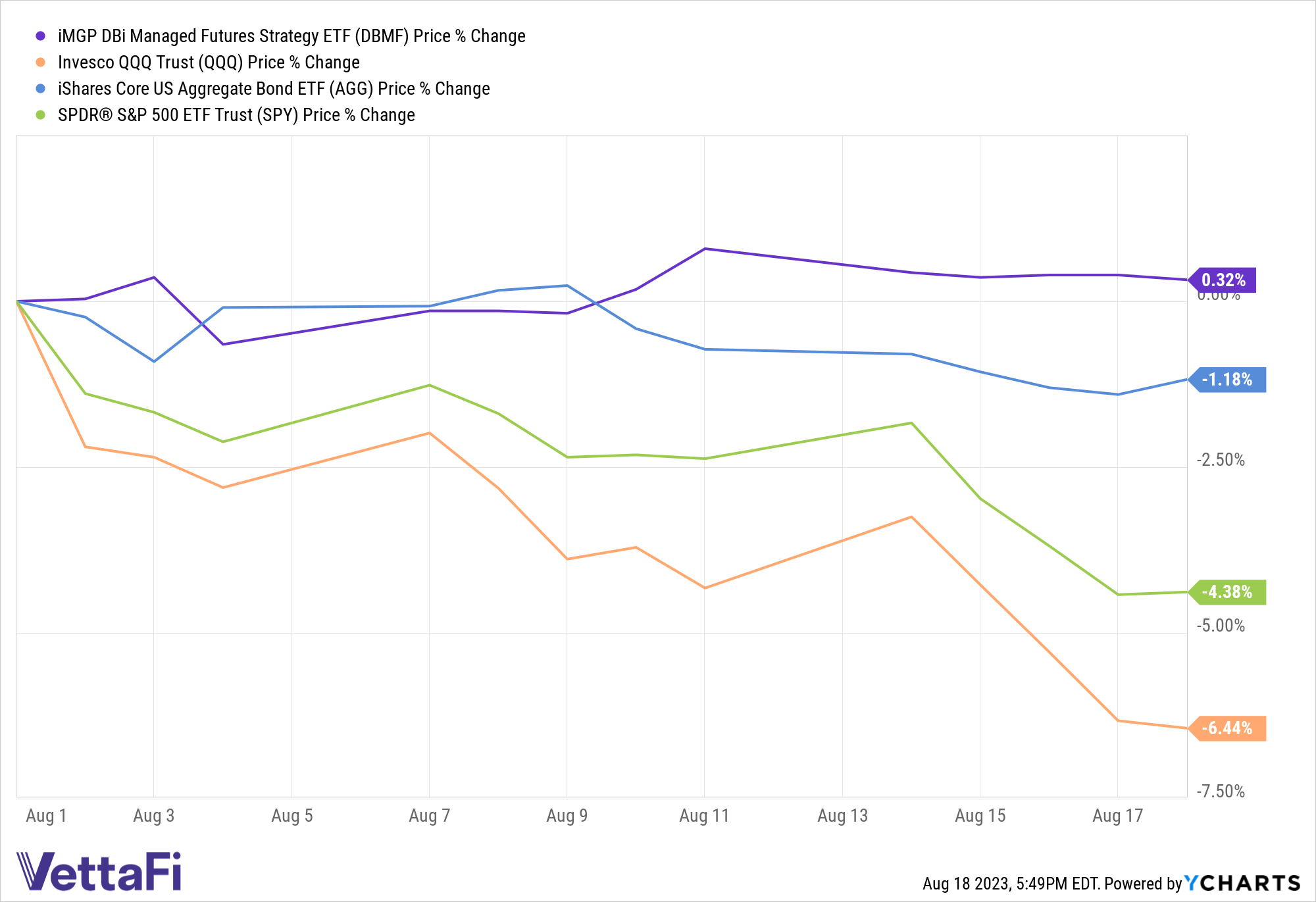

As of August 18, 2023, the Invesco QQQ Trust (QQQ) is down 6.44% on a price basis. Tech’s slide has pulled down the S&P 500 as well, with the SPDR S&P 500 ETF Trust (SPY) down 4.38% for the month on a price basis.

On the bonds side, yields continue to soar. Investors were confronted with the potential for further interest rate hikes this year in the wake of July’s FOMC minutes. Yields and prices move inversely to each other within bonds: the IShares Core US Aggregate Bond ETF (AGG) is down 1.18% this month.

While equities and bonds fell this month, the iMGP DBi Managed Futures Strategy ETF (DBMF) remained steady. As of August 18, the fund is up 0.32% on a price basis.

DBMF is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds. DBE then determines a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.