Debt ceiling turmoil is likely to draw to a close soon, leaving investors to focus on second-half positioning and trends. For those looking to increase non-correlated returns amidst second-half economic challenges, the iMGP DBi Managed Futures Strategy ETF (DBMF) is a fund to consider.

Congress adjourned for its Memorial Day recess Thursday afternoon with no resolution on the debt ceiling. The S&P 500 and Nasdaq both popped on Nvidia’s record-setting single-day stock gains. However, other equity indexes closed down as uncertainty and market turmoil extend into the long weekend.

It’s the latest stress point in a string of market stressors this year that continue to keep investor uncertainty elevated. This uncertainty equates to market turmoil and prevents any emergent trends from forming in the wake of regional banking crashes.

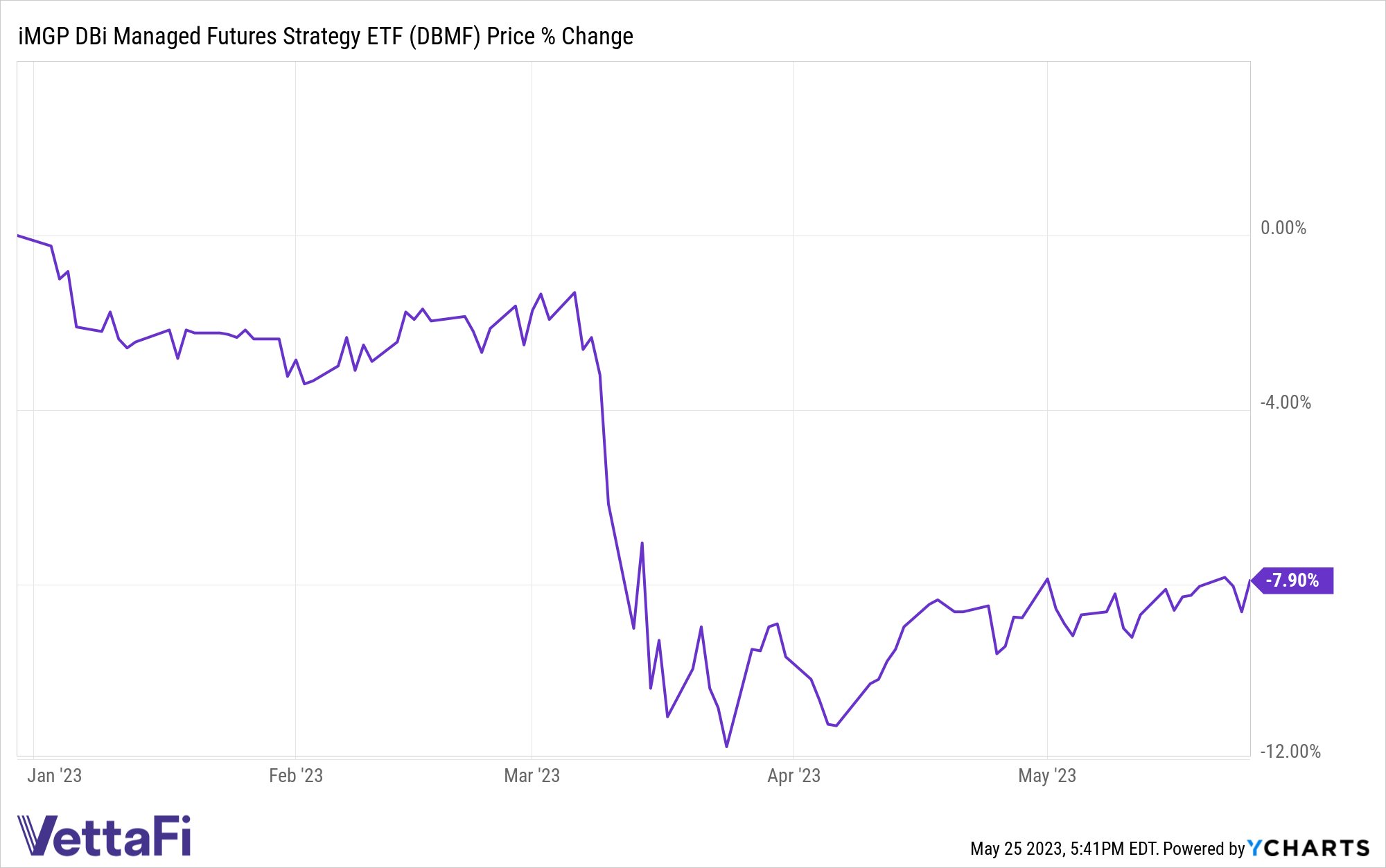

Many managed futures strategies — that invest in how assets are trending versus their forecast performance — dropped in the wake of the regional banking collapse in March. DBMF is down 7.9% as of 05/25, dropping sharply in March but partially recovering in the weeks after.

See also: “A Historical Look at Managed Futures Returns and Performance“

Capture Emerging Second Half Trends With DBMF

As debt ceiling turmoil and banking sector concerns subside, managed futures strategies are poised to capture emerging trends in the second half. The dynamic nature of the inflation and rates picture means that many inflation-based trends that the strategy capitalized on last year evaporated this year.

The DBMF allows for the diversification of portfolios across asset classes uncorrelated to traditional equities or bonds. The actively managed fund uses long and short positions within the futures market on several asset classes. These include domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The fund’s position within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. The DBE analyzes the trailing 60-day performance of CTA hedge funds. It then determines a portfolio of liquid contracts that would mimic the hedge funds’ averaged performance (not positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets anticipated to grow in value. The fund also takes short positions in derivatives with exposures expected to fall in value.

DBMF has management fees of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.