October’s inflation report sent markets soaring Tuesday as investors celebrated a hopeful end to Fed interest rate hikes. Though inflation continues to cool, there remains a potentially longer road ahead to get to the Fed’s desired 2%. In an environment of uncertainty and elevated inflation, the inclusion of managed futures in a portfolio made a significant difference in the last few years as modeled by DBi recently.

Hopes that inflation could truly be easing sent the S&P 500 rocketing up to close at its highest level since April. Meanwhile, 10-year Treasury yields dropped 0.2% points to 4.442% Tuesday morning. Investors are hopeful that the cooler inflation report marks the end of the Fed’s aggressive rate-hiking regime.

Diversification Proves Beneficial in Market Upheaval and Volatility

The last several years have been plagued by remarkable market turbulence. Inflation may be cooling, but much remains uncertain. Risk factors include the growing U.S. deficit, the impact of high rates on commercial real estate, geopolitical risk, and more. Though inflation continues to fall, it could be a long slog to reach the Fed’s desired 2%. That’s according to Federal Reserve Chair Jerome Powell at a press conference earlier this month.

In the period of instability and changing market regimes, managed futures continue to prove their worth as a non-correlated diversifier for portfolios. Andrew Beer, co-founder of DBi and co-PM of iMGP DBi Managed Futures Strategy ETF (DBMF), discussed the strategy and benefits in a recent video.

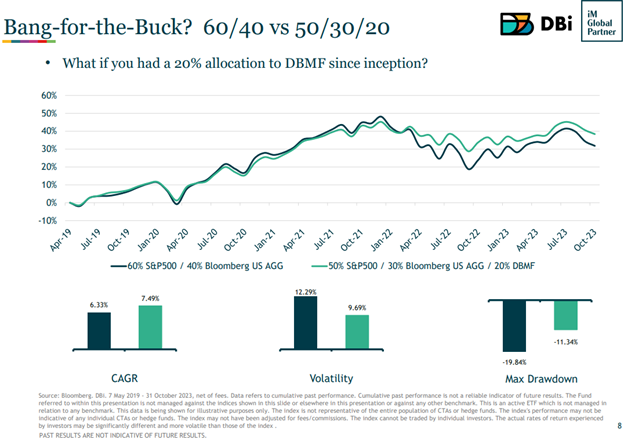

DBi modeled the performance of a traditional 60/40 portfolio compared to a portfolio comprised of 50/30/20. DBMF represented the 20% portfolio diversifier over a period from the fund’s inception in 2019.

Image source: DBi and iMGP

“The two portfolios were moving very closely together during the good period through the end of 2021,” Beer explained. “But then the real diversification value kicked in when inflation hit in early 2022.”

Diversification Without Sacrificing Returns

What’s noteworthy is that the inclusion of DBMF between April 2019 and the end of 2021 didn’t detract from overall returns. Once inflation soared and stocks and bonds moved in correlation, the benefits of managed futures as a diversifier became prominent. The 50/30/20 portfolio generated a CAGR of 7.49% over the period measured by DBi. Comparatively, the traditional portfolio generated a CAGR of 6.33% over the same period.

“The correlation between the two portfolios is 0.97,” Beer noted. “Since we all live in a benchmark-heavy world, I think there’s real value in a diversifier that can help to deliver a smoother ride for clients yet without straying too far from the pack.”

DBi doesn’t believe a 20% allocation to managed futures is necessary, given the variety of diversifiers available today. That said, managed futures have more than proven their worth in the changing market regime of the last few years. Beer believes that the inclusion of managed futures in an environment of elevated inflation for longer will prove beneficial for investors long term.

Look No Further Than DBMF For Portfolio Diversification

The iMGP DBi Managed Futures Strategy ETF (DBMF) is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.