Confounding market and economic signals persist as the year’s end draws near. In a year punctuated by heightened uncertainty as investors attempted to navigate a confluence of risk factors, stock and bond correlations proved a significant challenge to traditional portfolios.

Markets rallied this week on news of a cooler-than-expected CPI print for October, alongside a significant drop in wholesale prices. It’s hopeful news that could bring an end to Fed interest rate hikes and in other times would be seen as a potential inflection point for markets.

Alongside the positive news came reports of falling retail sales. Retail sales dropped 0.1% month over month in October, reversing a months-long trend of strong gains. For reference, retail sales grew 0.9% in September. Slowing consumer spending is a positive signal for inflationary pressure but also could lead to increased economic slowing.

There is also increasing concern about the resiliency of the U.S. consumer. Credit debt is at a record high — $1.08 trillion — as a higher cost of living gouges U.S. households. High interest rates from used cars to mortgages alongside the resumption of student loan payments will likely continue to weigh heavily on consumer spending.

Add in the muted forecasts from many large-cap companies in the most recent earnings season, the knock-on effect of rising rates on commercial real estate lending, the ballooning U.S. deficit, and the complexity persists.

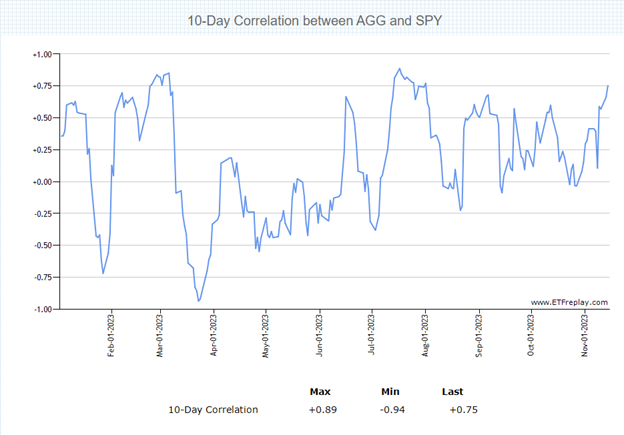

Inflation Drives Increased Correlation

The trend of complex and mixed market and economic signals is one that has carried through much of the year. One need look no further than in May, when broad inflation sat at 4% and the Nasdaq-100 soared 7.7%. At the same time, the Fed raised rates another quarter point in its 10th consecutive hike.

In such an environment of complex factors centered around high inflation, stocks and bonds moved in frequent correlation.

Image source: ETFreplay

While inflation remains elevated (above 2.5%), the likelihood of stock and bond correlations also remains elevated. That’s based on historical trends according to Andrew Beer, co-founder of DBi and co-portfolio manager of the iMGP DBi Managed Futures Strategy ETF (DBMF) in a recent video. This proves particularly challenging for the 60/40 traditional model portfolio.

“It’s become clear that most risk reduction in models came from that very powerful inverse correlation of stocks and bonds,” Beer explained.

Managed futures as a strategy could prove enormously valuable in the next decade and beyond. That’s because the strategy “tends to have zero and recently negative correlations to both stocks and bonds,” he said.

DBMF is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low-to-negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds make their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.