Inflation continues to cool but still remains another at least another year from the 2% target according to Fed officials. In such an environment of elevated inflation and restrictive rates when market stress remains heightened, finding inherently lower-volatility strategies could prove a boon for portfolios.

The Federal Reserve currently forecasts inflation returning to the target 2% sometime in 2025.

“I expect it will be appropriate to maintain a restrictive stance for quite some time to fully restore balance and to bring inflation back to our 2% longer-run goal on a sustained basis,” New York Fed President John Williams said recently.

The potential for market volatility remains elevated looking ahead to next year. It’s an environment of higher inflation and restrictive interest rates alongside geopolitical risk and continued economic slowing.

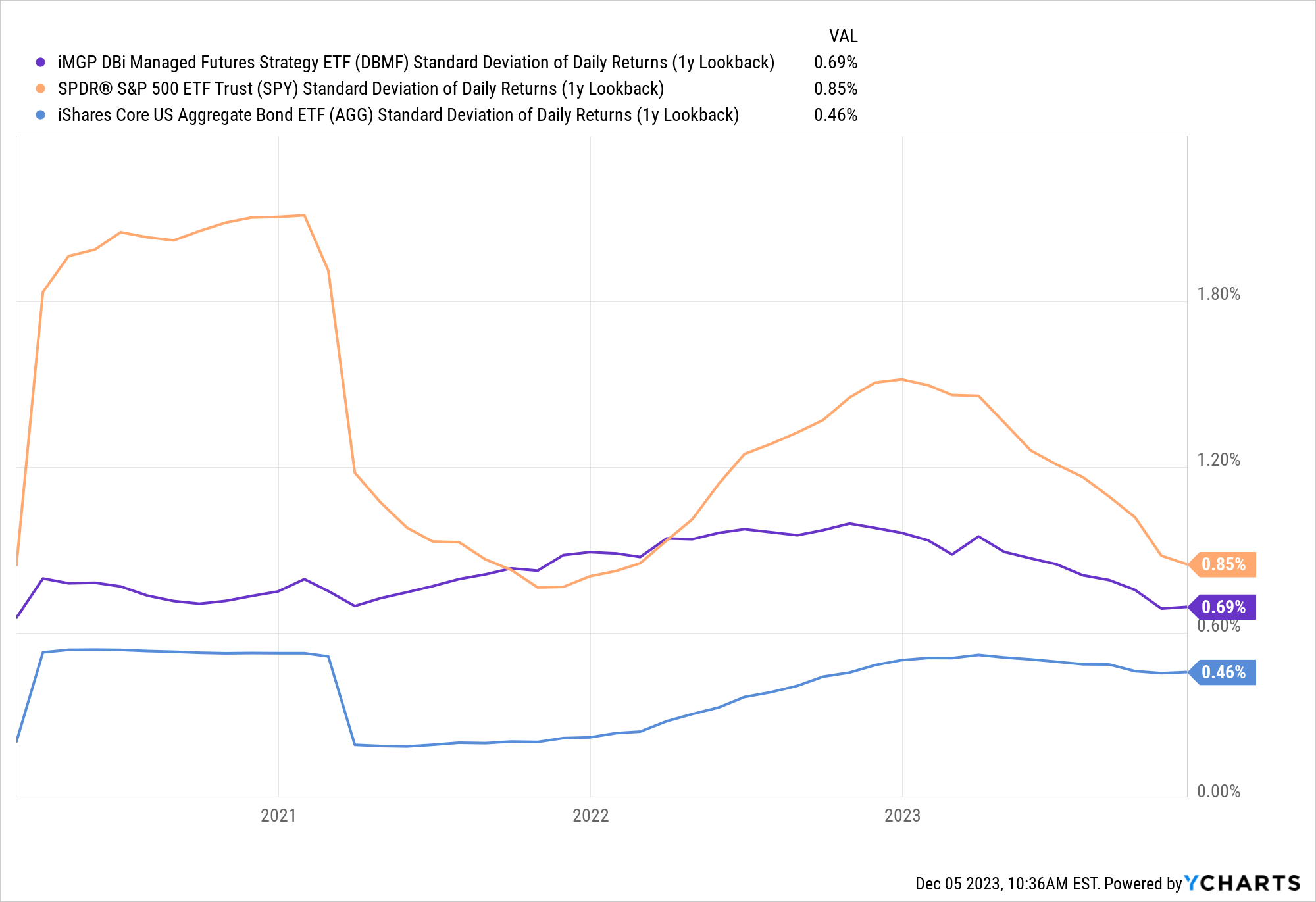

The era of artificially low volatility came to an abrupt end with the onset of the COVID-19 pandemic in early 2020. Since then, equities have proven particularly volatile. However, over the course of the last three years, managed futures strategies like the iMGP DBi Managed Futures Strategy ETF (DBMF) demonstrated significantly less volatility than stocks.

While there are limitations to what standard deviation conveys, it remains a reliable indicator of volatility looking backward. In times of extreme market stress and dislocation, DBMF provided noncorrelated exposures to stocks and bonds with significantly less volatility.

Look to DBMF in Times of Market Stress and Beyond

The iMGP DBi Managed Futures Strategy ETF (DBMF) offers a noncorrelated return stream for portfolios to stocks and bonds. It’s a strong portfolio diversifier and could prove a boon in times of equity and bond correlations and elevated volatility. In September, when stocks and bonds both dropped for the month, DBMF gained over 4%.

The fund is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.