Last year proved to be a phenomenal year for alternatives, and many managed futures strategies specifically. This year, many of the outperforming strategies face continued challenges in the shifting tides of investor uncertainty and market reversals. Andrew Beer, co-founder and managing member of DBi, talked through recent performance of the iMGP DBi Managed Futures Strategy ETF (DBMF) in this year’s markets.

DBMF dipped in the first quarter before plummeting in the wake of the mini banking crisis in March. Since then, the fund offered fairly consistent recovery until October, where it fell once more on abrupt changes in the interest rate narratives.

So far this year, DBMF trails the SocGen CTA Index, an index comprising the largest managed futures hedge funds. Though the fund lags, DBi remains confident about the fund’s replication strategy.

“Variations like this are to be expected,” explained Beer in a recent video. “Our correlations remain high and we know from multiple models and sources that we are accurately capturing the core positions across the industry.”

This year’s underperformance is an anomaly for the strategy’s historical performance. The replication strategy outperformed in six of the last eight years, finishing 2020 even with the index, and then is down this year.

2023: Whipsaw Markets and Trend Waves

Trend-following strategies measure trade signals and invest in how asset classes are currently trading. This is in comparison to strategies that invest based on future outlooks.

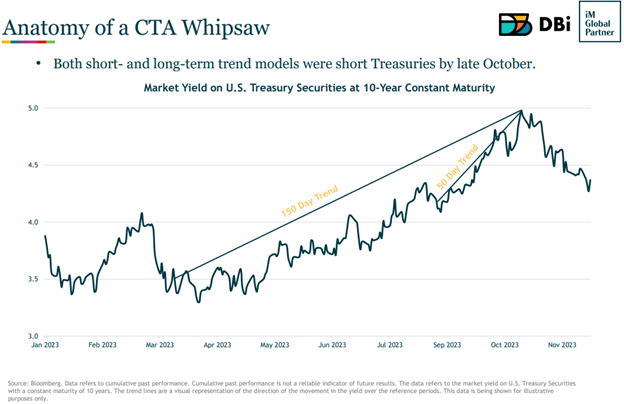

“Trend followers often use multiple window lengths, which provides some diversification,” Beer explained. However, when an asset class trends strongly in one direction over a long enough period of time, an asset can end up modeled similarly across different windows of time.

Image source: DBi and iMGP

This is precisely what happened for DBMF and its position in Treasuries going into October. All models aligned with an outlook of continued rising yields. When that narrative abruptly changed at the end of the month, Treasuries and a number of asset classes reversed course. It left DBMF to plummet in November, caught on the wrong side of trades previously profitable.

Managed futures gained popularity for their ability to rapidly pivot positions to capture changing trends. The dynamic nature means that DBMF will continue to replicate the changing positions of the SG CTA Index as it repositions in the new rate narrative.

Trend following means that sometimes you ride the wave, sometimes you miss, and sometimes you end up pulled under.

“I try to keep the perspective that… these big waves, like those in 2022 in commodities, rates and currencies, are the most fertile area for alpha generation over time,” Beer said. As with any other strategy, Beer cautioned that investors should work to accept “these kinds of reversals as the natural variations inherent in this, and any investment strategy.”

Managed Futures: Down But Not Out

The iMGP DBi Managed Futures Strategy ETF (DBMF) is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.