Suppose you didn’t know about managed futures before this year. In that case, that’s almost assuredly been remedied in the volatility of 2022 when managed futures funds have outperformed virtually everything else by a sizable margin. In the most recent episode of ETF Battles, ETF Guide’s founder Ron DeLegge hosted a head-to-head of the KFA Mount Lucas Managed Futures Index Strategy ETF (KMLM) versus the iMGP Dbi Managed Futures Strategy ETF (DBMF), two top performing managed futures ETFs this year.

On to discuss how they thought each ETF stacked up in a range of categories was Dave Nadig, financial futurist at VettaFi, and Mike Akins, CEO of ETF Action. The way that ETF Battles are structured is that each guest must decide how they believe the ETFs featured stack up in various categories picked by the audience. This episode’s categories were cost, exposure strategy, performance, and a mystery category that each guest selected.

Cost

Both ETFs carry very similar management fees: DBMF has a total of 0.95% in fees compared to KMLM’s 0.92%, give or take.

“That’s expensive for any kind of strategy in an ETF wrapper, but given that this is a pretty niche strategy with some pretty complicated implementation underneath the hood, I don’t think those are aggressively overpriced, but they are both expensive,” Nadig explained.

Akins agreed on the premise that fees and differences between ETF management fees are critical in some areas of the ETF market but managed futures aren’t one of those areas. He voted DBMF the winner within the cost category because of its larger size and greater liquidity (DBMF has $1.1 billion in AUM versus KMLM’s $345 million).

Exposure Strategy

Akins explained that managed futures funds (which take long and short positions on a variety of asset classes through the futures market) aren’t the kind of funds that most advisors can just glance at the holdings and understand what is going on with the fund.

“It’s a lot more dust off your old due diligence process of understanding the process and understanding the managers, and I think that’s really key here,” Akins said.

Akins leaned towards DBMF of the winner in this category simply because of its active management and ability to be nimble in changing markets compared to KMLM’s passive one, although it is a strong contender with a diverse basket of assets that include 11 commodities, six currencies, and five global market bonds.

Nadig agreed that active management makes DBMF more appealing in this space when markets roll, and there are sharp drops or dislocations.

“What you’re in today could literally be the opposite of what you’re in a month from now — that’s one of the attractions of managed futures is you’re going both long and short based on whatever signals the manager has here,” explained Nadig.

He went on to explain that though both funds are managed futures ones and may be similarly correlated because of that fact, they take very different approaches to how they’re investing in the futures market.

Performance

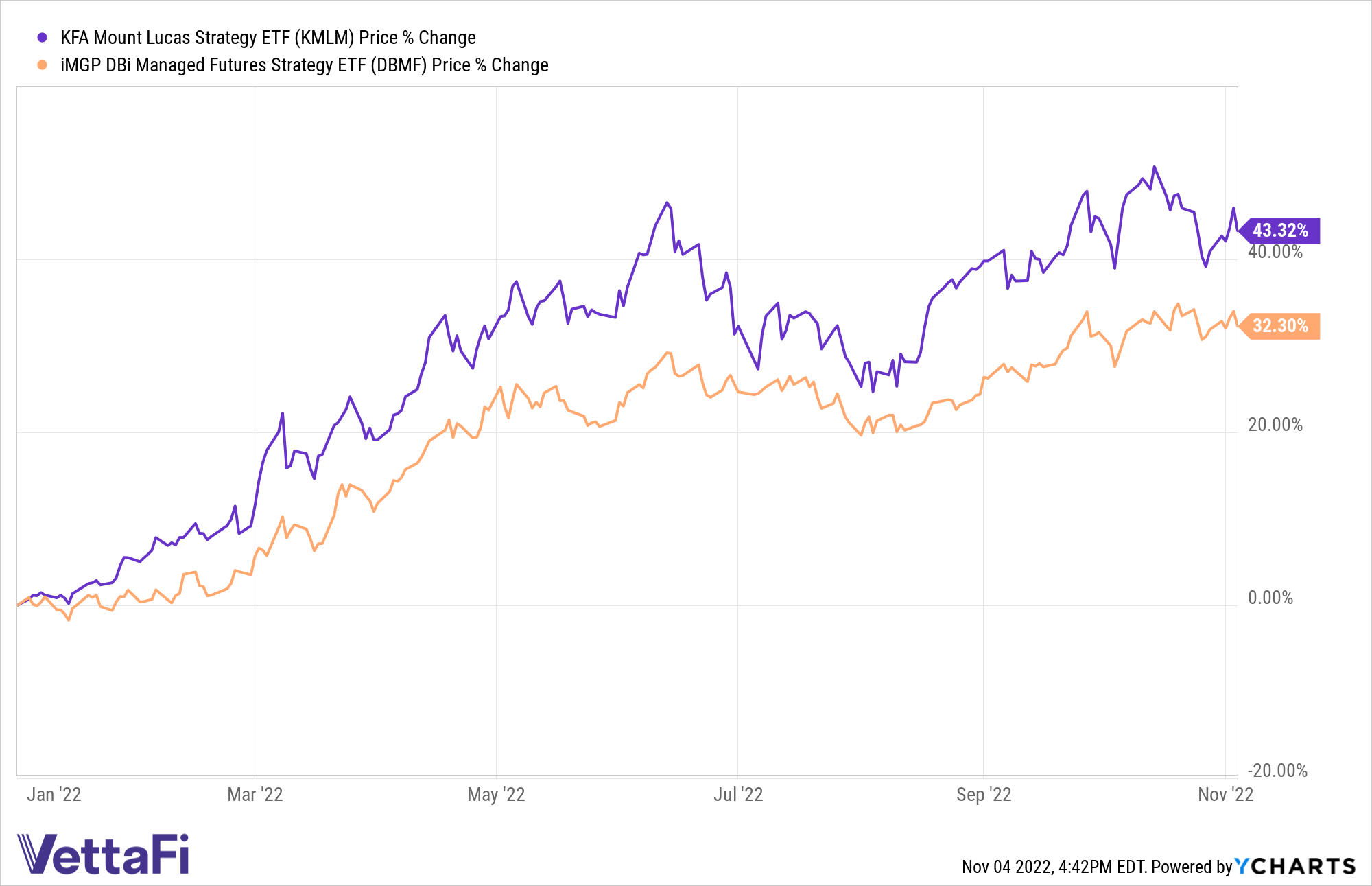

When it comes to performance, the clear winner this year is KMLM, which is up 42% YTD and 34-35% on a trailing 12-month basis compared to DBMF’s 33% YTD and 30% over the trailing 12-month basis, according to Nadig.

“Most of that change happened very recently, in the last 90 days or so, KMLM has just been on fire. It’s been in the right place at the right time: all of its longs have worked for it very well,” Nadig said.

KMLM comes out on top in terms of current performance in Akins’ book, but with the probability of the market cycle likely to change in the near future, he gives the winner to DBMF on a forward-looking basis.

Mystery Category

Akins went with portfolio construction as a choice for comparing the two funds and explained that managed futures are a strategic play over a tactical one purely on the basis that tactical traders can invest in the individual asset classes for much cheaper than within a managed futures vehicle. Managed futures are something worth committing to and staying in if you believe in them from an investment strategy perspective and not just committing partially or temporarily.

“Right now, those people that have had that allocation are reaping the benefits but a lot of people, and you can see it in the flows in this category, gave up on it in the 10-year bull run prior to what we’re seeing in this current market,” Akins said.

Nadig’s mystery category was concentration, and he was a fan of DBMF’s more concentrated positions (it only holds between 8-10 different futures contracts) compared to KMLM’s more broad mandate via its index, though KMLM has the benefit of being a more transparent fund because of its passive nature.

The overall winner was DBMF, but KMLM had many qualities about it that could make it a better fit for some portfolios, dependent on the advisor and investor’s perspective and needs. Overall, they’re both fantastic managed futures ETFs, and both have performed phenomenally this year with strong inflows.

For more news, information, and strategy, visit the Managed Futures Channel.