A string of good luck, a stroke of bad luck, the luck of the draw. Ask any investor that’s been in the markets long enough and they’ll tell you a story about the time they caught that lucky break, or when their portfolio fell on a string of bad luck. While there’s likely a rational explanation underlying the swings of fortune (or misfortune), sometimes investing really can just feel like flipping a coin.

Turns out, it’s the same for investing strategies, at least according to Andrew Beer, co-founder of Dynamic Beta Investments and co-PM of the iMGP DBi Managed Futures Strategy ETF (DBMF).

“Every strategy has an element of luck,” Beer said in a communication to VettaFi. “Just like flipping coins, you will have hot and cold streaks, but over time it washes out. As an allocator, the key is to make sure the coin isn’t broken.”

DBMF’s 2023 Hard Luck Investing Story

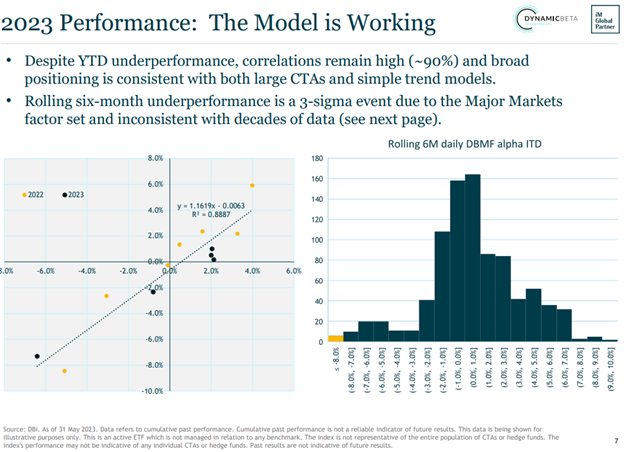

2023 continues to prove challenging for DBMF, a managed futures hedge fund replication ETF. The fund continues to underperform the SocGen CTA hedge fund index YTD. The strategy and replication model are working as intended, with correlations at normal historical levels. The fund currently has an almost 89% correlation to the index.

The underperformance is instead due instead to the specific “factor set” DBMF currently employs, Beer explained in a recent DBMF monthly performance video. While the fund trends up and down with the SocGen CTA Index, it is more narrow in scope than broad-reaching hedge funds. This means that while sometimes the fund outperforms the index, sometimes it underperforms too and misses opportunities the hedge funds may have captured.

Image source: Dynamic Beta investments

This year’s performance is statistically akin to flipping five or six tails consecutively. It’s the worst rolling six-month performance for DBMF since its inception in 2019. Beer refers to the odds as a three-sigma event, putting the odds at one in 100 for such a performance.

It’s worth noting that the luck (monthly noise of replication) does work in the other direction too. While current performance is statistically rare, it’s not “unprecedented” as Beer explained in the video.

Over a longer timeline, performance invariably smooths out. This allows the strategy to capitalize on the fee savings that the ETF wrapper provides. Over long timelines, DBMF outperforms more often than it underperforms.

“Since 2016, we’ve seen that there are periods when we’re flipping more heads than we expect, and others when we’re flipping more tails,” Beer wrote to VettaFi. “We think we’ll look back on the first several months of 2023 as a great example of the latter, but also a case study that the strategy recovered as expected.”

Seize the Investing Opportunities in DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) seeks to capture the average return of the 20 largest managed futures hedge funds. By offering the strategy within the cost-efficient ETF wrapper, DBMF seeks to provide similar performance with significantly reduced management fees. The fund is currently down 5.32% YTD, presenting an opportunity to gain access to the popular strategy at a discount. DBMF is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value. It also takes short positions in derivatives with exposures expected to fall in value. Under normal market conditions, the fund seeks to maintain volatility between 8%–10% annually.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.