The failure of Silicon Valley Bank and Signature Bank in March brought about an abrupt crash to the inflation trade that had offered strong returns during the last year for managed futures strategies. In the wake of the banking crisis, and changing market trends, managed futures strategies like the iMGP DBi Managed Futures Strategy ETF (DBMF) are positioned to capture opportunity abroad and in the trade and safety hedges such as gold and short-duration bonds.

Hedge fund managed futures strategies are shifting to capture the changing trends of markets and investors since the collapse of the inflation trade that lead to strong outperformance in 2022. At the end of February, DBMF was short positions in all Treasuries, bonds, and U.S. equities and was long the euro, MSCI EAFE, and MSCI emerging markets.

See also: “Andrew Beer Discusses the Collapse of the Inflation Trade and DBMF“

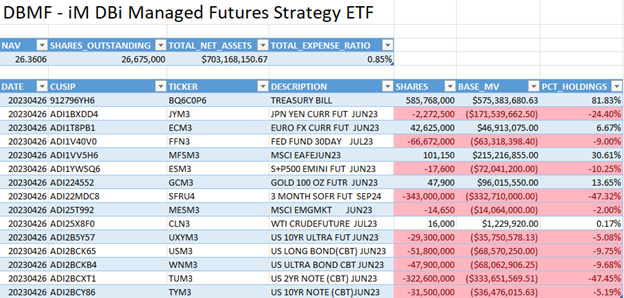

With bank stress continuing and the increasing impacts of bank tightening on the economy, the flight to safety by investors has been substantial, and managed futures strategies are taking note for now. Post-banking collapse, DBMF is now long the one-year Treasury bill, the euro, MSCI EAFE, gold, and crude oil, and is short all other U.S. Treasuries, the yen, and U.S. equities (both daytime and overnight 3-month SOFR).

Image source: Dynamic Beta investments as of 04/06/23

The iMGP DBi Managed Futures Strategy ETF (DBMF) allows for the diversification of portfolios across asset classes uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within the futures market on several asset classes: domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). DBMF is currently down 10.86% YTD as of 03/23/2023, presenting a buying opportunity for advisors and investors seeking long-term diversification for their portfolios.

The fund’s position within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine, which analyzes the trailing 60-day performance of CTA hedge funds and then determines a portfolio of liquid contracts that would mimic the hedge funds’ averaged performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value and takes short positions in derivatives with exposures expected to fall in value.

DBMF has management fees of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.