March brought about a drastic shift in markets on the backs of the collapse of two U.S. regional banks, creating a ripple effect that reverberated through markets and caught many managed futures strategies unexpectedly, as investors flooded into Treasuries for safety. Andrew Beer, co-founder of Dynamic Beta Investments and co-PM of the iMGP DBi Managed Futures Strategy ETF (DBMF), talked about the challenges that March brought and DBMF’s positioning and performance in a monthly video update.

The collapse of Silicon Valley Bank and Signature Bank and then the subsequently forced merger of Credit Suisse has led to bank lending tightening and an easing of the Fed interest rate hike path as banking sector stress adds fuel to the recession fire. Investors fled to Treasuries on fears of systemic bank sector risk in droves, sending yields plummeting in a matter of days.

“The various legs of the inflation trade were upended on March 9, when Silicon Valley Bank suddenly collapsed and kicked off a run on regional banks,” Beer said. “Treasuries staged a historic rally – I’ve heard the move in Two-year Treasuries described as a thirteen standard deviation event.”

What followed was pronounced volatility and uncertainty before banking sector contagion fears settled by month’s end, with stocks rallying to finish up for the month.

“Not surprisingly, the hard reversal of the inflation trade meant March led to a very rough month for the managed futures space,” explained Beer. Most managed futures hedge funds fell roughly 7% in March, as did DBMF.

See also: “Andrew Beer: This is the Time to Buy Managed Futures“

March DBMF Performance in Review

DBMF is currently trailing the broad SocGen CTA Hedge Fund index by about 400 basis points whereas it spent most of last year outperforming the same index by about 350 basis points. The underperformance this year is one that Beer explained as frustrating but understandable in light of the strong recovery in risk assets that began last fall.

“In 2022, the strategy realized broad-based gains in three of four asset classes; so far this year, the opposite is true. In some ways, this is to expected when many markets are being driven by a single underlying force – today, inflation and the Fed’s reaction to it,” said Beer. “Still, it can be frustrating.”

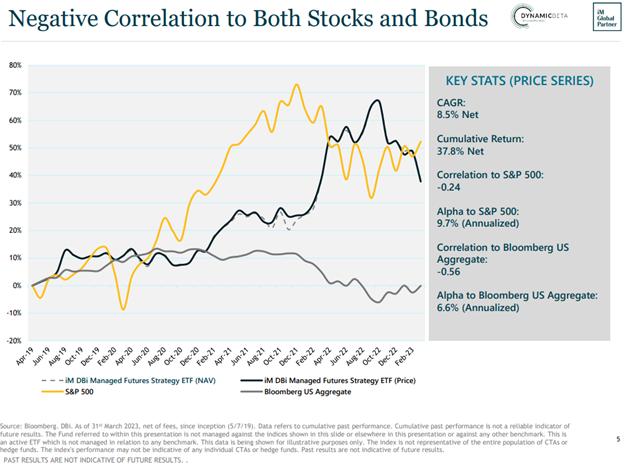

The fund went into March positioned for inflation across several asset classes, including short positions in Treasuries, long in the euro versus the yen, and long in developed country stocks outside of the U.S. over U.S. stocks. When the inflation trade suddenly collapsed in the wake of bank failures, these diversified assets moved in correlation, though DBMF continues to maintain a non-correlation to stocks and bonds in the last year.

Image source: Dynamic Beta investments

Changing Trends and Opportunities

The market trends of the last year changed abruptly in March with the collapse of the inflation trade, and managed futures strategies are shifting to position for what the new trends to emerge will be.

“Given the magnitude of the recent market moves, we see a rotation in underlying positions, including a reduction in long-dated Treasury risk, flipping from short gold to long, the opposite for crude oil, and jettisoning spread trades in non-U.S. developed stocks and the bet that the EUR would rise relative to the yen,” Beer explained. “We expect this to continue as models readjust and hunt for new opportunities.”

The iMGP DBi Managed Futures Strategy ETF (DBMF) allows for the diversification of portfolios across asset classes uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within the futures market on several asset classes: domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). DBMF is currently down 10.86% YTD as of 03/23/2023, presenting a buying opportunity for advisors and investors seeking long-term diversification for their portfolios.

The fund’s position within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine, which analyzes the trailing 60-day performance of CTA hedge funds and then determines a portfolio of liquid contracts that would mimic the hedge funds’ averaged performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value and takes short positions in derivatives with exposures expected to fall in value.

DBMF has management fees of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.