After a decade of relatively smooth sailing for U.S. markets, advisors and investors have found themselves thrown into choppy waters in 2022 as market volatility remains persistent. In an environment of rapidly rising interest rates by the Federal Reserve, quantitative tightening, and inflation still soaring, many of the traditional portfolio allocations have felt the squeeze as markets have plummeted.

“There are trillions of dollars of ETF-based model portfolios that thrived in a world where 60/40 worked beautifully year after year. Those days are over,” said Andrew Beer in a communication to VettaFi. Beer is co-portfolio manager of the iMGP DBi Managed Futures Strategy ETF (DBMF), a four-star rated fund that currently has over $300 million in AUM, the largest managed futures ETF to date, and a managing member at Dynamic Beta Investments, the sub-advisor to the fund.

As advisors search for income opportunities and hedges for their portfolios against inflation, volatility, rising interest rates, and a growing list of categories that are providing pressures on equity and bond performance managed futures are filtering to the top of the list for many.

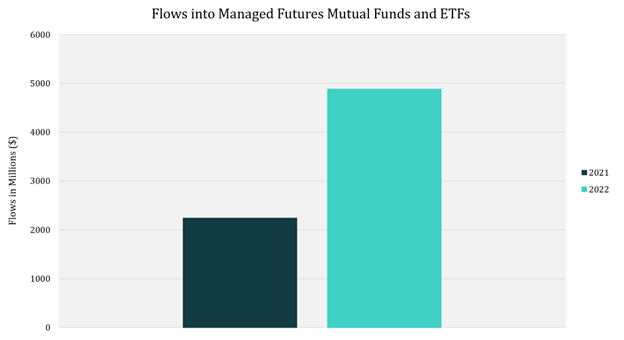

Image courtesy of Dynamic Beta Investments

In 2021 there was $2.237 billion invested in managed futures mutual funds and ETFs; 2022 has already seen that more than double as of the end of May at $4.883 billion according to Dynamic Beta Investments research.

Managed futures are an attractive option for many in the current environment for their ability to offer performance and return potential regardless of the direction of market movements, their ability to provide “crisis alpha” during times of market stress, and the diversification opportunities they provide due to their lack of correlation to both equities and bonds.

“From a diversification perspective, it is blindingly obvious that every model portfolio should have exposure to managed futures. The only debate should be whether it’s 5% or 20%,” said Beer.

Capturing Hedge Fund Performance in an ETF

The iMGP DBi Managed Futures Strategy ETF (DBMF) is a managed futures fund that seeks long-term capital appreciation by investing in some of the most liquid U.S.-based futures contracts in a strategy utilized by hedge funds. The fund seeks to replicate the averaged performance of the largest managed futures hedge funds while offering better return capture for investors through the reduced fees that an ETF wrapper provides.

DBMF allows for the diversification of portfolios across asset classes that are uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within derivatives, mostly futures contracts, and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestic managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value and takes short positions in derivatives with exposures expected to fall in value. Under normal market conditions, the fund seeks to maintain volatility between 8%–10% annually.

DBMF has a management fee of 0.85% and an additional 10 bps for other expenses listed in the prospectus.

For more news, information, and strategy, visit the Managed Futures Channel.