It’s been an unpredictable year for investors and analysts when it comes to market outcomes. In such confounding and uncertain times, ensuring adequate portfolio diversification is tantamount. It’s why strategies like managed futures are worth consideration, given the non-correlated return stream they provide compared to stocks and bonds.

Markets and the economy continue to navigate a number of scenarios in surprising and unexpected ways. Looking back to beginning of the year predictions, hardly anyone could have guessed the path of economic performance. That the economy would endure over 500 basis points in interest rate hikes without falling into recession seemed inconceivable. Another unlikely scenario includes inflation retreating while the labor market grows and unemployment holds near historic lows.

It’s all led to what Andrew Beer, co-founder of Dynamic Beta Investments and co-PM of the iMGP DBi Managed Futures Strategy ETF (DBMF), coins the “Impossible Market” in a recent video.

“To make matters even more irritating to the smart money crowd, if you got the macro call right (eg persistent inflation), figuring out how the markets would react has been something of a wildcard (e.g., growth kills value),” Beer said. “A lot of playbooks have been torn to pieces.”

The heightened uncertainty and continued surprising both under- and outperformance of a number of asset classes underscore the importance of portfolio diversity.

“We think the name of the game today is to diversify across asset classes and strategies,” Beer explained. This includes into “strategies like managed futures that can be nimble and can adapt to these big shifts in the macro landscape.”

See also: “Evolving Equity Outlook: A Guide to DBMF’s July Performance”

Enhance Your Portfolio’s Diversification With DBMF

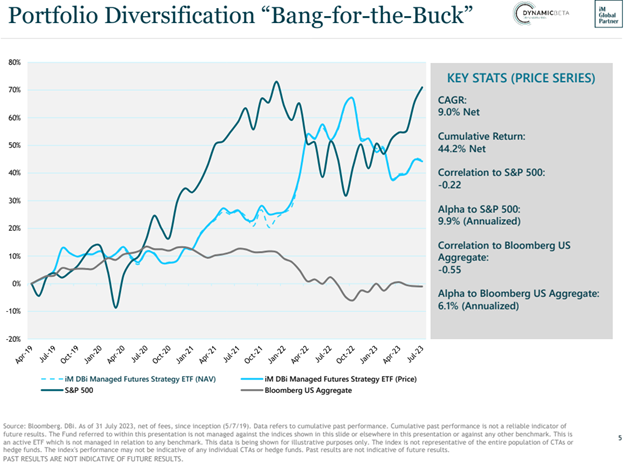

Since its inception, DBMF offers a -0.22 correlation to the S&P 500 and a -0.55 correlation to the Bloomberg U.S. Aggregate index. The fund offers diversification in spades and is worth inclusion in portfolios long-term.

Image source: Dynamic Beta investments

The iMGP DBi Managed Futures Strategy ETF (DBMF) is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds. DBE then determines a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.