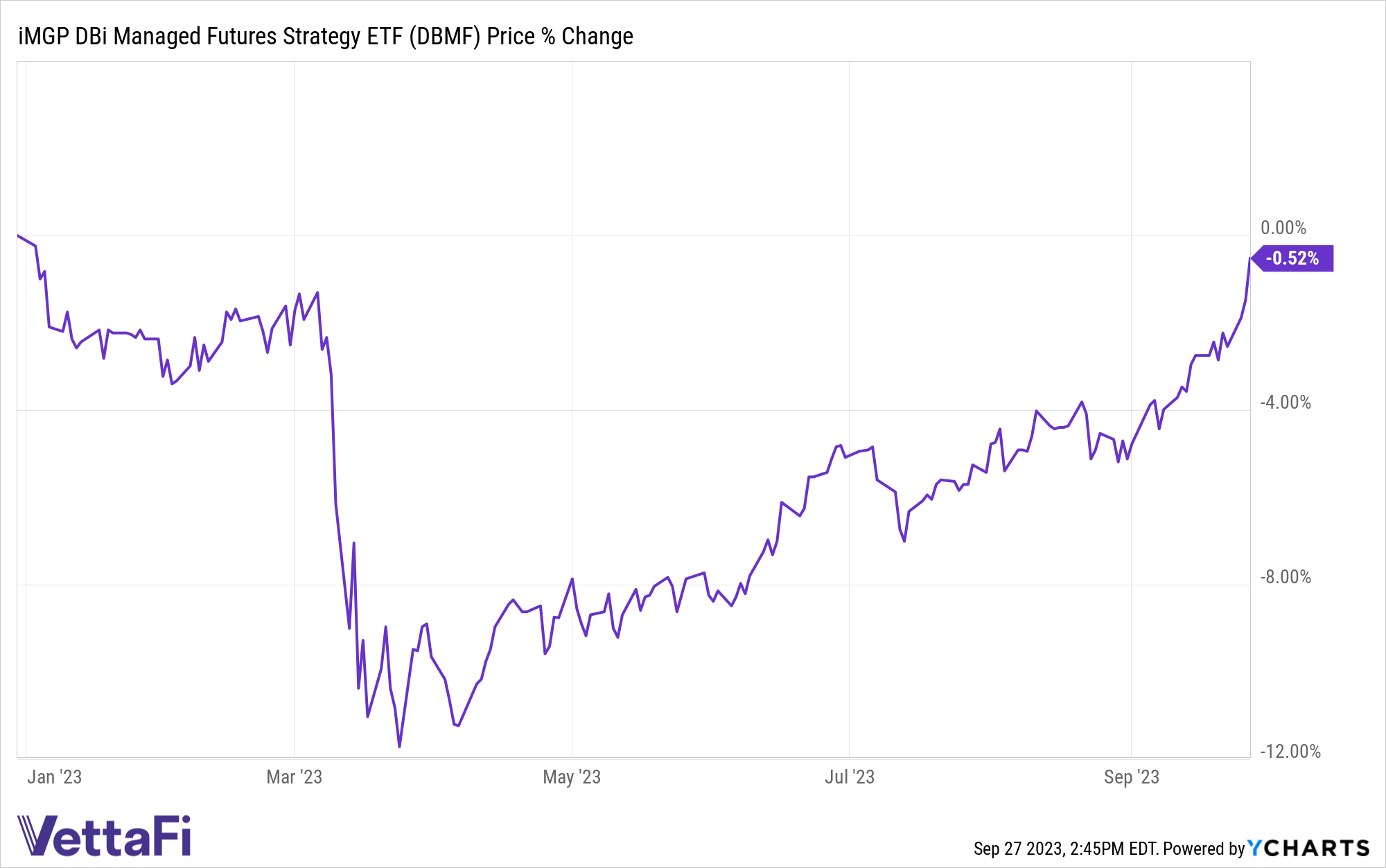

Bond yields once again hit new highs while the major equity indexes slipped in the wake of the Fed’s meeting earlier this week. Concerns of government shutdown also weigh heavily on the broad market. In such an environment, the iMGP DBi Managed Futures Strategy ETF (DBMF) is on the rise, on track to erase losses this year by week’s end.

The 10-year Treasury yield reached 15-year highs today as concerns of higher rates for longer weigh heavily on bonds. Lower than forecast new home sales and plummeting consumer confidence in September pulled equities down. Looming over markets too are concerns of government shutdown next week.

In this challenging market environment, DBMF gained 2.51% From 09/20/23 to 09/27/23 as of midday trading. What’s more, the fund is on track this week to fully recover its losses from earlier this year.

A Lookback Over the Challenges of 2023

In March, the fund experienced its most significant drawdown since inception in the wake of the mini banking crisis. The abrupt reversal of the inflation trade resulted in a rare drawdown over 10%.

Managed futures are a trend following strategy that invest based on how stocks are actually trading. They don’t take into account long-term outlooks or forecasts. This means the fund’s position changes as trends change. Managed futures have the ability to take both long and short positions across four core asset classes via the futures market. This allows the strategy to capitalize on asset class losses as well as gains. In an environment of pronounced market and investor uncertainty, however, no dominant trend emerged for much of this year.

With so many factors at play — Fed interest rate hikes, persistent inflation, consumer resilience, a strong labor market, geopolitical tensions with China — the only truly apparent trend was prolonged volatility. It created an environment where no asset class emerged as a prolonged trend. So instead, DBMF held positions that reflected a number of potential outcomes.

For part of the year, DBMF maintained a short position in crude oil as a potential recession hedge and a long position in gold as a potential inflation hedge. The fund also went long the 10-year Treasury in the wake of the banking crisis but moved gradually to short positions on all Treasuries. Strong U.S. equity performance also resulted in long exposures to the S&P 500.

The fund is now long crude oil, the 1-Year Treasury Bill, the euro, EAFE, and a small, long position in the S&P 500 as of 09/27/23. It is short gold, all other Treasuries, emerging markets, and the yen. In the wake of the FOMC meeting earlier this week, the fund made strong gains while equities and bonds both fell. DBMF continues to prove its worth as a long-term portfolio diversifier for its non-correlation to both stocks and bonds.

See also: “Diversification Across Asset Classes Matters in Trend-Following“

Enhance Your Portfolio’s Diversification With DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.