The September slump for U.S. markets picked up speed in October as equities plummeted and bond yields soared. The performance of the iMGP DBi Managed Futures Strategy ETF (DBMF) in October compared to stocks and bonds demonstrates the noncorrelated potential of the fund as a portfolio stabilizer.

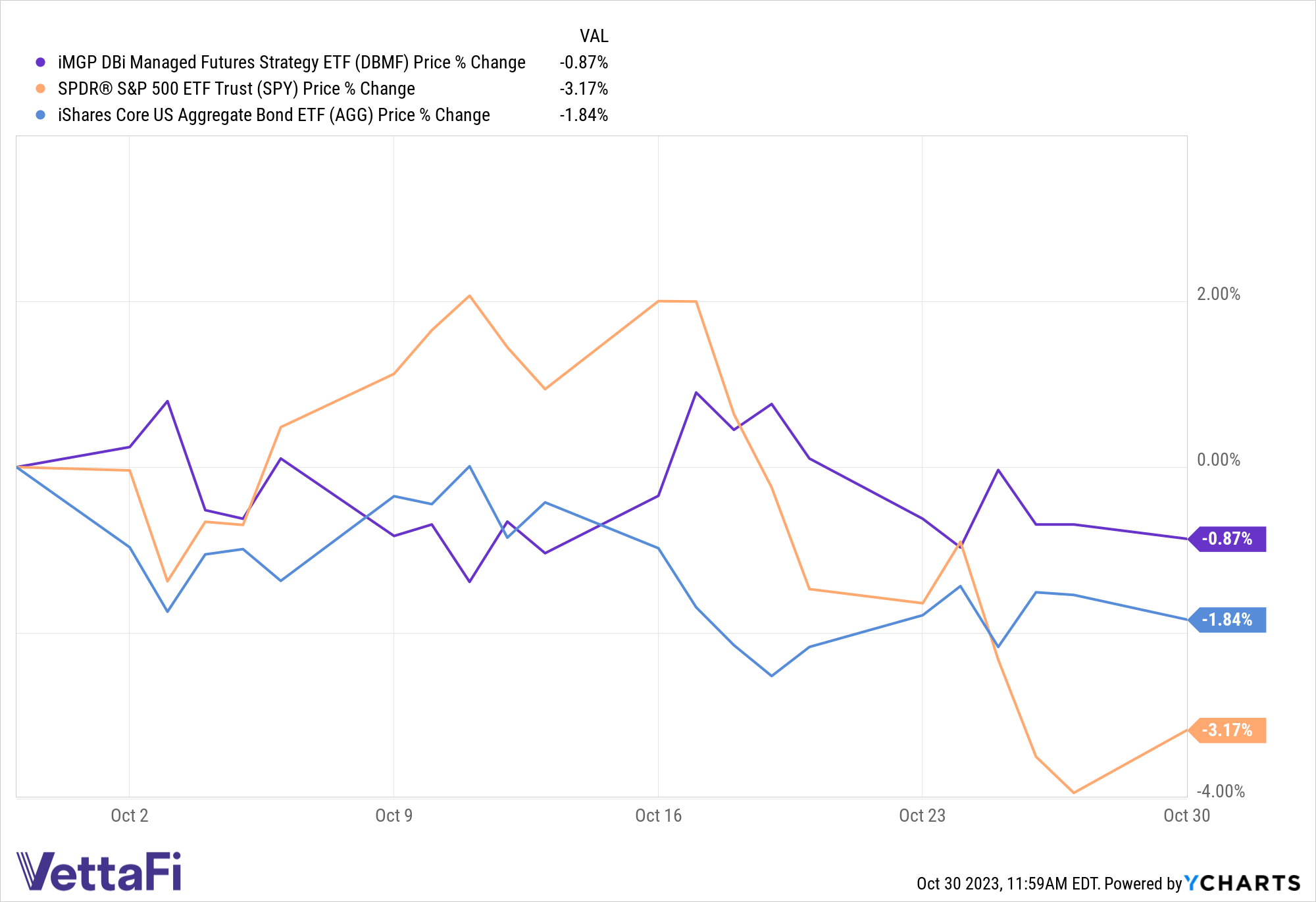

Though equities attempted to stage a rally Monday morning, October remains a difficult month for markets. From October 1 through October 30, the SPDR S&P 500 ETF Trust (SPY) lost 2.97% on a price return basis. Meanwhile, the iShares Core US Aggregate Bond ETF (AGG) dropped 1.86%. Though DBMF decreased during the same period, it fell less than stocks and bonds, just 0.76%.

What’s more, DBMF’s performance demonstrated its noncorrelated performance potential in October. The fund gained when stocks and bonds dropped on October 2 and again on October 24. While stocks plummeted between October 24 and October 27, DBMF either gained or held steady.

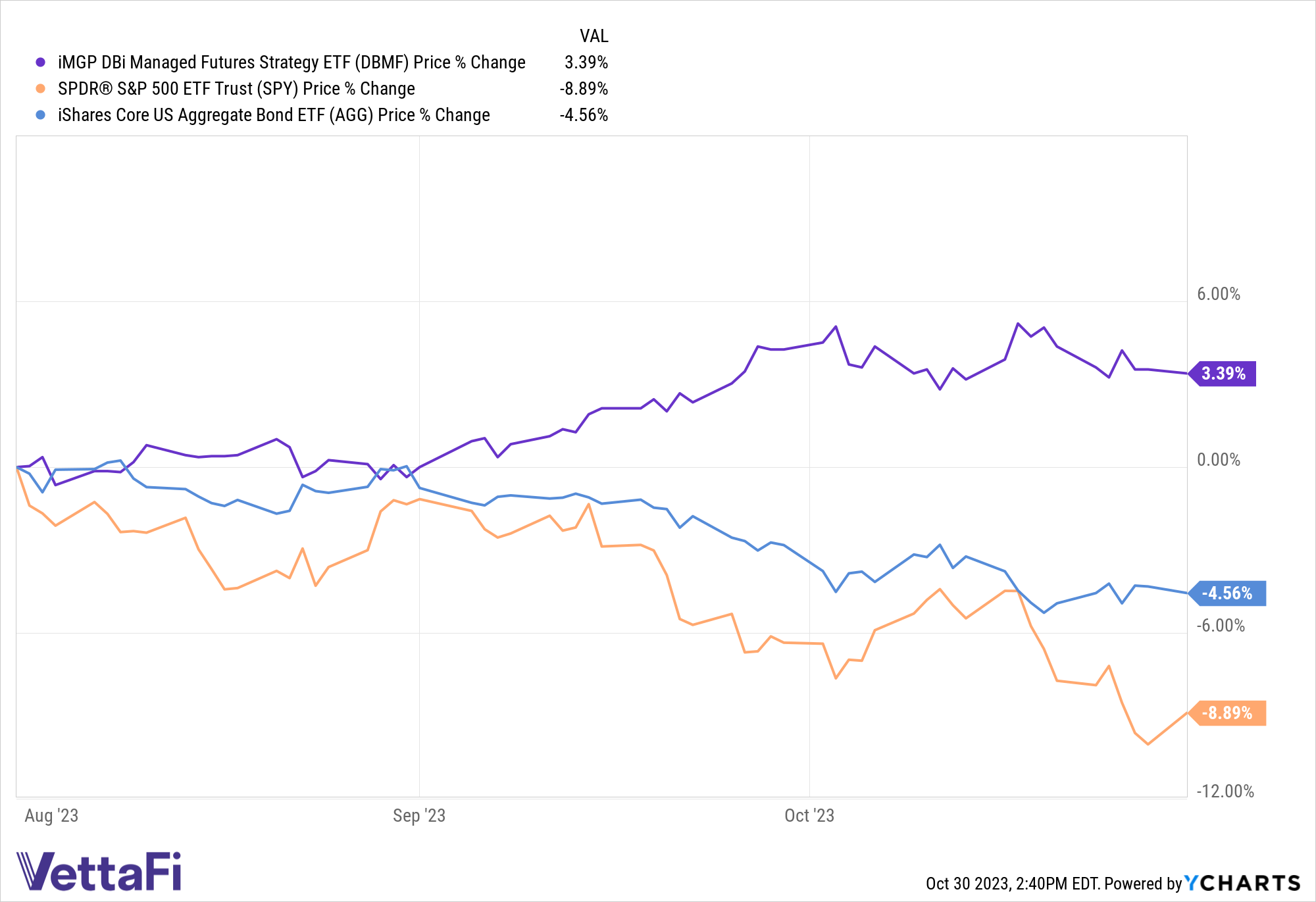

Zooming out to look at performance since August, stock and bond losses steepen. SPY dropped 9.00% on a price basis, and AGG fell 4.57%. DBMF, on the other hand, gained 3.39% over the same period. It’s a strong case for the fund’s inclusion as a portfolio stabilizer.

The iMGP DBi Managed Futures Strategy ETF (DBMF) is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.