Tumultuous markets driven on investor fears and uncertainty persist mid-year as the potential for more Fed rate hikes looms and inflation remains elevated. In spite of continuously changing market sentiment, the iMGP DBi Managed Futures Strategy ETF (DBMF) continues strong recovery from March lows as the fund reverts to mean.

“I’m pleased to report that, after a difficult and frustrating first quarter, things appear to be back to normal,” said Andrew Beer, co-founder of Dynamic Beta investments and co-PM of DMBF, in a monthly video update.

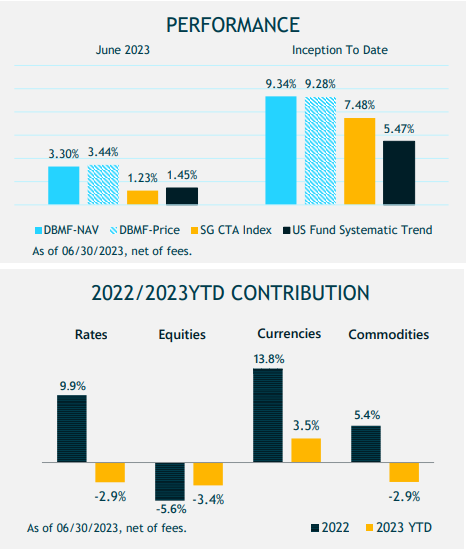

DBMF gained 3% in June on both a NAV and price performance basis. The fund outperformed both the SocGen CTA Index and the Morningstar US Trend Systematic Category for the month. Although it trails both year-to-date after challenges in April and May, strong June performance put the fund back on track to deliver strong performance potential within the category.

A Guide to DBMF’s June Positioning

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

Image source: Dynamic Beta investments

As of end of June, correlations for the strategy remained high, and Beer explained that the positioning of the fund aligns with current hedge fund positioning.

“We are cautiously optimistic that we are back to our prior pattern of potentially outperforming through fee disintermediation with high correlation to both the Hedge Fund Index and Morningstar Category,” Beer said.

Continued investor and market uncertainty can be challenging for trend-following strategies. The current positioning of DBMF reflects market uncertainty regarding the path forward. In June, DBMF maintained a short position in the yen — a highly lucrative position in 2022 — on bets that the Fed will continue to raise rates.

The fund is long on the S&P 500 EAFE, a play on growth’s performance YTD, and captures the “AI frenzy.” It’s a position that traditionally conflicts with a preference for value stocks amidst rising rates. DBMF also holds a position in what Beer describes as a “modest bet on higher rates.” The fund remains long on gold as an inflation hedge and short on crude oil as a recession hedge.

It makes for a “very interesting portfolio with these idiosyncratic bets on various market trends.” In June, those idiosyncratic bets paid off big. DBMF heads into the second half positioned to capitalize on high correlations and the fee savings the fund provides. It’s a reversion to mean, where the mean generally yields outperformance over longer timelines.

Investing in Managed Futures With DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) seeks to capture the average return of the 20 largest managed futures hedge funds. By offering the strategy within the cost-efficient ETF wrapper, DBMF seeks to provide similar performance with significantly reduced management fees.

DBMF is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.