September is historically a challenging month for the U.S. market as the summer comes to a close. Though this year proved less painful than 2022, stocks and bonds both fell in September. In a time of market challenge, the performance of the noncorrelated iMGP DBi Managed Futures Strategy ETF (DBMF) is particularly noteworthy.

This year, major equity indexes fell around 5% in September. In 2022, major equity indexes fell 20% on average in the same month. The September slump, more commonly referred to as the “September Effect,” is a trend that goes back over a century. Historically, it’s usually the worst month for markets out of the entire year.

Dr. Lily Fang, professor of finance and dean of research at INSEAD in France, theorizes that markets absorb and respond slower to bad news than good. This is due to the inherent limitations of investor responses. When a company releases good news, anyone can buy the stock. When a company reveals bad news, however, only the current holders of the stock can respond by selling.

“So bad news, you have just a smaller market for that information to get absorbed,” Fang explained on an NPR interview recently. She theorizes that Wall Street traders on vacation over the summer pay less attention to the markets. This means that they respond slower to bad news, until the back-to-work influx in September.

It’s a phenomenon that isn’t constrained just to U.S. markets and is often reflected after any major holiday globally. In such times, portfolio diversifiers can prove a boon.

Advisors and investors wanting to learn more about the benefits of managed futures can register here for the “Managed Futures: The Great Portfolio Diversifier” webcast happening Tuesday, October 10.

DBMF Gains in Spite of September Effect

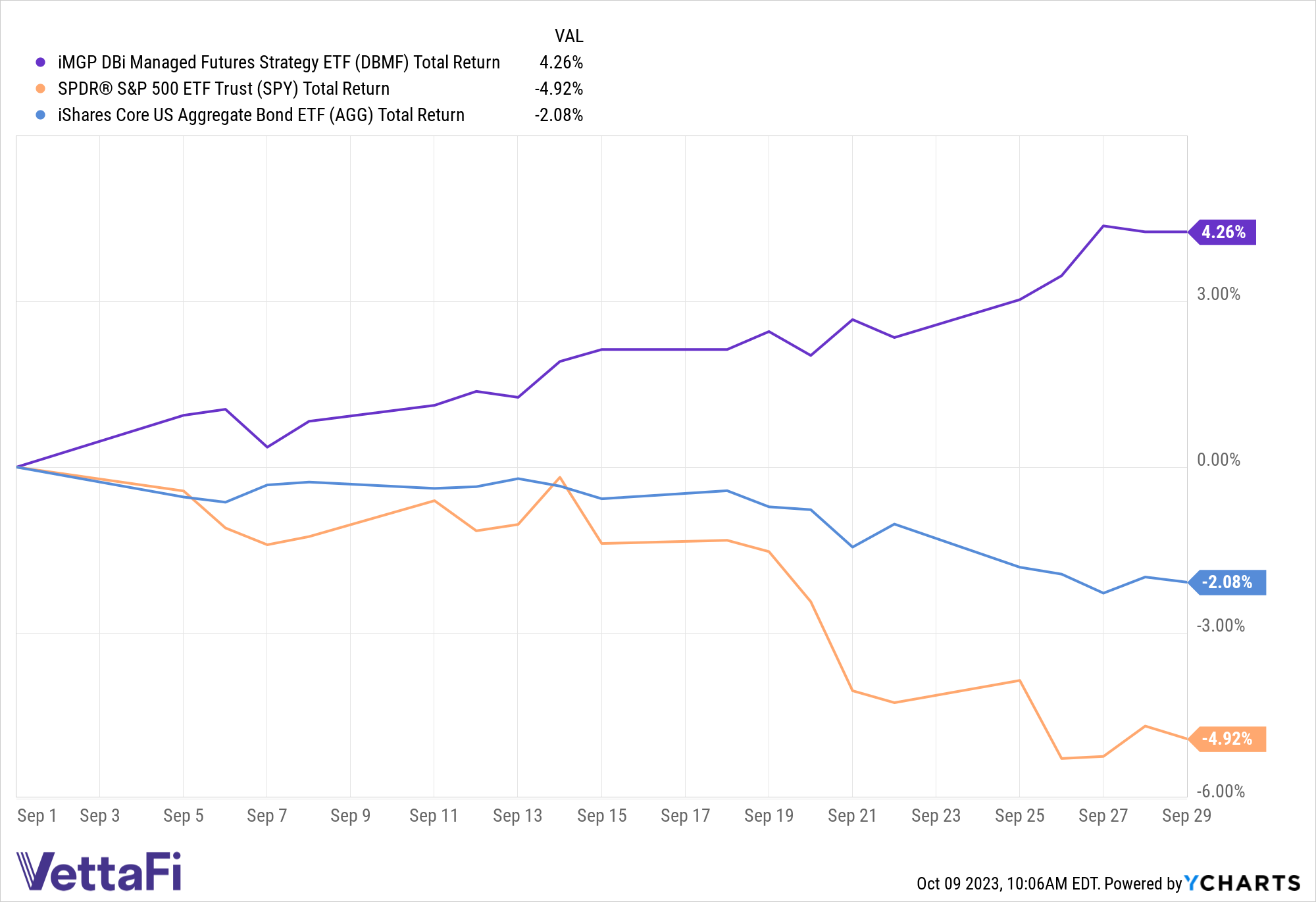

In September, the iMGP DBi Managed Futures Strategy ETF (DBMF) rose 4.26% on a total returns basis. These gains happened at a time when broad markets dropped and investor uncertainty spiked once more. The SPDR S&P 500 ETF Trust (SPY) dropped 4.92%, while the iShares Core US Aggregate Bond ETF (AGG) decreased by 2.08%.

What’s more, DBMF brought in nearly $167 million in net flows in September. The fund is up $36 million in October as of 10/05/23.

DBMF offers a noncorrelated return stream for portfolios to stocks and bonds. It’s a strong portfolio diversifier and could prove a boon in times of equity and bond correlations and elevated volatility.

The fund is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.