Major equity indexes crossed into correction territory this week, only days after the 10-year Treasury hit 16-year highs. With echoes of 2022’s route for stocks and bonds reverberating, investors would do well to look beyond traditional portfolio allocations as market troubles continue. Managed futures offer several benefits for portfolios and are worth consideration in today’s market regime.

The S&P 500 entered into correction territory Friday, falling more than 10% from recent highs. The broad equity index is on course to close down for the third consecutive month. Earlier this week, the Nasdaq tumbled into correction territory as well, off from its July highs.

As equities plummet, bond yields continue to rise (bond prices and yields move inversely). Increased correlations of stocks and bonds have sent increasingly more investors into alternatives for non-correlated returns and performance.

See also: “’60/40 Portfolios are Broken’: Finding a New Toolkit for Markets”

Managed Futures a Substantial Portfolio Diversifier

A noteworthy, non-correlated strategy that gained broad investor attention in the last 2 years is managed futures. Managed futures offer low and even negative correlations to equities and fixed income allocations. These strategies remain nimble and often capitalize on market dislocations and crises. This allows these funds to provide non-correlated strategies during periods of market stress.

“Since the 2000s, managed futures hedge funds delivered returns that were better than bonds, and nearly as good as stocks,” explained Mike Pacitto, CFP, CIMA, director, institutions and U.S. strategic relationships at iMGP, in a DBMF explainer video. “They did this with roughly zero correlation to either.”

Managed futures are a hedge fund strategy that invests in how asset classes are currently trending, not based on future performance estimates. These funds invest across four core asset classes: equities, interest rates, commodities, and foreign exchange markets. However, they. invest via the futures market. Managed futures funds take long and short positions depending on how asset classes are currently trending. Because they invest through futures, they remain noncorrelated to both stocks and bonds.

The iMGP DBi Managed Futures Strategy ETF (DBMF) captures the hedge fund strategy in an ETF wrapper, providing broader accessibility for investors. The fund delivers a “one-two punch” for investors because it seeks to replicate the performance of the 20 largest managed futures hedge funds. In doing so, it eliminates single manager risk in the space.

Image Source: IMGP and DBi

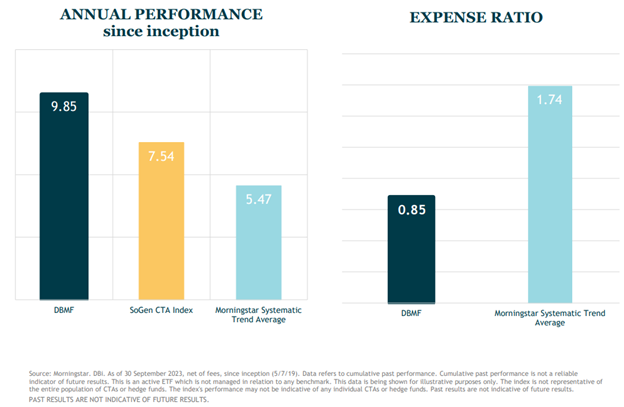

Because DBMF captures the strategy via an ETF, it offers substantial fee savings compared to its hedge fund and mutual fund counterparts. The strategy seeks to replicate the performance of the SG CTA Index net of fees, while also offering management fee savings. It’s an “index plus” approach that allows for better return retention for investors.

The fund is actively managed. The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.