Managed futures strategies climbed their way out of obscurity in the market gyrations of the last few years. Investors looking to add the strategy to their diversification sleeve should consider the iMGP DBi Managed Futures Strategy ETF (DBMF) for the fee alpha the fund captures.

Managed futures hold appeal for their low to negative correlations to stocks and bonds. The strategy takes long and short positions on several asset classes via the futures market. Because exposure is through futures, managed futures carry low and often negative correlations to stocks and bonds.

In periods of elevated inflation and volatility, stock and bond correlations rise historically. The removal of the Fed put in markets creates the potential for elevated volatility compared to the 2010s. In the changing market regime, managed futures offer long-term diversification opportunities for investors.

Image source: DBi and iMGP

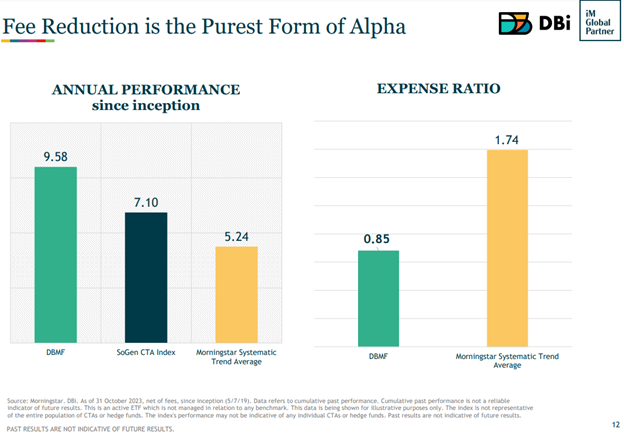

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure. The fund does so by seeking to replicate the performance of the 20 largest managed futures hedge funds. By capturing the strategy in an ETF wrapper, DBMF generates high correlation returns to hedge funds with significant fee savings.

“Since inception, DBMF has outperformed both [the SocGen CTA Index and the Morningstar US Systemic Trend Category] with a correlation of around 0.9,” explained Andrew Beer, co-founder of Dynamic Beta investments and co-PM of DBMF in a recent video.

Fee Alpha and Non-Correlation With DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.