The S&P 500 hit bull market territory this week from October lows, carried by a small number of mega-cap companies. Investors with an eye toward the concentration risk within broad equity exposure should consider managed futures for their low correlations to stocks and bonds.

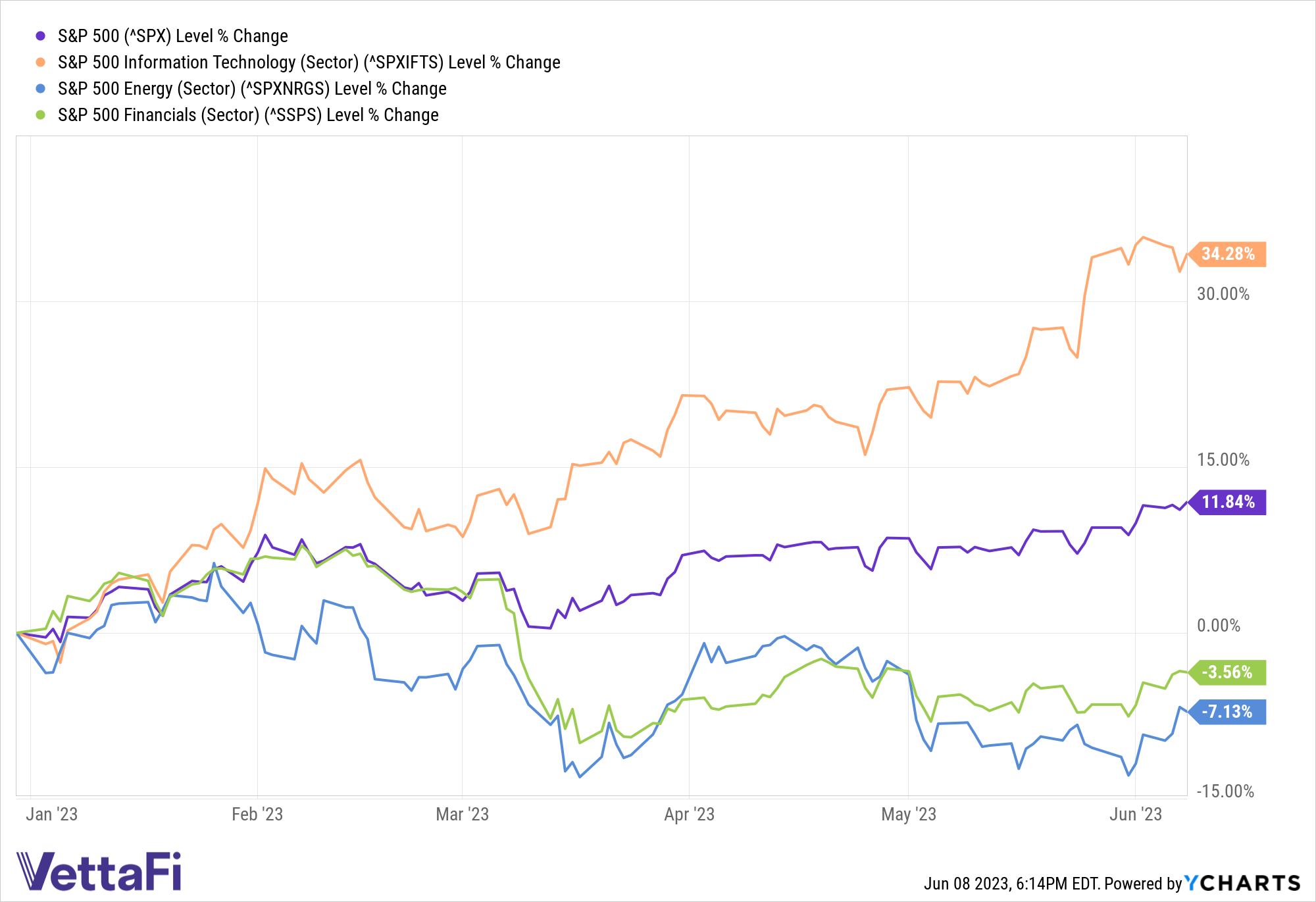

Many of the strongest-performing companies this year are tech companies. The S&P 500 information technology sector is up 34.28% YTD. Meanwhile, the financial and energy sector continue to drag on broad S&P 500 performance, down 3.56% and 7.13% respectively YTD.

Technology companies rely heavily on forward earnings estimates and are historically more sensitive to forecast downturns and periods of market stress. They have defied many investors’ expectations this year and continue to be some of the most crowded trades of the year.

Beyond the risk to companies reliant on forward earnings should the economic outlook definitively turn for the worse is the concentration risk of the S&P 500. Just five companies — Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA), and Alphabet (GOOGL) — make up 20% of the index’s weight as of 06/07/2023.

The concentration risk is most apparent when comparing the SPDR S&P 500 ETF Trust (SPY) and the Invesco S&P 500 Equal Weight ETF (RSP). SPY is up 12.19% while RSP, which weights all sectors evenly, is up just 2.89%.

See also: “Is Your Portfolio Positioned for Economic Weakening?”

Diversify Away from Equity Concentration Risk With DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) allows for diversification across asset classes uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within the futures market on several asset classes. These include domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

Image source: LOGICLY

As demonstrated in the chart above, DBMF maintains low correlations to equities. The fund offers extremely low correlations to the Dow Jones Industrial Average, the S&P 500, and the Russell 2000. In addition, DBMF maintains low correlations to the Nasdaq. (Correlations calculated using weekly returns calculated back a maximum of three years.)

The fund’s position within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This analyzes the trailing 60-day performance of CTA hedge funds, then determines a portfolio of liquid contracts to mimic the hedge funds’ averaged performance (not the positions).

DBMF is currently down 7.90% YTD as of June 7, 2023, presenting a buying opportunity for those seeking long-term diversification.

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets anticipated to grow in value. It takes short positions in derivatives with exposures expected to fall in value.

DBMF has management fees of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.